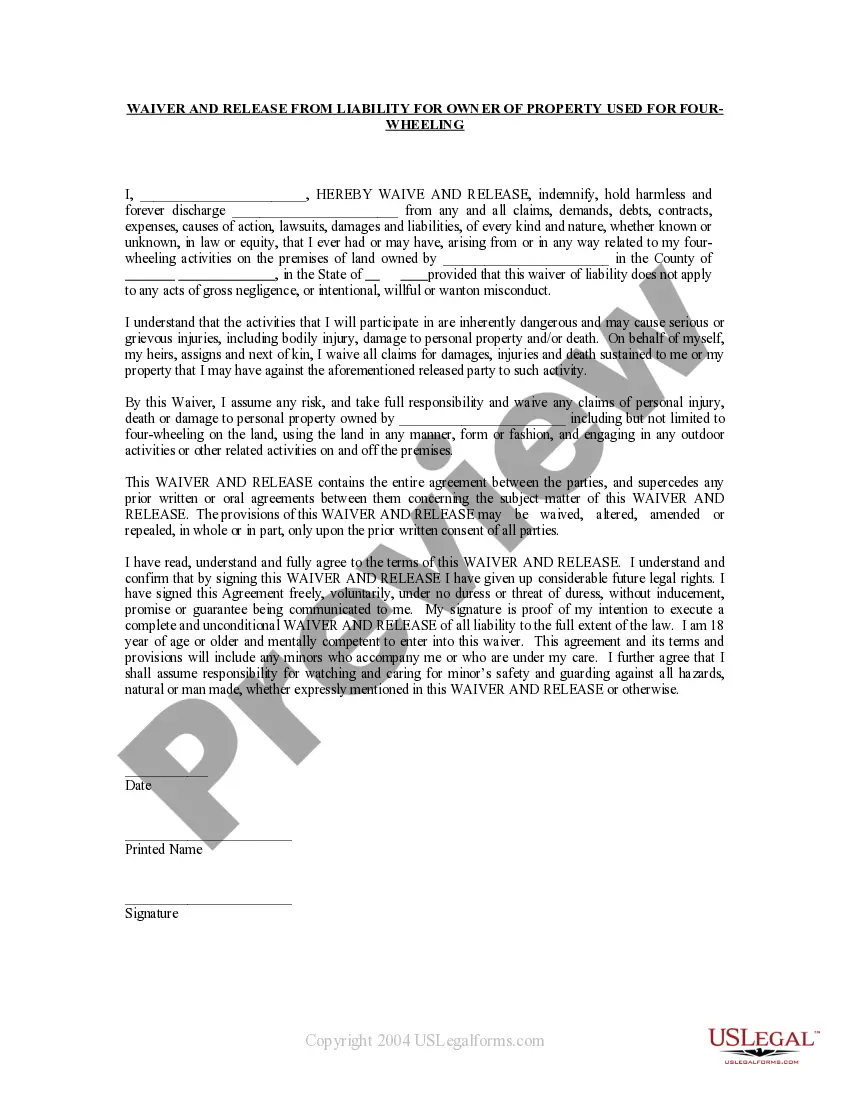

A discretionary trust is a trust where the beneficiaries and/or their entitlements to the trust fund are not fixed, but are determined by the criteria set out in the trust instrument by trustor. Discretionary trusts can be discretionary in two respects. First, the trustees usually have the power to determine which beneficiaries (from within the class) will receive payments from the trust. Second, trustees can select the amount of trust property that the beneficiary receives. Although most discretionary trusts allow both types of discretion, either can be allowed on its own. It is permissible in most legal systems for a trust to have a fixed number of beneficiaries and for the trustees to have discretion as to how much each beneficiary receives.

North Carolina Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary

Description

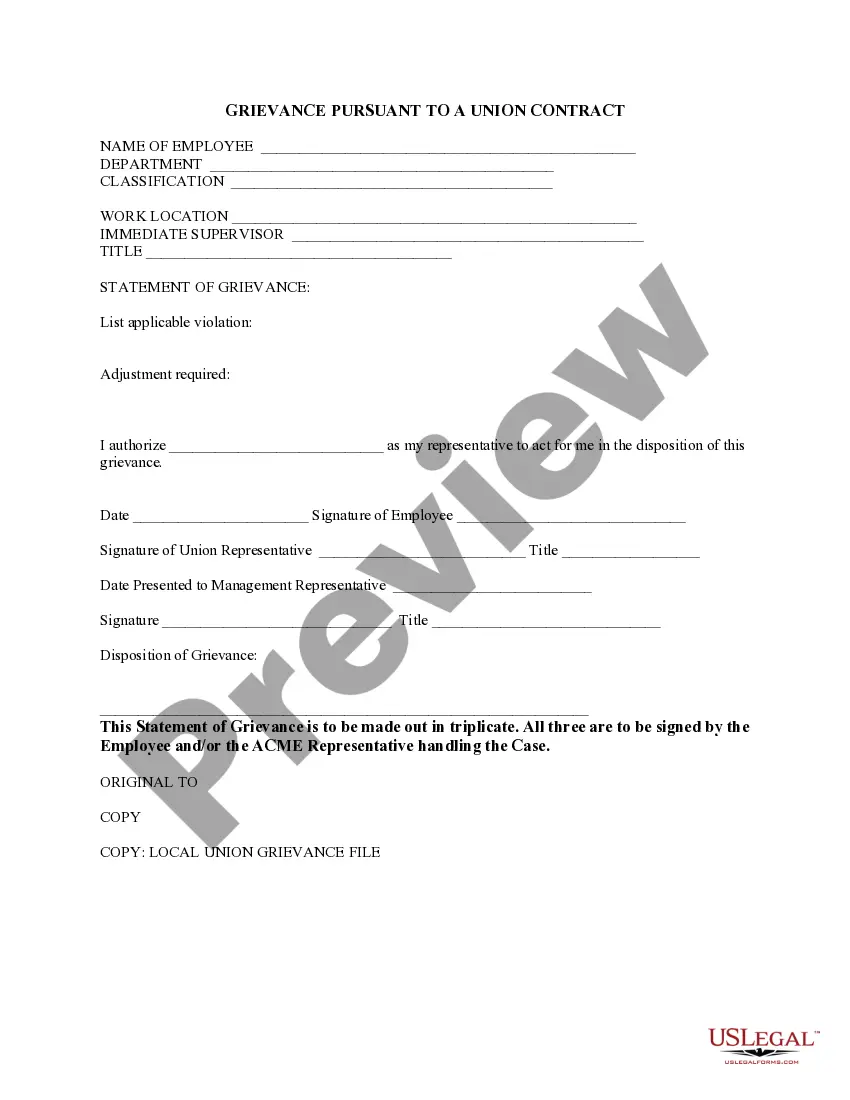

How to fill out Discretionary Distribution Trust For The Benefit Of Trustor's Children With Discretionary Powers Over Accumulation And Distribution Of Principal And Income Separate Trust For Each Beneficiary?

If you want to be thorough, download or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly and convenient search tool to find the documents you need.

A range of templates for both business and personal purposes are organized by categories and states, or keywords.

Step 4. After you have located the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to process the payment.

- Utilize US Legal Forms to locate the North Carolina Discretionary Distribution Trust for the Advantage of Trustor's Children with Discretionary Powers over the Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to obtain the North Carolina Discretionary Distribution Trust for the Advantage of Trustor's Children with Discretionary Powers over the Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for your specific city or region.

- Step 2. Use the Review option to examine the form's contents. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The most important rights of estate beneficiaries include: The right to receive the assets that were left to them in a timely manner. The right to receive information about estate administration (e.g., estate accountings) The right to request to suspend or remove an executor or administrator.

Key TakeawaysTrust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

When executing their trust, settlors generally name themselves as the sole trustee and beneficiary while they are living; this allows them to exercise full control over the trust and its assets during their lifetime, as well as to withdraw trust funds as they see fit.

Beneficiaries are entitled to see legal advice provided it is paid for by the trust fund. beneficiaries may not see legal advice relating to trustees' disputes with beneficiaries; and. if trustees have a controlling shareholding in a company then company documents may be subject to disclosure.

Fortunately, California law protects beneficiaries by requiring trustees to communicate throughout the trust administration process and act in the best interests of beneficiaries.

If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year. The trustee must issue you a Schedule K-1 for the income distributed to you, which you must submit with your tax return.

Some trusts contain provisions where the trustee can make uneven distributions to people in the same class of beneficiaries; this is called a sprinkling power.

When you set up a Discretionary Trust, you identify a class of beneficiaries such as children and/or grandchildren who can receive capital and/or income from the trust at the discretion of the Trustees. No one beneficiary has an absolute entitlement to either income or capital.

Generally, when you inherit money it is tax-free to you as a beneficiary. This is because any income received by a deceased person prior to their death is taxed on their own final individual return, so it is not taxed again when it is passed on to you.

Discretionary trusts disadvantages Complexity. Setting up and maintaining a solid discretionary trust structure can be complicated. Potential loss. Only profits are distributed losses remain as such. Trust.