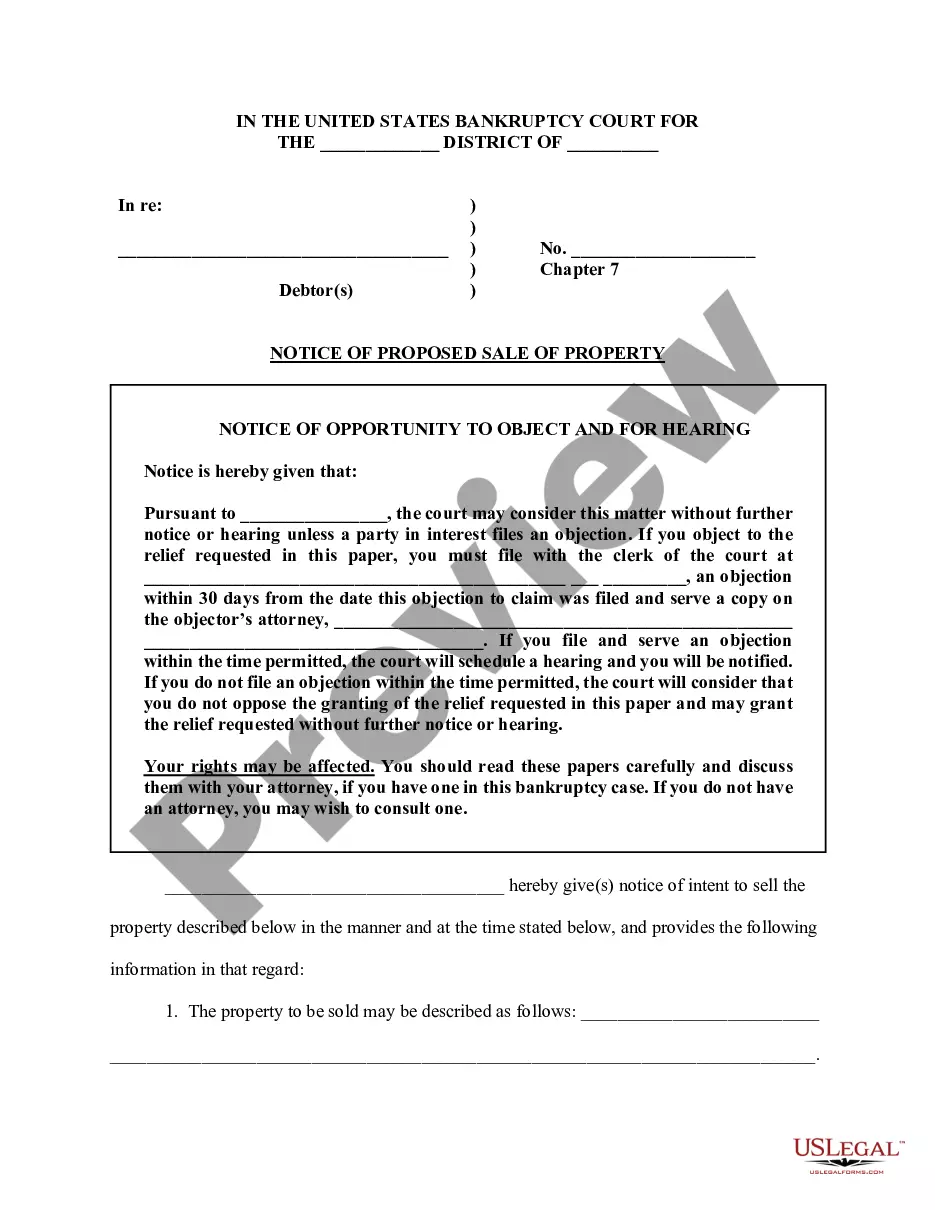

A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

North Carolina Notice of Foreclosure Sale - Intent to Foreclose

Description

How to fill out Notice Of Foreclosure Sale - Intent To Foreclose?

You might spend multiple hours online looking for the proper document template that satisfies the state and federal requirements you desire.

US Legal Forms provides a vast array of legal documents that can be reviewed by professionals.

It is easy to download or create the North Carolina Notice of Foreclosure Sale - Intent to Foreclose from the platform.

If available, use the Review button to inspect the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can fill out, modify, print, or sign the North Carolina Notice of Foreclosure Sale - Intent to Foreclose.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form details to confirm you have chosen the right one.

Form popularity

FAQ

Once the foreclosure process begins, it can be challenging to halt it, but it is not impossible. Homeowners may consider options such as filing for bankruptcy or negotiating with the lender for a temporary stay. Knowing the details surrounding the North Carolina Notice of Foreclosure Sale - Intent to Foreclose can be invaluable. Using resources like uslegalforms can provide detailed guidance and forms to assist you in navigating your options effectively.

Backing out of a foreclosure sale in North Carolina is generally not an option once it is finalized. The sale transfers ownership to a new party, and the homeowner typically loses their rights to the property. Understanding the implications of the North Carolina Notice of Foreclosure Sale - Intent to Foreclose is essential, as this notice marks the beginning of the process. Make sure to consult with experts who can help you explore possible alternatives before the sale.

In North Carolina, there is no redemption period after a foreclosure sale. Once the sale is finalized, the homeowner loses the right to redeem the property. It's imperative to understand this aspect of the North Carolina Notice of Foreclosure Sale - Intent to Foreclose as it highlights the importance of resolving issues before the sale takes place. Being informed and prepared can make a significant difference in your situation.

An intent to foreclose notice serves as an official notification that a lender plans to foreclose on a property. In North Carolina, this notice is a crucial step in the foreclosure process, alerting homeowners of the impending actions. By receiving this notice, you can take proactive measures to address your situation, including seeking advice or assistance. It's essential to act promptly upon receiving a North Carolina Notice of Foreclosure Sale - Intent to Foreclose.

Receiving a foreclosure letter can be alarming; however, it is crucial to act swiftly. Start by understanding your options and seeking assistance to navigate the intricacies of the North Carolina Notice of Foreclosure Sale - Intent to Foreclose. Consider reaching out to legal experts or platforms like USLegalForms, where you can access resources that guide you through foreclosure processes. Taking prompt action can lead you to better solutions.

A letter of intent in real estate serves as a preliminary agreement outlining the terms and conditions of a future transaction. It could affect your situation if you are facing a North Carolina Notice of Foreclosure Sale - Intent to Foreclose. This letter signals the parties' interest and intentions, but it is not legally binding. Being clear about your intent can help establish communication and ensure you're moving in the right direction.

A letter of intent for foreclosure is a document from the lender notifying the borrower of the foreclosure process initiation. It outlines the details, including the North Carolina Notice of Foreclosure Sale - Intent to Foreclose, and informs the borrower of their rights. This letter serves as an important reminder to take action, whether that’s disputing the foreclosure or seeking alternatives. Using resources like US Legal Forms can help you draft an appropriate response or seek legal advice.

In North Carolina, the foreclosure process typically takes about 2 to 3 months, depending on the specific circumstances of the case. After the North Carolina Notice of Foreclosure Sale - Intent to Foreclose is filed, there is a mandatory waiting period before the sale can occur. This timeline can vary based on court schedules and any actions taken by the borrower to contest the foreclosure. Understanding these timelines can help you prepare and respond effectively.

When you receive a foreclosure notice, respond promptly to protect your interests. Write a formal response to the lender, outlining your position and any issues you may have with the notice. Ensure you reference the North Carolina Notice of Foreclosure Sale - Intent to Foreclose in your communication. Seeking help from professionals can also provide clarity on your response options and the next steps.

The 120 day rule primarily refers to the requirement that lenders notify homeowners of their intent to foreclose 120 days prior to filing for foreclosure. This timeline allows homeowners the opportunity to explore options to avoid losing their home. Being aware of this rule is crucial for anyone at risk of foreclosure. The North Carolina Notice of Foreclosure Sale - Intent to Foreclose is an essential resource for details related to this rule.