A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There is a multitude of legal document templates accessible online, but finding trustworthy ones isn't easy.

US Legal Forms offers a vast array of template forms, such as the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, designed to comply with state and federal regulations.

Choose a convenient document format and download your version.

Access all of the document templates you have purchased in the My documents section. You can download an additional copy of the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability at any time if needed. Simply click on the required form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and prevent errors. The service provides properly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/state.

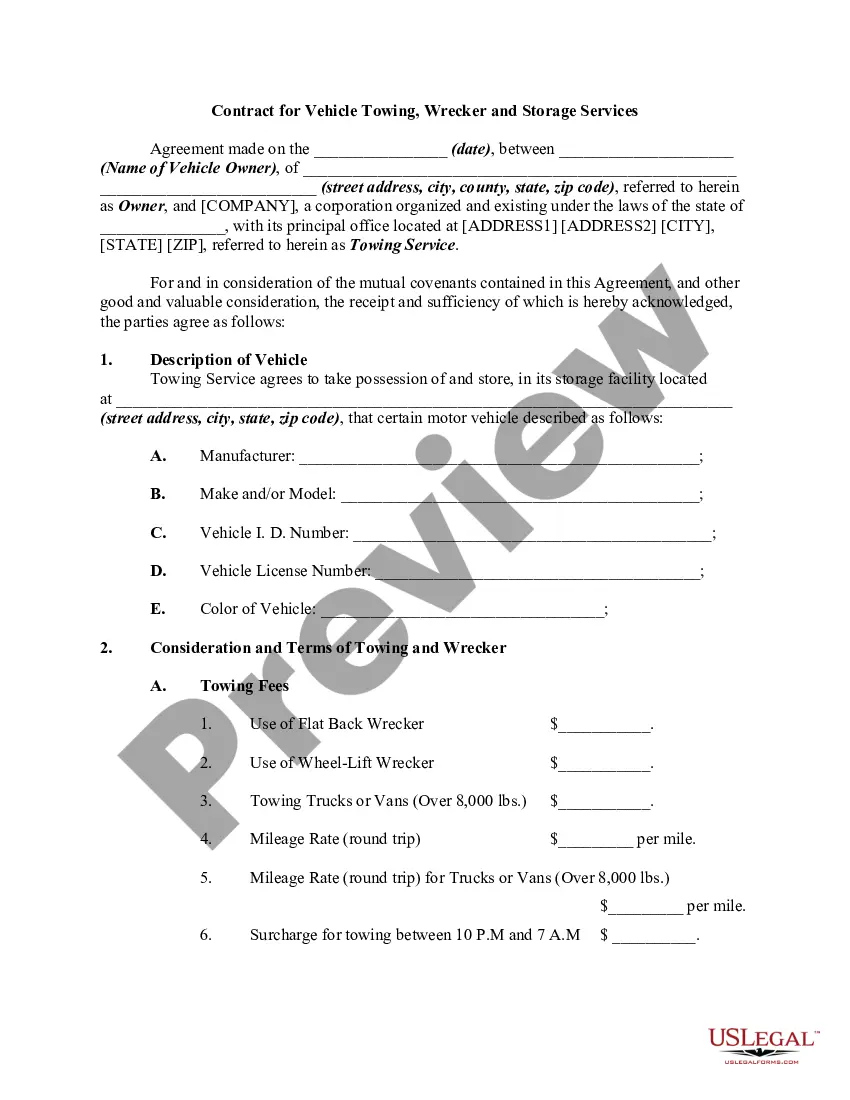

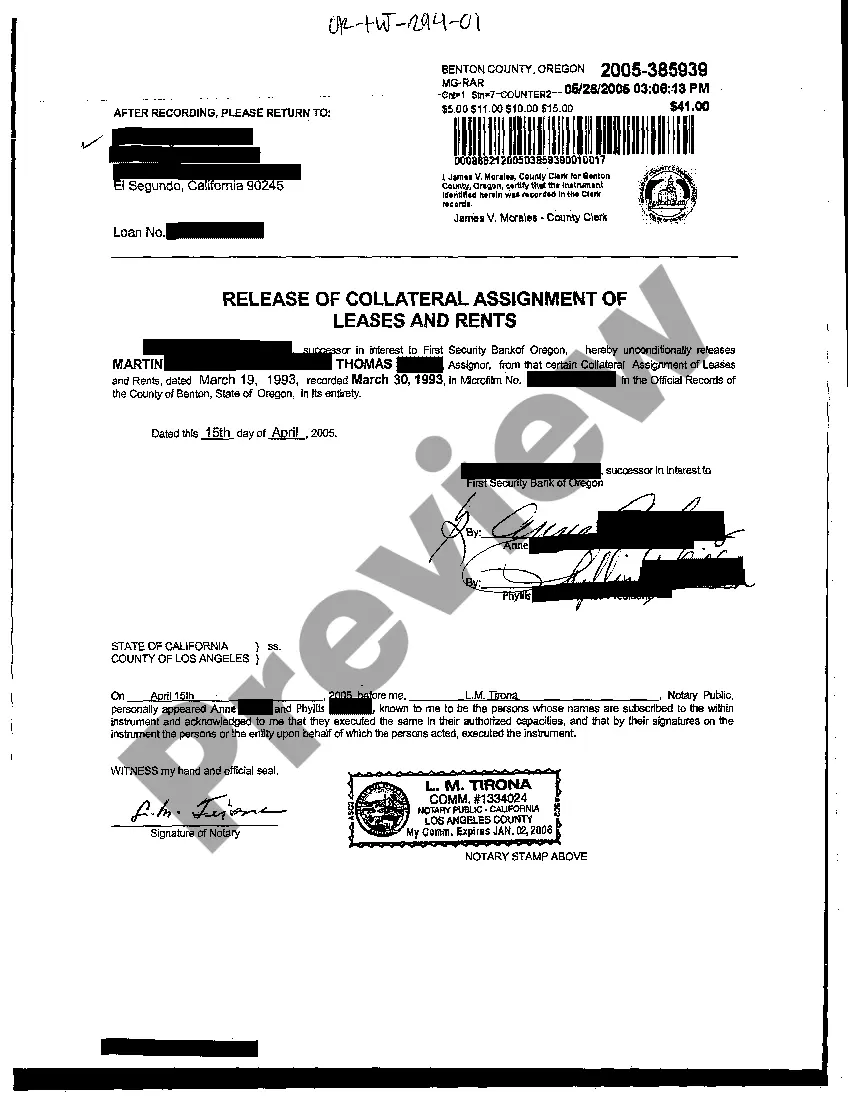

- Utilize the Review button to assess the document.

- Read the description to ensure you have chosen the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the right form, click on Get now.

- Select the pricing plan you want, fill in the necessary information to create your account, and complete your order using PayPal or credit card.

Form popularity

FAQ

The downside of being a guarantor includes the potential risk of financial loss if the borrower defaults on their obligations under the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. You may be liable for the entire amount of the debt, which could impact your credit score and financial stability. It's crucial to weigh these risks carefully before agreeing to serve as a guarantor.

A guarantor can protect themselves by setting specific terms in the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability agreement, such as an expiration date or a cap on liability. Staying informed about the borrower's financial status is vital, as it enables you to take early action if issues arise. Additionally, consulting with legal professionals for guidance and support can fortify your position.

To protect yourself as a guarantor, clearly understand your obligations before agreeing to the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. You might also consider limiting the amount of your guarantee or securing an indemnification agreement. Regularly monitor the financial health of the borrower to ensure you are aware of any potential risks.

The discharge of guarantor liability occurs when a guarantor is released from their obligations under the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. This can happen through various means, such as repayment of the debt or formal agreement with the creditor. Understanding this process can help you navigate your responsibilities and protect your financial interests.

Guarantors may have options for removing themselves from their role under the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, but this typically requires mutual consent from the creditor. It's essential to check the terms of the guaranty for any provisions related to resignation or release. In some cases, you may need legal assistance to negotiate this process.

To protect yourself from a personal guarantee, consider seeking legal advice before signing any agreements, especially in the context of the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Ensure that you fully understand the terms and obligations outlined in the guarantee. By reviewing the document closely, you can identify potential risks and negotiate terms that limit your liability.

Loopholes in personal guarantees can create uncertainties in financial agreements. Some potential loopholes include vague language or specific exemptions that shield assets from claim. In context to the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, being aware of these loopholes is critical for both lenders and borrowers. This knowledge can help you navigate risks effectively and safeguard your interests.

A personal guarantor is an individual who agrees to take on the responsibility for someone else’s debt if the main borrower fails to meet their obligations. This role is essential in many business transactions, including those governed by the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Utilizing a personal guarantor can enhance your chances of obtaining financing, but it also carries significant personal risk.

A guarantor can be anyone who pledges to repay a debt if the primary borrower defaults. In contrast, a personal guarantor specifically refers to an individual who uses personal assets to back the guarantee. This distinction is pivotal in the realm of the North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, as it affects liabilities and risk. Knowing which type of guarantor you work with can shape the terms of your financial agreement.

A guarantor provides a broader commitment to cover all obligations, while a limited guarantor restricts their liability to specific conditions or amounts. This distinction plays an important role in a North Carolina Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, ensuring that a guarantor can manage their obligations without overextending their financial risk.