North Carolina Deferred Compensation Agreement - Long Form

Description

How to fill out Deferred Compensation Agreement - Long Form?

It is feasible to dedicate numerous hours online searching for the legal document template that meets the state and federal requirements you seek.

US Legal Forms offers a vast array of legal documents that are reviewed by experts.

You can effortlessly download or print the North Carolina Deferred Compensation Agreement - Long Form from their service.

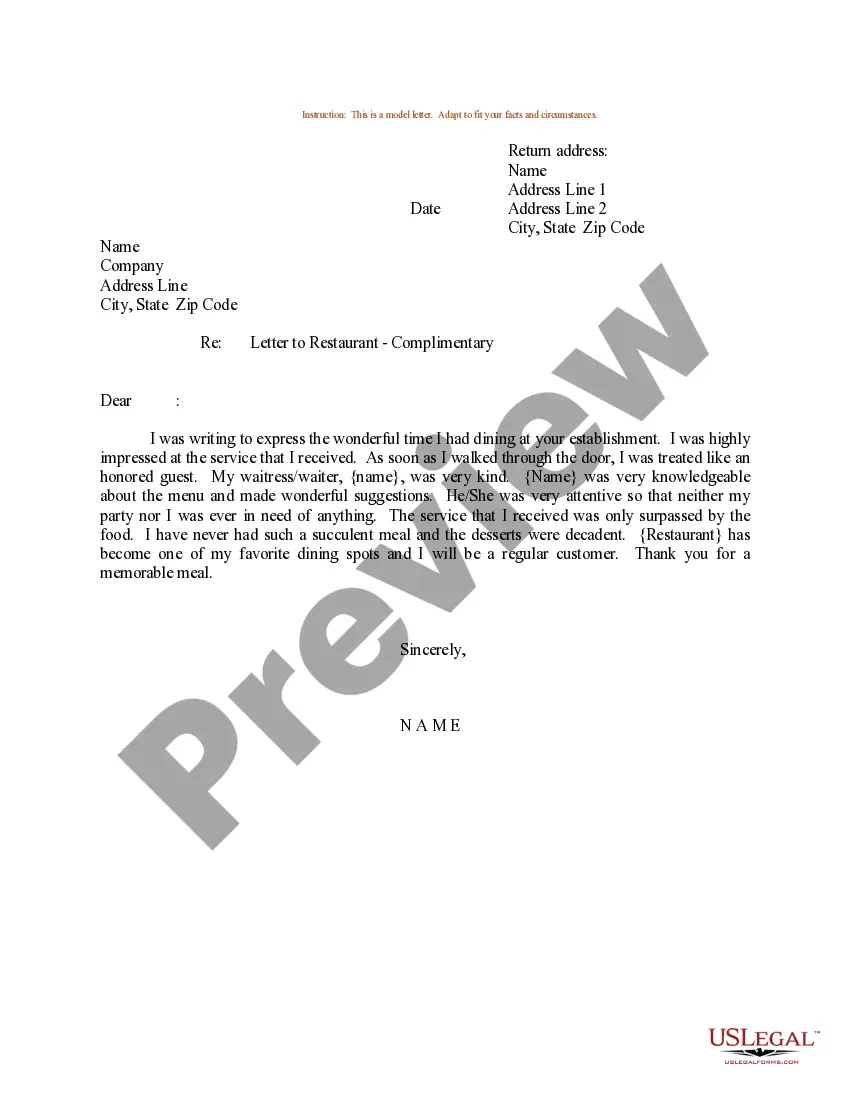

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- Subsequently, you can complete, edit, print, or sign the North Carolina Deferred Compensation Agreement - Long Form.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/area that you choose.

- Review the document description to confirm you have selected the appropriate form.

Form popularity

FAQ

You can typically withdraw from your 457 B plan without penalty once you reach the age of 59½. This allows you to access your savings without incurring additional fees, making it a flexible option in retirement. Understanding the implications of the North Carolina Deferred Compensation Agreement - Long Form will help you navigate these rules effectively.

When you retire, it's important to evaluate your options for your 457 B plan. You may choose to leave the funds in the plan, roll them over into an IRA, or withdraw the funds. A North Carolina Deferred Compensation Agreement - Long Form can help clarify your options and guide you toward a decision that aligns with your retirement goals.

One downside to a 457 B plan is that it does not allow for catch-up contributions beyond the age of 50, unlike some other retirement accounts. Furthermore, withdrawal restrictions can complicate financial planning. By exploring a North Carolina Deferred Compensation Agreement - Long Form, you can better prepare for these potential limitations.

A 457 B plan can limit your investment choices and may come with higher fees than other retirement accounts. Additionally, if you leave your employer, you may face challenges in rolling over your funds. Understanding these downsides is essential when considering a North Carolina Deferred Compensation Agreement - Long Form.

Yes, you generally need to claim deferred compensation on your taxes when you receive it, not when it's earned. With a North Carolina Deferred Compensation Agreement - Long Form, taxes are often deferred until you withdraw the funds. It’s advisable to consult a tax professional to navigate the specifics and maximize your tax benefits.

A deferred compensation form is a document used to outline the specifics of a North Carolina Deferred Compensation Agreement - Long Form. This form details how and when compensation is deferred, along with the associated tax implications. Using a platform like USLegalForms can help you create a tailored form that meets your needs.

You can typically start withdrawing from a North Carolina Deferred Compensation Agreement - Long Form at age 59½. However, some plans may allow earlier withdrawals under specific circumstances. It's essential to review your plan's terms to understand the age limits and any penalties for early withdrawal.

Determining how much to contribute to your deferred compensation plan depends on various factors like your salary, financial goals, and retirement plans. A general guideline suggests allocating a percentage of your income to maximize the benefits of tax deferral. The North Carolina Deferred Compensation Agreement - Long Form is a valuable resource for establishing a contribution strategy that aligns with your future objectives. It's important to reassess your contributions regularly to ensure they remain effective for your financial situation.

A typical deferred compensation plan allows employees to set aside a portion of their earnings for future use, typically until retirement or another designated date. These plans often come with various investment options and tax benefits, making them attractive for long-term savings. Engaging in a North Carolina Deferred Compensation Agreement - Long Form can provide you with the structure and support needed to create a solid financial future. It’s essential to review the available plans to find what best meets your needs.

The 10 year rule for deferred compensation is a provision that specifies how long you must wait before receiving payments from your deferred compensation plan. Essentially, this rule ensures that you do not access your funds until at least ten years after the compensation is earned. This feature has been designed to encourage long-term savings and investment. If you are exploring a North Carolina Deferred Compensation Agreement - Long Form, understanding this rule can help you plan your finances more effectively.