North Carolina Services Contract - General

Description

How to fill out Services Contract - General?

If you need to obtain, download, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search to find the documents you need.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours indefinitely. You have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and download, and print the North Carolina Services Contract - General with US Legal Forms. There are numerous professional and state-specific forms you can use for your personal business or personal needs.

- Utilize US Legal Forms to acquire the North Carolina Services Contract - General in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the North Carolina Services Contract - General.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

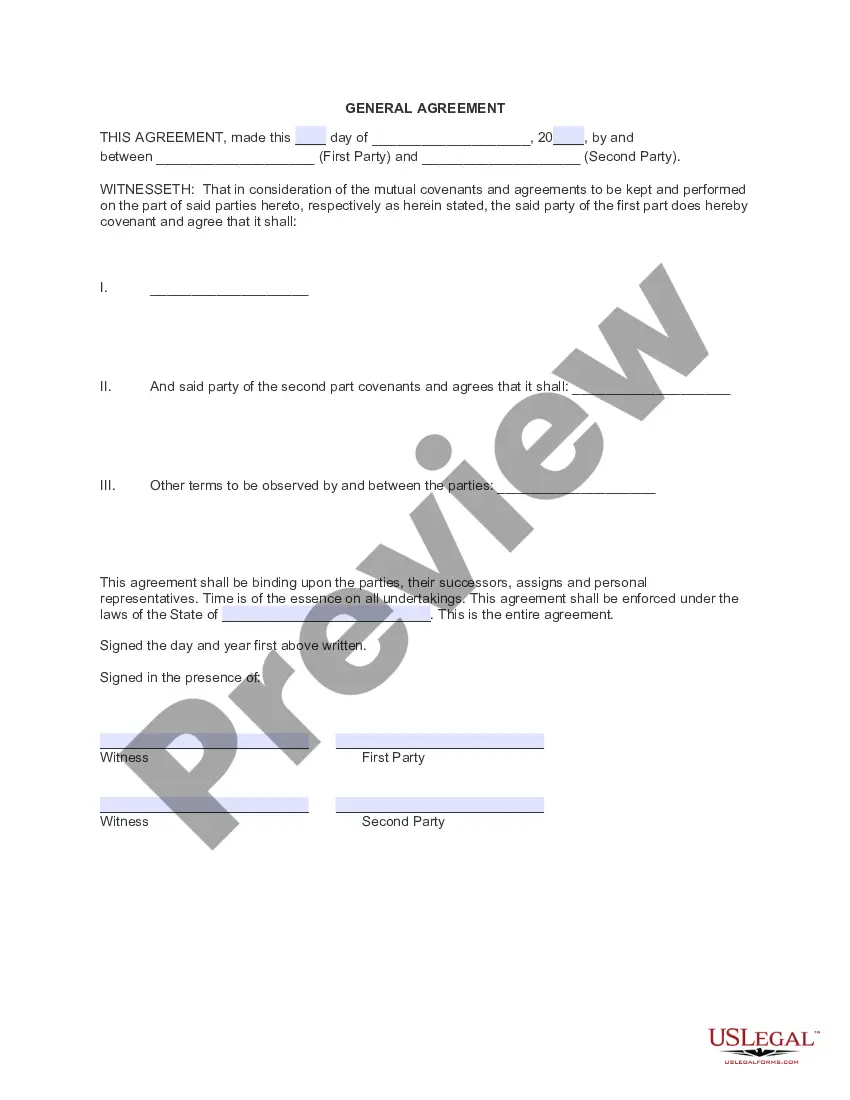

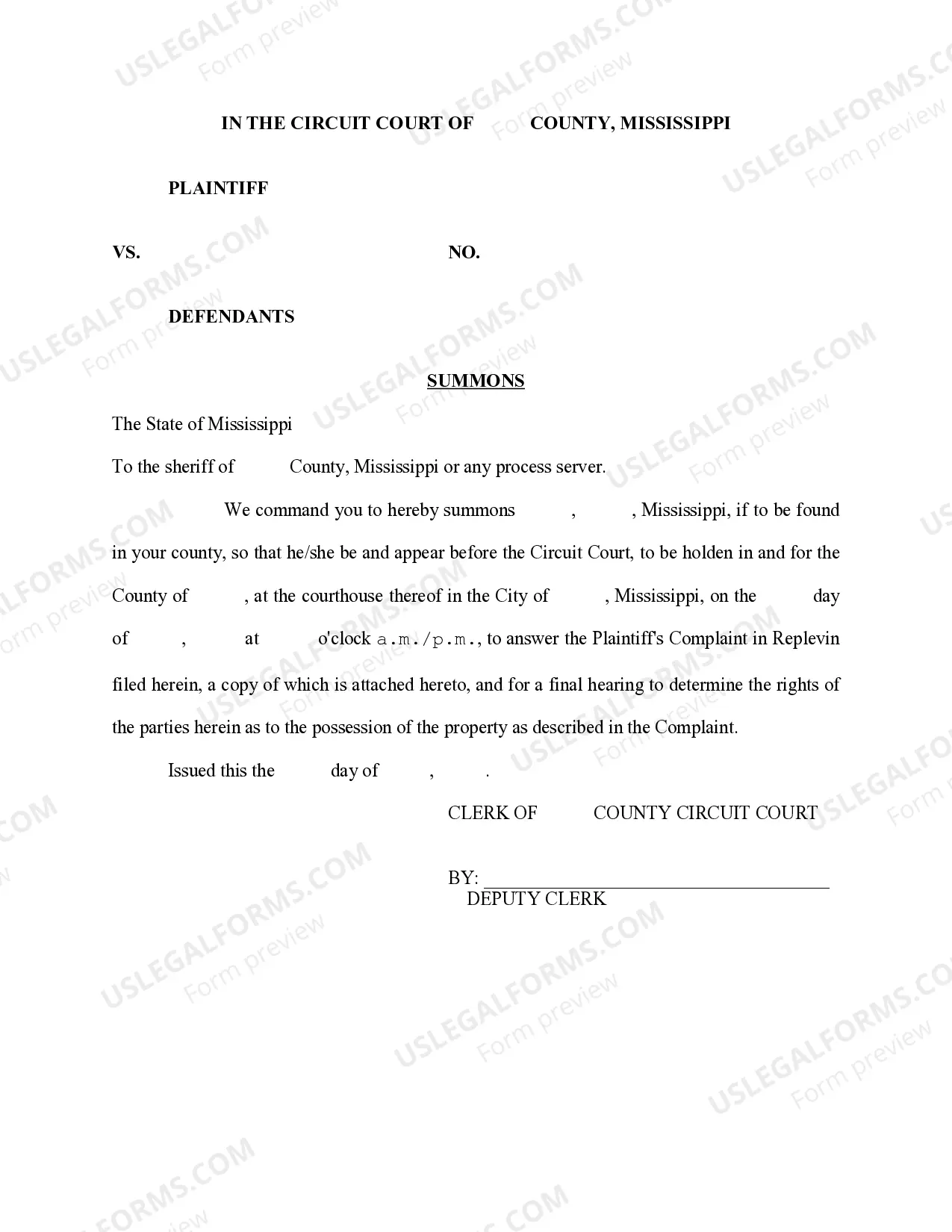

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get Now button. Select the pricing plan you prefer and enter your details to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the North Carolina Services Contract - General.

Form popularity

FAQ

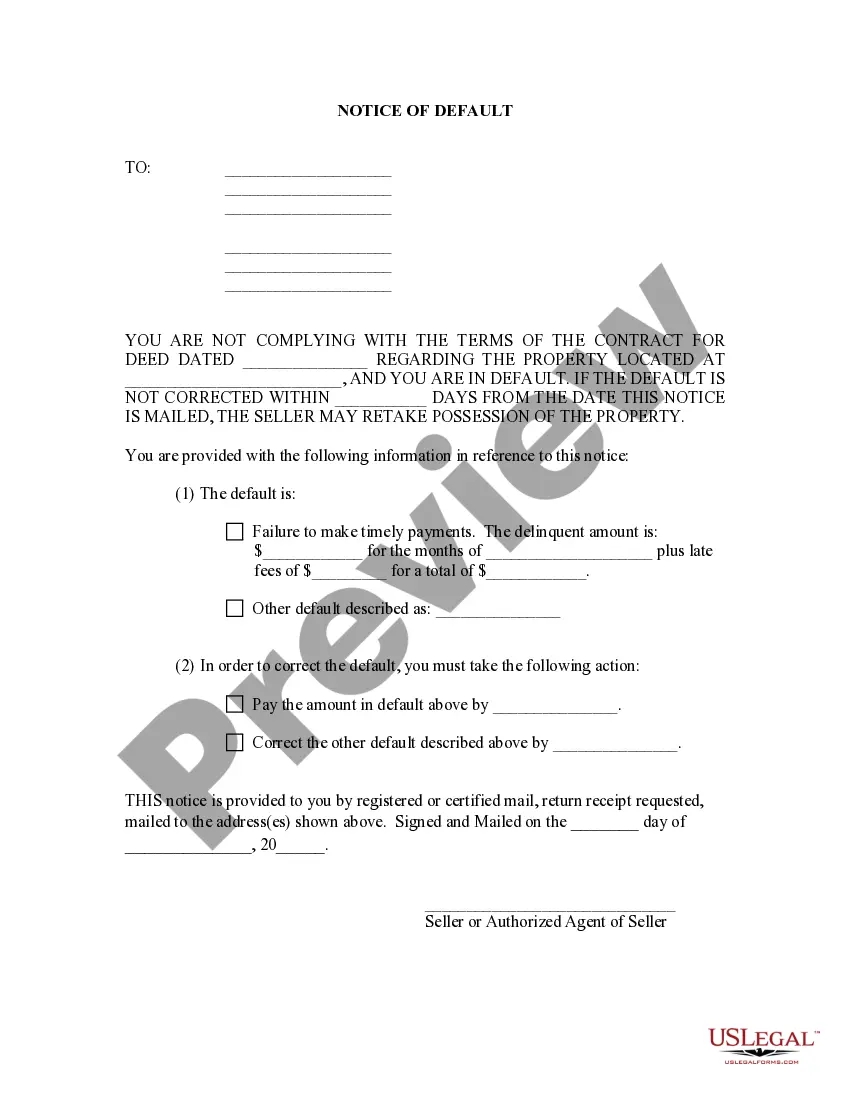

To file a notice of contract in North Carolina, you must prepare a document that states the relevant information about the contract, including the parties involved and the services contracted. This notice must be filed in the appropriate county register of deeds. Understanding how to file correctly is important for protecting your rights under a North Carolina Services Contract - General. Depending on your situation, utilizing templates from uslegalforms could simplify this process.

Service contracts in North Carolina are typically subject to sales tax based on the nature of the services provided. However, some exceptions may apply depending on the specific services outlined in your North Carolina Services Contract - General. It is crucial to review the details and consult with tax professionals to ensure compliance. This due diligence can save you from unexpected tax liabilities.

Yes, contract labor is generally considered taxable in North Carolina. If you hire independent contractors for a project, you may need to report their income accordingly. Understanding the tax implications of a North Carolina Services Contract - General is vital for compliance. Therefore, always keep accurate records and consult tax resources to navigate these requirements.

A contract can be voided in North Carolina if it was formed under duress, fraud, or misrepresentation. Additionally, if the contract lacks essential elements like capacity or lawful purpose, it may also be declared void. Recognizing the factors that void a North Carolina Services Contract - General can help you ensure your agreements are robust and enforceable. Always consult a legal expert when in doubt.

A valid contract requires mutual consent, consideration, lawful purpose, parties with capacity, and definite terms. These components ensure that when forming a North Carolina Services Contract - General, all parties understand their obligations. It is crucial that each requirement is clearly defined to avoid potential disputes. Adequate attention to detail can help in creating a robust agreement.

The 3-day rule refers to a consumer protection law that allows buyers in North Carolina to cancel certain contracts within three days of signing. This is particularly significant for service contracts, giving consumers a safeguard against impulsive decisions. When dealing with a North Carolina Services Contract - General, it's essential to be aware of this rule to ensure compliance. Therefore, always check whether your contract falls under this rule.

A contract is legally binding in North Carolina when it contains the essential elements: offer, acceptance, consideration, and competent parties. Additionally, the contract must not violate any laws or public policy. Understanding these conditions is crucial when drafting any North Carolina Services Contract - General. Ensuring clarity in the terms will protect your rights as a party.

To create a legally binding contract, you must establish an offer, acceptance, consideration, and mutual consent. In the context of a North Carolina Services Contract - General, these elements form the backbone of agreement. When both parties understand and agree to these terms, the contract becomes enforceable. Always ensure you meet these key requirements.

Yes, you can assign a contract to another party, provided the original contract does not prohibit such action. Always check the terms of your agreement before proceeding. Utilizing a North Carolina Services Contract - General can provide guidance on how to effectively manage assignments.

Yes, in North Carolina, Software as a Service (SaaS) is generally considered taxable. This applies whether the software is accessed online or delivered via download. It’s essential to incorporate this understanding into your business model, potentially using a North Carolina Services Contract - General to address tax liabilities.