This form is a Complaint For Declaratory Judgment To Determine ERISA Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage

Description

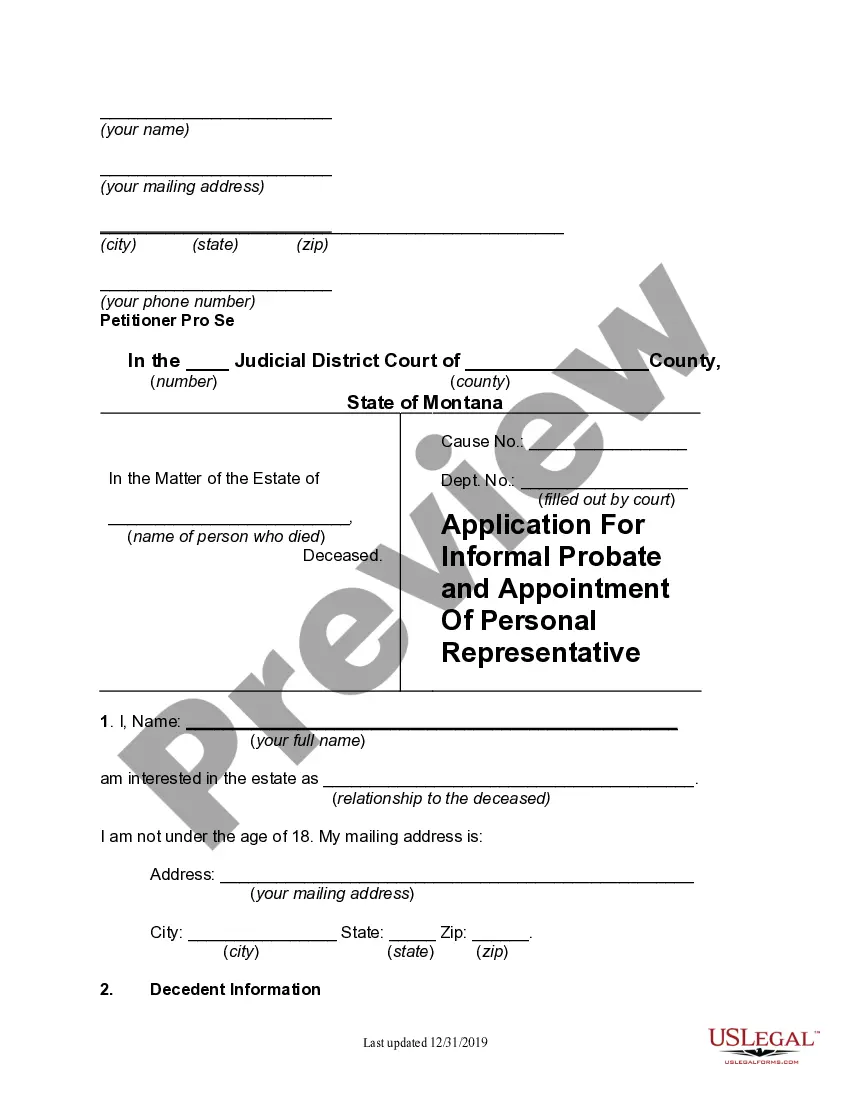

How to fill out Complaint For Declaratory Judgment To Determine ERISA Coverage?

If you desire to completely, download, or print legal document templates, use US Legal Forms, the largest selection of legal forms available on the web.

Utilize the site’s simple and user-friendly search to find the documents you require.

Numerous templates for business and personal applications are categorized by types and regions, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to locate the North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your specific area/country.

- Step 2. Use the Review option to check the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other versions of the legal form format.

Form popularity

FAQ

A declaratory judgment in insurance is a legal ruling that clarifies the rights and duties of parties under an insurance policy. It serves as a tool to resolve disputes regarding coverage, especially in cases related to ERISA, such as a North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage. By obtaining a declaratory judgment, policyholders and insurers can establish a clear understanding, which can prevent future conflicts.

An insurance company may seek a declaratory judgment when it needs clarity on its obligations under a policy, particularly in complex cases involving ERISA. For instance, if there is ambiguity about coverage under a North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage, the insurer might approach the court for a definitive ruling. This legal step helps protect the insurer from future liability and ensures compliance with regulations.

You might consider bringing a declaratory judgment action when there is uncertainty about your rights or obligations under an insurance policy. In particular, if you face a dispute regarding benefits or coverage, such as with a North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage, this legal action can help clarify your position. This approach often resolves issues before they escalate, saving time and resources.

NC General Statute 58-3-225 outlines the requirements for insurance companies regarding the disclosure of policy coverage. This statute is particularly relevant when dealing with a North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage, as it mandates that insurers provide clear and accurate information about benefits. Understanding this statute can strengthen your position in disputes related to insurance claims. It ensures that consumers have access to the information necessary for informed decision-making.

A complaint for declaratory judgment is a legal document that requests the court to clarify the rights of the parties involved. When you submit a North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage, you are asking the court to interpret specific provisions under ERISA as they apply to your situation. This type of complaint helps prevent future disputes by establishing clear legal standings. It is an essential tool for individuals seeking resolution in complex insurance matters.

The point of a declaratory judgment is to provide clarity and resolve legal uncertainties before they escalate into further disputes. For cases involving a North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage, this means establishing your rights and obligations under an insurance policy. It helps parties understand their positions and can often lead to settlements or prevent litigation. Ultimately, it promotes judicial efficiency and fairness.

The burden of proof for a declaratory judgment typically falls on the party seeking the declaration. In the context of a North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage, this means you must provide sufficient evidence to support your claims regarding coverage. The court will evaluate the information presented to determine the validity of the declaratory relief you are seeking. Understanding this burden helps you prepare a stronger case.

To file a complaint against an insurance company in North Carolina, you need to prepare a formal complaint detailing your issue. This process often involves drafting a North Carolina Complaint For Declaratory Judgment To Determine ERISA Coverage if your case relates to benefits under ERISA. You can submit your complaint to the North Carolina Department of Insurance or file in the appropriate court. Consider using US Legal Forms to find templates and guidance to simplify your filing.