North Carolina Corporation - Transfer of Stock

Description

How to fill out Corporation - Transfer Of Stock?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the North Carolina Corporation - Transfer of Stock in an instant.

If the form doesn't meet your needs, use the Search box at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose your preferred pricing plan and provide your credentials to register for an account.

- If you already have a subscription, Log In to download the North Carolina Corporation - Transfer of Stock from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously obtained forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your city/state.

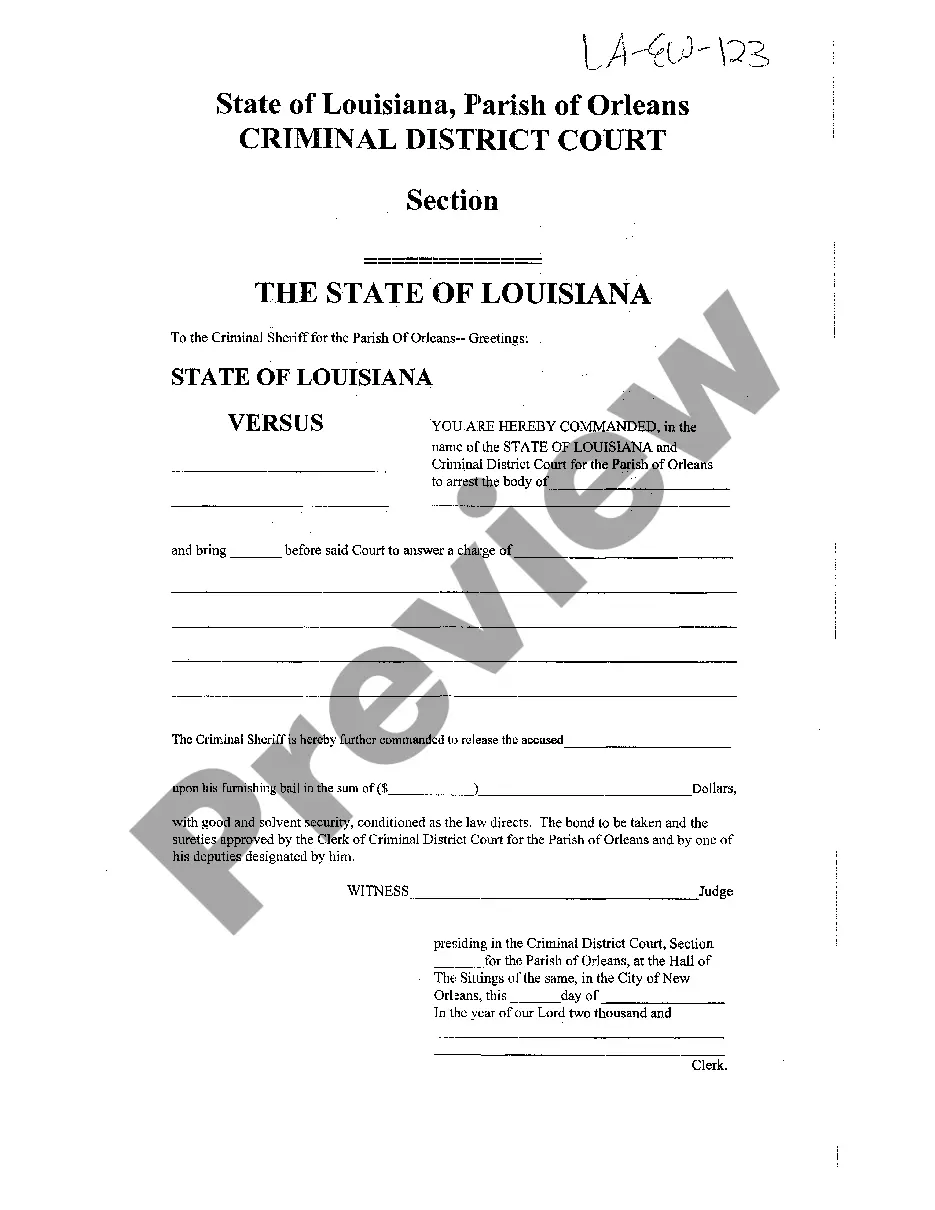

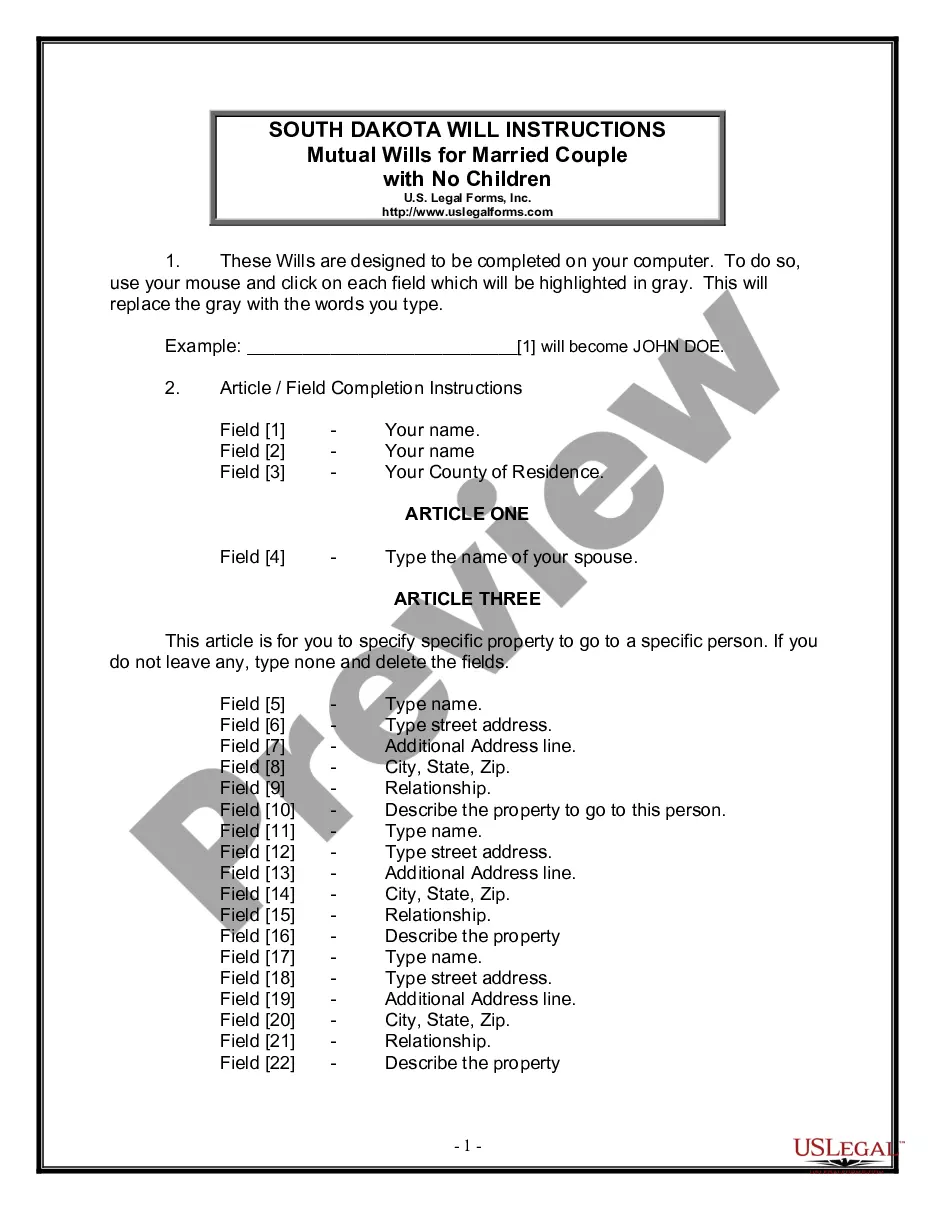

- Click the Review button to examine the form's content.

Form popularity

FAQ

Transferring shares in a corporation involves a few clear steps. You must fill out a stock transfer form, which is a legal document required for the transaction. After securing the necessary approvals from the board if needed, submit the form to the corporation, completing the North Carolina Corporation - Transfer of Stock process smoothly.

Yes, transferring ownership in corporations through stock is generally easier compared to other business types. Stocks represent ownership that can be easily bought and sold, allowing for flexible ownership changes. This simplicity is one of the benefits of a North Carolina Corporation - Transfer of Stock.

To transfer shares in a corporation, first review the corporate bylaws for specific transfer requirements. Create a stock transfer agreement that documents the terms of the transfer. Once signed, submit this agreement to the corporation for record updating, which is an essential part of a North Carolina Corporation - Transfer of Stock.

The procedure for transferring shares in a company begins with verifying the ownership and title of the shares being transferred. Then, complete a share transfer form and gather any necessary signatures from both the seller and the buyer. Finally, notify the company to update their records, facilitating the North Carolina Corporation - Transfer of Stock effectively.

Transferring ownership of an LLC in North Carolina involves a straightforward process. First, check your LLC's operating agreement for any specific rules about transferring membership interests. After that, draft a membership transfer agreement and obtain the necessary approvals from existing members. This ensures you handle the North Carolina Corporation - Transfer of Stock correctly.

To transfer ownership of a company's shares in a North Carolina Corporation, start by reviewing the corporation's bylaws and any shareholder agreements. Next, prepare a stock transfer form that outlines the details of the transaction. Finally, submit the completed form to the corporation and update the stock ledger to reflect the new ownership. This process ensures a smooth North Carolina Corporation - Transfer of Stock.

The BE-17 form in North Carolina is related to business entity ownership and stock transfers. This form collects information about taxpayers who own or transfer stock in corporations. Filing this form correctly is essential for maintaining accurate records within the state’s business registry. For assistance with this form, uslegalforms provides helpful resources tailored to your needs.

Yes, as stated earlier, an S Corporation must file an annual report in North Carolina each year. This report ensures that your corporation remains in good standing and up to date with the state’s requirements. It's crucial because failure to comply can lead to administrative dissolution. Ensuring timely submission is key to smooth operations for your North Carolina Corporation - Transfer of Stock.

Yes, North Carolina recognizes S Corporations. This structure allows business owners to enjoy pass-through taxation, which can be beneficial for both the corporation and its owners. Additionally, S Corporations in North Carolina continue to maintain compliance with state regulations. If you're considering this structure, it’s wise to consult resources like uslegalforms for guidance.

In North Carolina, all corporations, including S Corporations and C Corporations, must file an annual report. This filing is mandatory and helps the state keep updated records on businesses. However, LLCs and limited partnerships also have their own reporting obligations. Remember, timely filing maintains your North Carolina Corporation's compliance.