This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

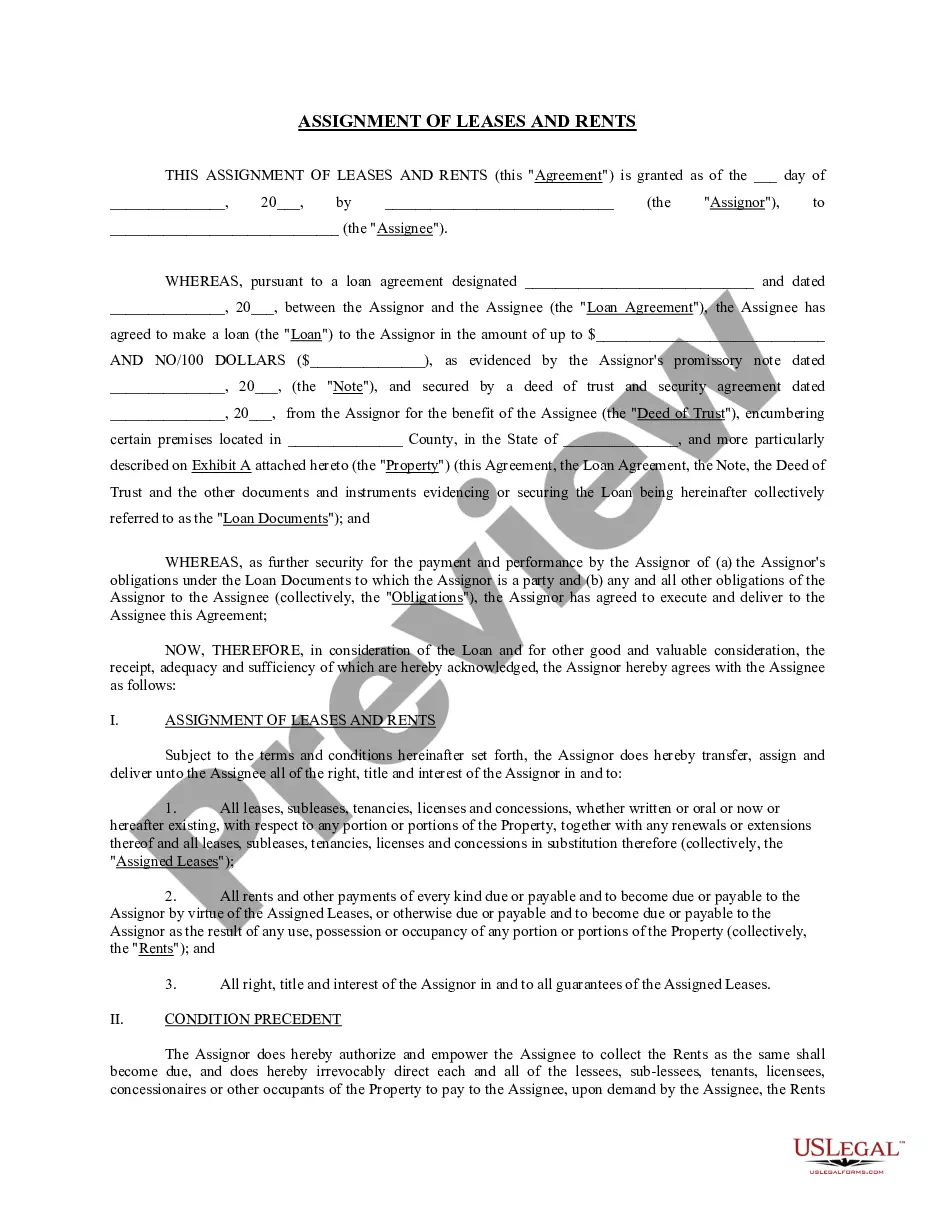

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

US Legal Forms - one of the most important collections of legal documents in the USA - provides a diverse array of legal form templates you can obtain or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms, such as the North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, in moments.

Read the form details to confirm you have selected the right form.

If the form does not suit your requirements, use the Search field at the top of the screen to find one that does.

- If you have a monthly membership, Log In and obtain the North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children from the US Legal Forms repository.

- The Download button will appear on every form you view.

- You can access all previously obtained forms from the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have chosen the correct form for your locality/region.

- Click the Preview button to view the form's details.

Form popularity

FAQ

You can use the North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children to make gifts without incurring gift tax. This agreement allows you to transfer assets on behalf of minors while ensuring they benefit from the annual gift tax exclusion. By setting up trusts, you can manage how and when these assets are distributed, providing security for your children’s future. This strategic approach not only minimizes tax implications but also promotes financial education for your children as they mature.

A minor trust typically refers to a trust established for the benefit of a child. This can include trusts like a 2503(c) trust, which allows for gifts to be held until a minor reaches adulthood. Establishing a North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children is a straightforward way to secure a child’s financial future.

The best trust to set up largely depends on your individual needs. For minors, trusts like 2503(c) or UTMA accounts are commonly considered. When working with a North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, consulting a professional can clarify which option suits you best.

A 2503(c) trust is often recommended as it offers flexibility in distributed assets upon the beneficiary reaching adulthood. Alternatively, custodial accounts like UTMA can also serve well. Ultimately, choosing a North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can help streamline this process.

The ideal trust for minors often depends on your specific goals. Generally, 2503(c) trusts are suitable for minor beneficiaries as they provide immediate access to funds once the child turns 21. Considering a North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can further enhance your planning.

UTMA, or the Uniform Transfers to Minors Act, allows gifts to minors without the need for a formal trust. In contrast, a 2503(c) trust allows contributions that can be held until the minor reaches adulthood. If you're navigating a North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, understanding these differences is key.

Yes, gifts to certain types of trusts can qualify for the annual exclusion. The trust must allow the beneficiary to withdraw the gift or have a reasonable expectation to access it. Therefore, when dealing with North Carolina Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, ensuring access rights is crucial.

The gift limit in North Carolina typically aligns with the federal Annual Gift Tax Exclusion, allowing you to give away $17,000 per recipient in 2024 without incurring tax. This limit is beneficial when creating plans for your children's future. Using a North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children ensures that you can maximize these limits while providing support for your minors.

NC state employees have restrictions on accepting gifts to prevent conflicts of interest and ensure fairness. Generally, gifts under a certain value may be acceptable, but larger gifts are often prohibited. Understanding these rules can be crucial, especially when establishing a North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

Yes, you can gift a house to someone in North Carolina. However, this type of gift may have tax implications, especially if the value exceeds the Annual Gift Tax Exclusion limit. A North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can also help manage such gifts effectively while reducing potential tax burdens.