This notice is not from a debt collector but from the party to whom the debt is owed.

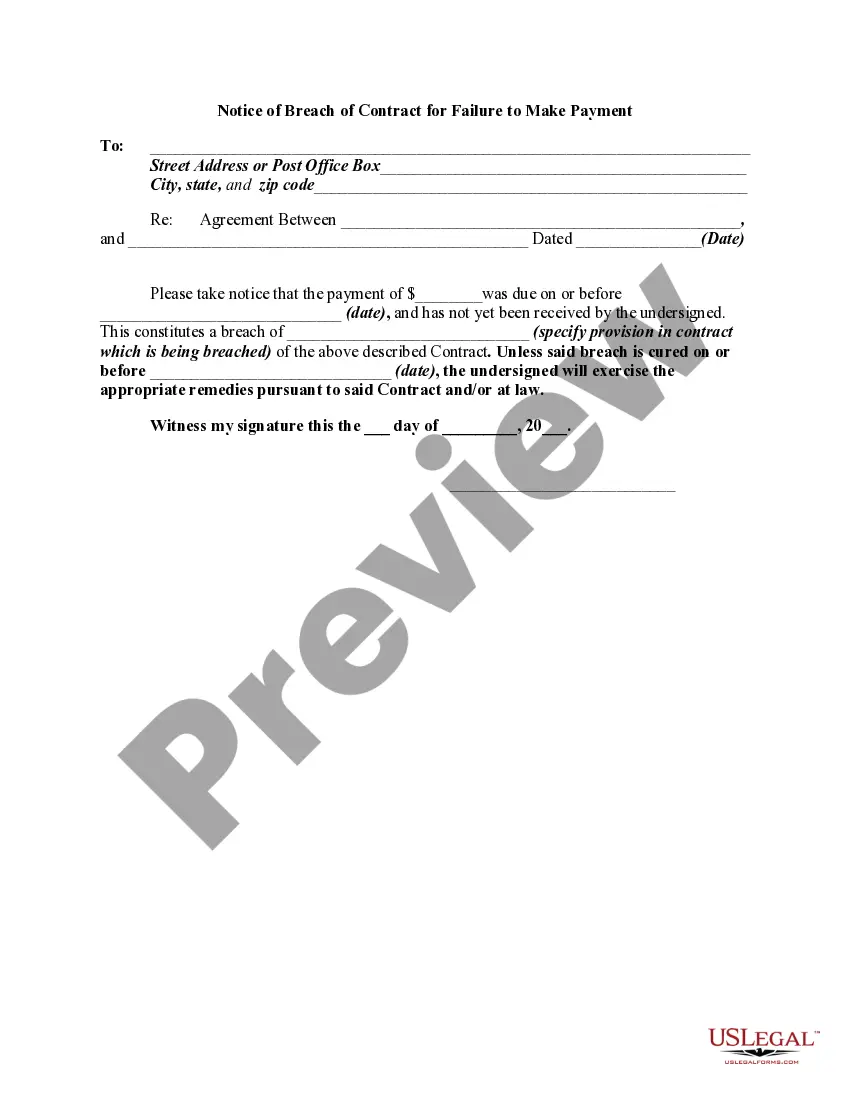

North Carolina Notice by Mail to Debtor of Action if Payment not Made

Description

How to fill out Notice By Mail To Debtor Of Action If Payment Not Made?

You are able to commit time on-line looking for the lawful file format which fits the federal and state demands you will need. US Legal Forms gives thousands of lawful kinds which can be examined by professionals. It is simple to down load or printing the North Carolina Notice by Mail to Debtor of Action if Payment not Made from our services.

If you already possess a US Legal Forms bank account, you may log in and click on the Down load option. Afterward, you may full, revise, printing, or signal the North Carolina Notice by Mail to Debtor of Action if Payment not Made. Every lawful file format you purchase is your own for a long time. To obtain yet another copy of the bought form, check out the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms internet site the very first time, follow the straightforward instructions beneath:

- First, ensure that you have selected the right file format for that area/area of your choice. Browse the form information to make sure you have picked the proper form. If accessible, take advantage of the Preview option to check throughout the file format at the same time.

- If you would like get yet another version from the form, take advantage of the Research industry to discover the format that meets your requirements and demands.

- Upon having located the format you want, click Acquire now to carry on.

- Find the rates strategy you want, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal bank account to cover the lawful form.

- Find the format from the file and down load it in your gadget.

- Make changes in your file if required. You are able to full, revise and signal and printing North Carolina Notice by Mail to Debtor of Action if Payment not Made.

Down load and printing thousands of file web templates utilizing the US Legal Forms Internet site, that provides the greatest collection of lawful kinds. Use expert and status-particular web templates to tackle your organization or person requires.

Form popularity

FAQ

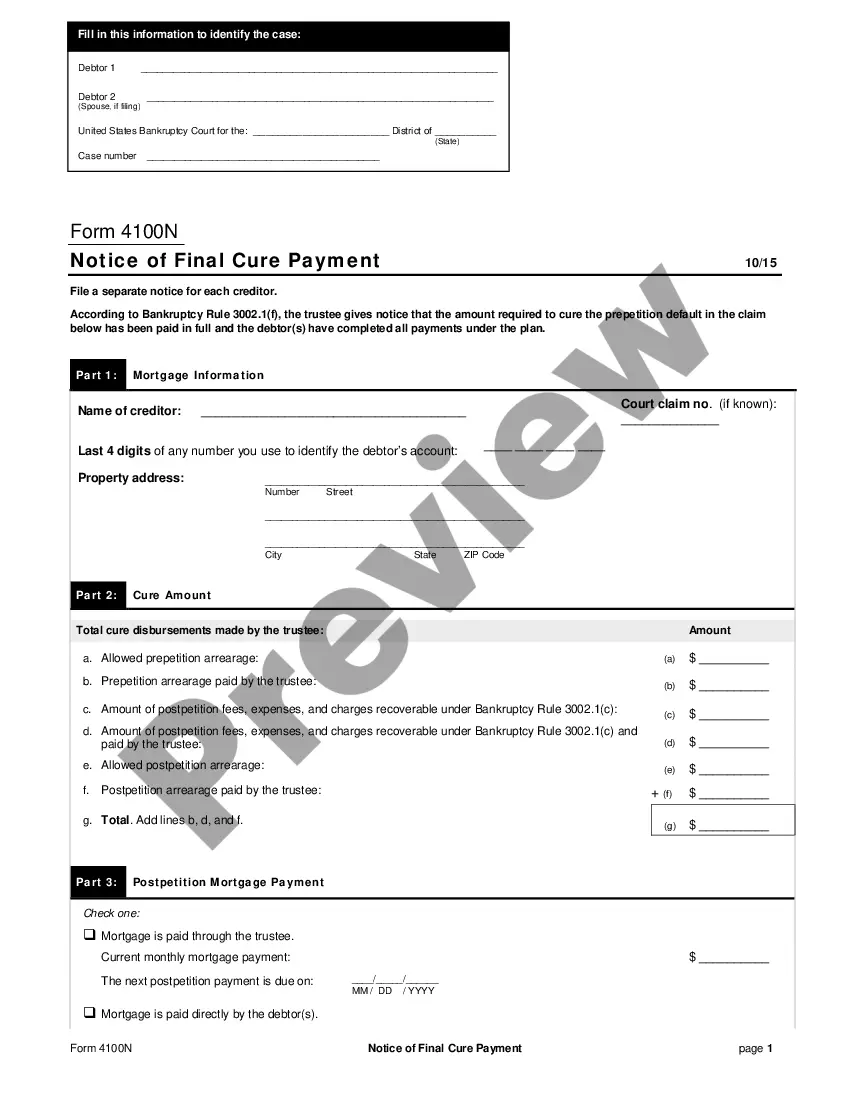

§ 28A-19-6. (a) After payment of costs and expenses of administration, the claims against the estate of a decedent must be paid in the following order: First class. Claims which by law have a specific lien on property to an amount not exceeding the value of such property.

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

The Estate Settlement Timeline: While there is no strict deadline for this in North Carolina law, it's typically advisable to do so within a month to avoid unnecessary delays in the probate process.

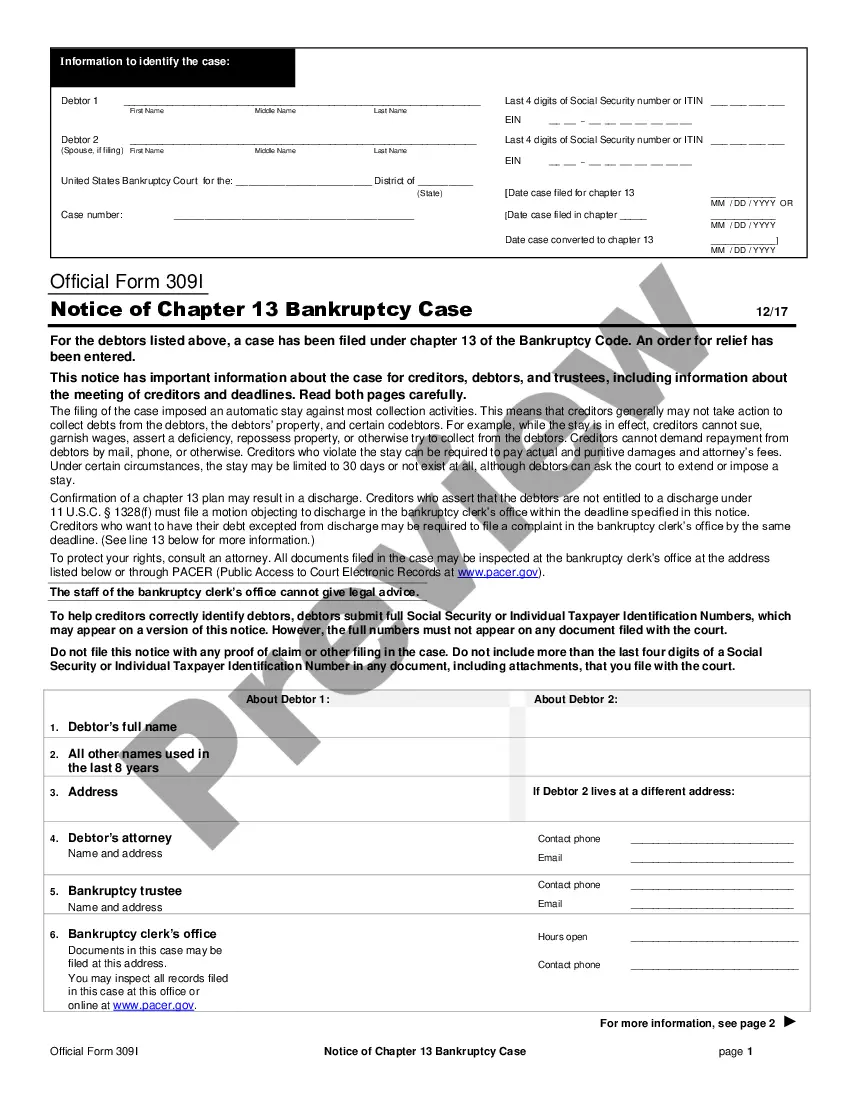

A notice to creditors is a public statement noting the death of an individual to alert potential creditors to the situation. Still published in local newspapers, the notice is filed by the estate's executor and meant to facilitate the probate proceedings.

NC Specifics If the executor has faithfully fulfilled the notification duties in Task: Publish Notice of Death, then creditors will have only 90 days from the date of the first publication of notice to creditors, or 90 days from an individual notification, whichever comes later.

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person ...

NC Specifics If the executor has faithfully fulfilled the notification duties in Task: Publish Notice of Death, then creditors will have only 90 days from the date of the first publication of notice to creditors, or 90 days from an individual notification, whichever comes later.

Notices to creditors must be published once a week for four (4) consecutive weeks and should state that claims must be filed by a date certain, which date is at least three (3) months from the date of first publication of the notice.