No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

North Carolina Collection Agency's Return of Claim as Uncollectible

Description

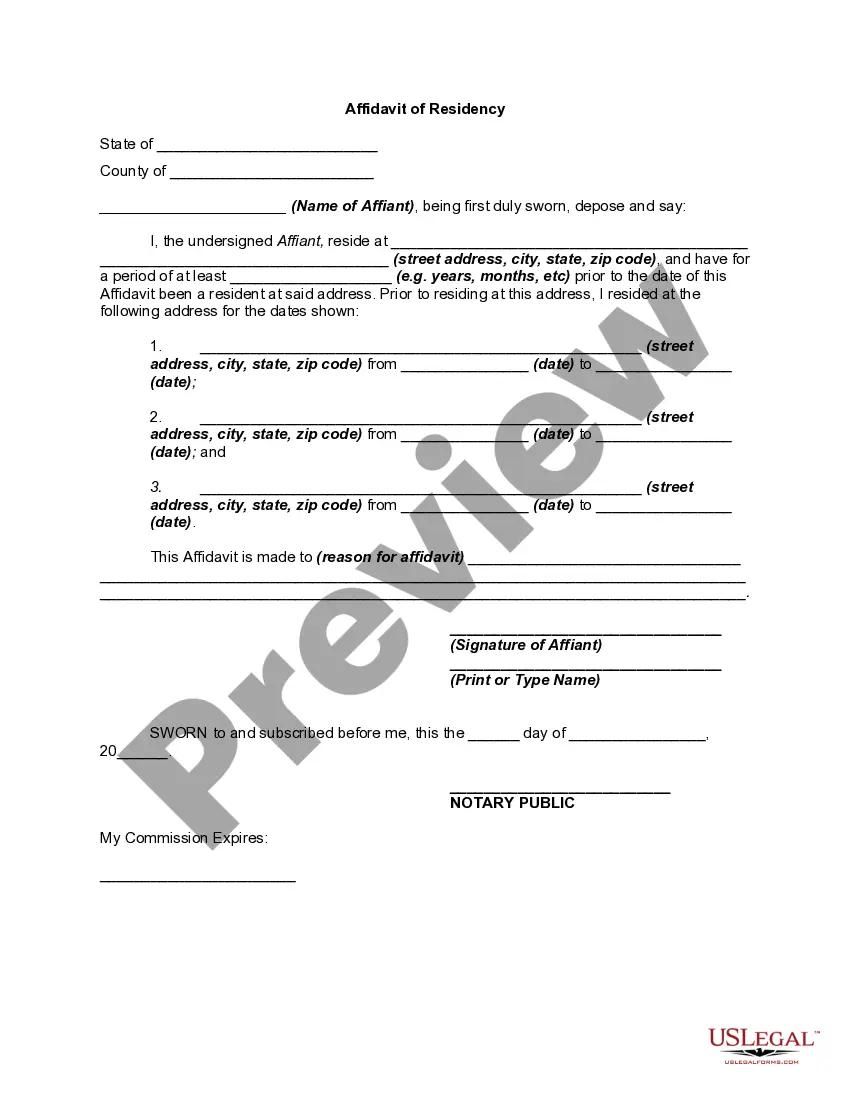

How to fill out Collection Agency's Return Of Claim As Uncollectible?

Locating the correct authentic document format can be a challenge.

Naturally, there are numerous templates available online, but how can you obtain the authentic form you require.

Utilize the US Legal Forms website. The platform provides a wide array of templates, including the North Carolina Collection Agency's Return of Claim as Uncollectible, which you can utilize for both business and personal purposes.

You can review the form using the Review button and read the form description to ensure this is indeed the right one for you.

- All the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the North Carolina Collection Agency's Return of Claim as Uncollectible.

- Use your account to browse the legitimate forms you have previously acquired.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

- Firstly, ensure you have selected the correct form for your region/location.

Form popularity

FAQ

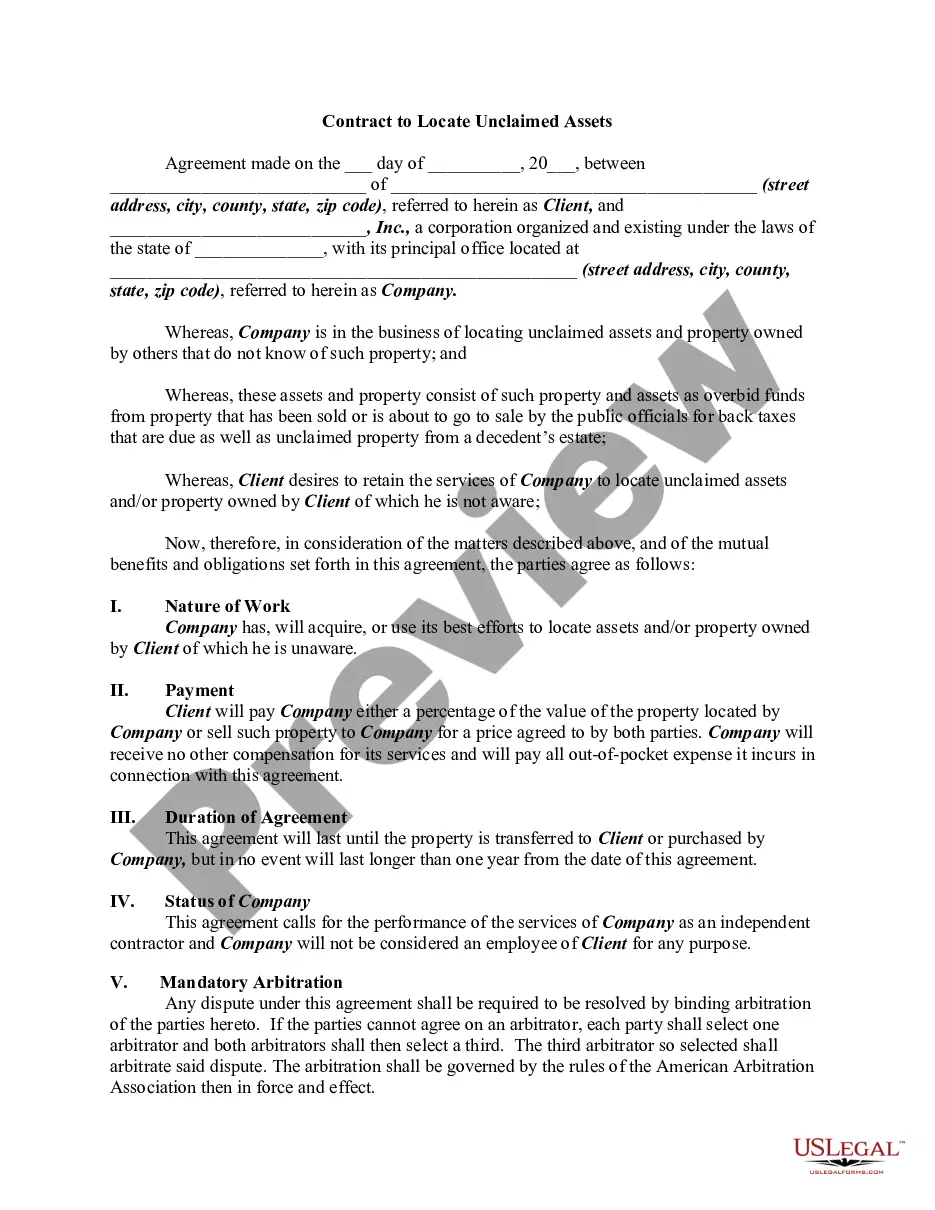

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

North Carolina law treats medical bills like other unpaid debts. Your hospital or any other health care provider has three years after billing you to sue for an unpaid debt; after that, it can no longer take you to court.

North Carolina Statute of Limitations on Debt Collections If you are living in North Carolina, consumer debt has a statute of limitations of three years. This is one of the shortest lengths of the statute of limitations in the country, with most ranging from four to six years.

Statute of Limitations and Your Credit ReportCollection accounts can remain on your report for seven years and 180 days from the original delinquency. Depending on the type of account and your location, this can be more than or less than the statute of limitations.

North Carolina's statute of limitations on most debts is 3 years. North Carolina does not permit wage garnishment for commercial debts, though the IRS or State can garnish wages. Bank accounts are not exempt from attachment by judgment creditors.