North Carolina Oil, Gas and Mineral Lease

Description

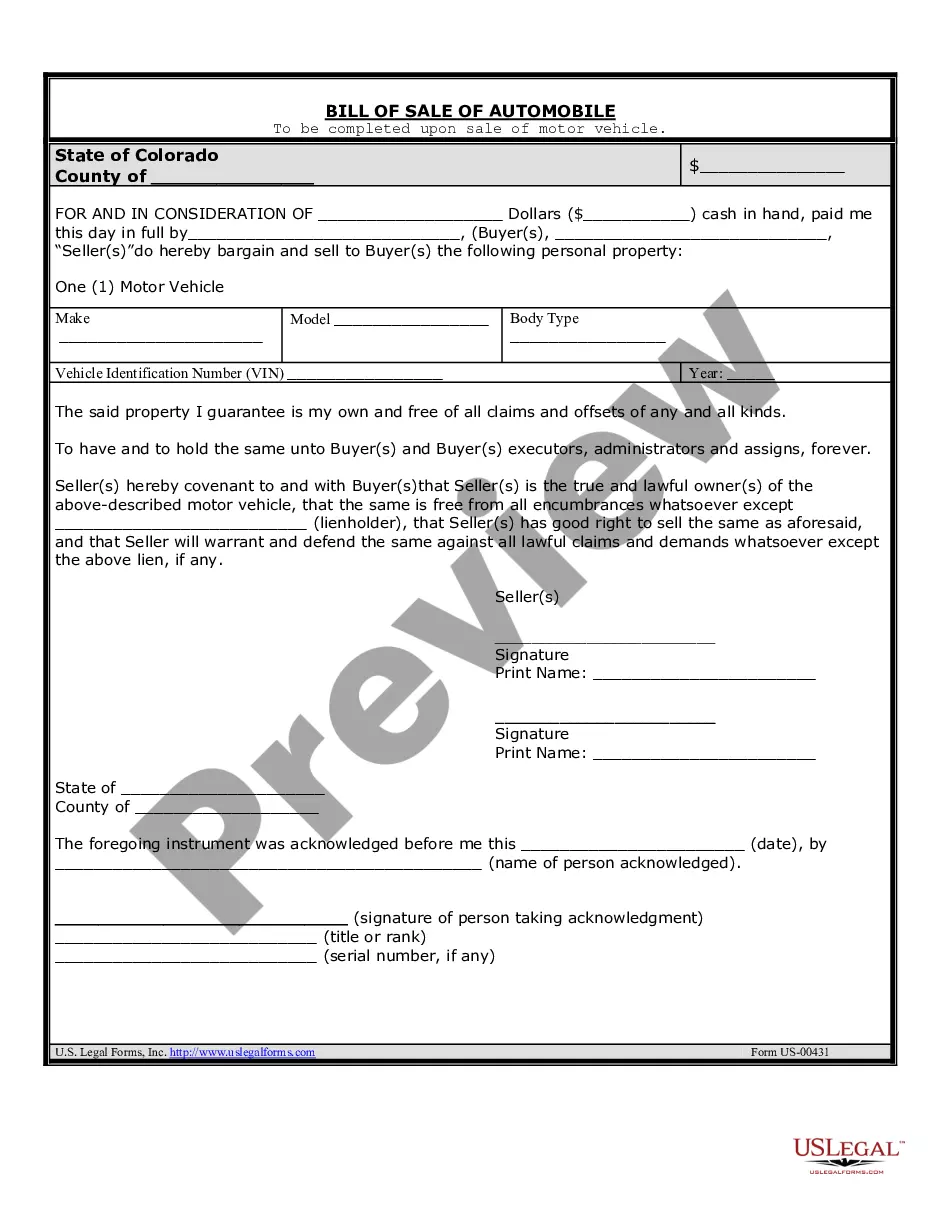

How to fill out Oil, Gas And Mineral Lease?

If you wish to total, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s user-friendly and convenient search to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the North Carolina Oil, Gas and Mineral Lease with just a couple of clicks.

Every legal document template you acquire is your property indefinitely.

You will have access to each form you downloaded within your account. Visit the My documents section and select a form to print or download again.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the North Carolina Oil, Gas and Mineral Lease.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview feature to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you require, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment process. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Download the format of the legal form and save it to your device.

- Step 7. Fill out, modify and print or sign the North Carolina Oil, Gas and Mineral Lease.

Form popularity

FAQ

The State of North Carolina Mineral and Oil and Gas Rights Mandatory Disclosure Statement requires all sellers of a new or existing homes in NC to disclose whether the mineral, oil and gas rights for the property are owned by someone other than the seller.

Pursuant to property laws, the owner of the mineral rights typically has the right to use the surface of the property in such ways and to such an extent as is reasonably necessary to obtain the minerals under the ground.

Royalties on private lands are influenced by state rates. They generally range from 12?25 percent. Before negotiating royalty payments on private land, careful due diligence should be conducted to confirm ownership.

A contract that, for a stipulated sum, conveys to an operator (Lessee) the right to drill for oil and gas.

The Federal onshore oil and gas rate is 16.67% for leases issued after August 16, 2022. However, there are a few exceptions, including different royalty rates on older leases, reduced royalty rates on certain oil leases with declining production, and increased royalty rates for reinstated leases.

time payment to a lessor as consideration for signing a paidup oil & gas lease. The bonus is generally not written in the lease. It is normally paid on a per net mineral acre basis and should be paid in a simultaneous exchange of the signed lease.

Again, negotiating oil leases takes time. Don't Respond That You're Not Interested. ... Don't Rush to Hire a Lawyer. ... Don't Start Spending Money You Don't Yet Have. ... Don't Warrant the Mineral Title. ... Don't Lease Multiple Non-contiguous Tracts on One Lease Form. ... Don't Spout Off during Negotiating.

North Carolina currently does not produce any natural gas or oil. Natural gas and petroleum are made up of many hydrocarbon compounds.