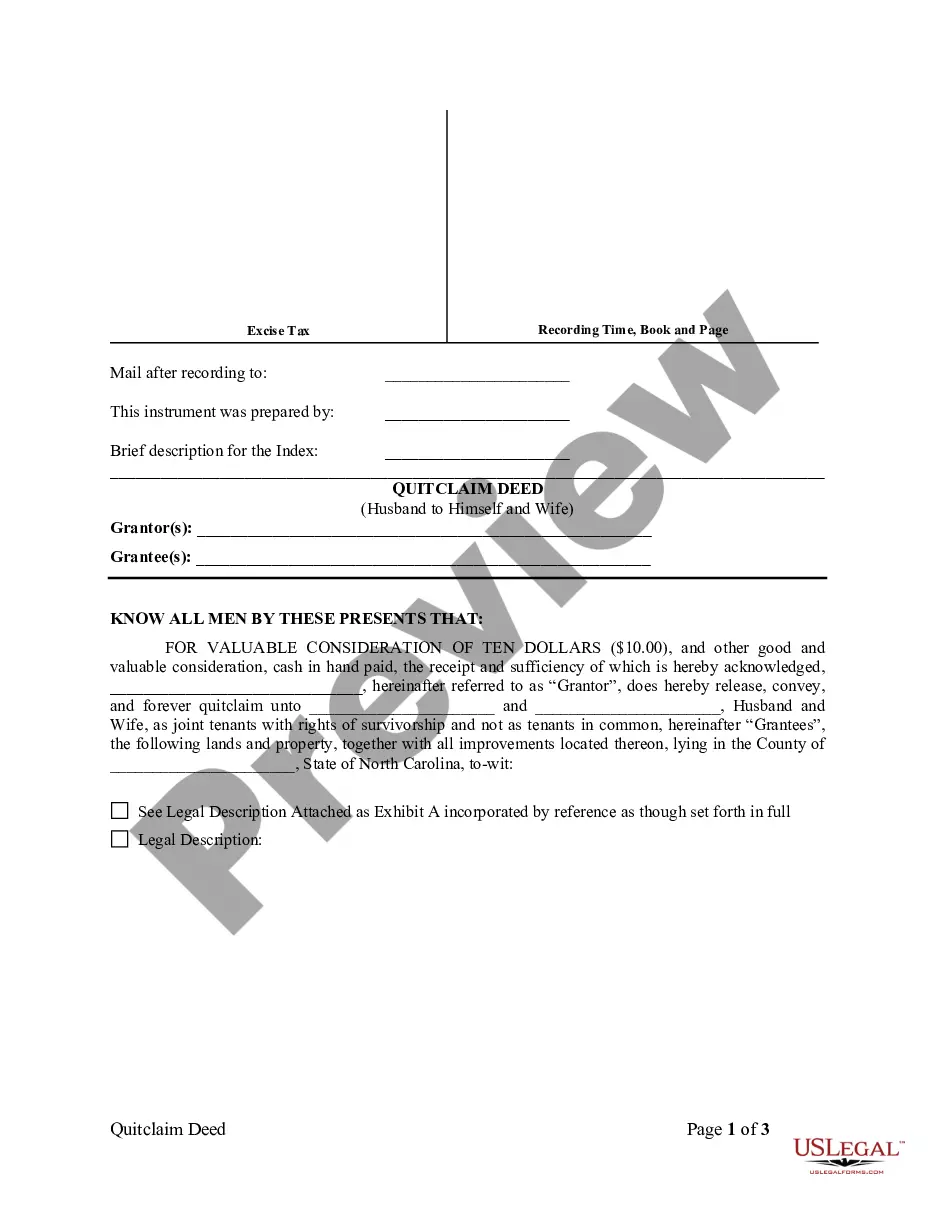

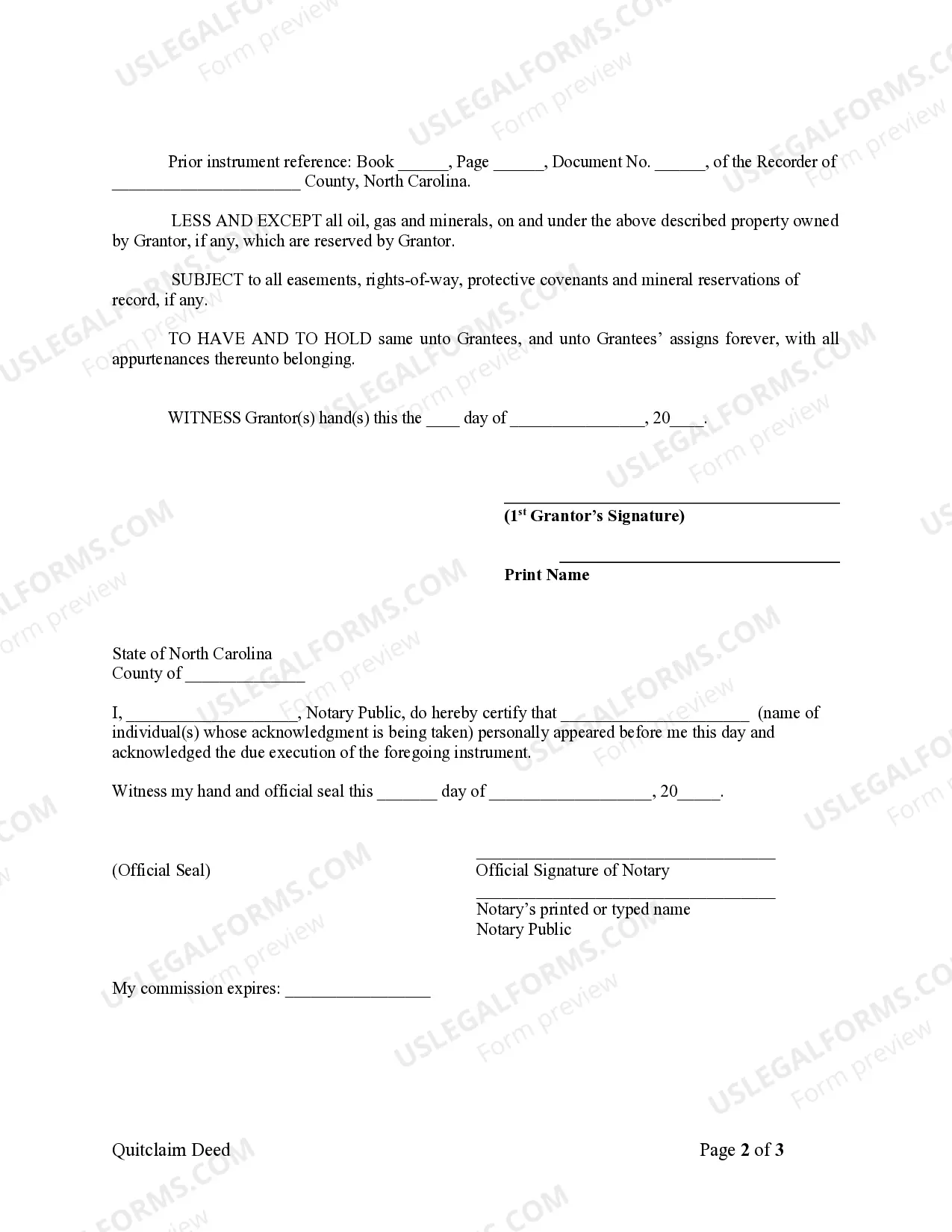

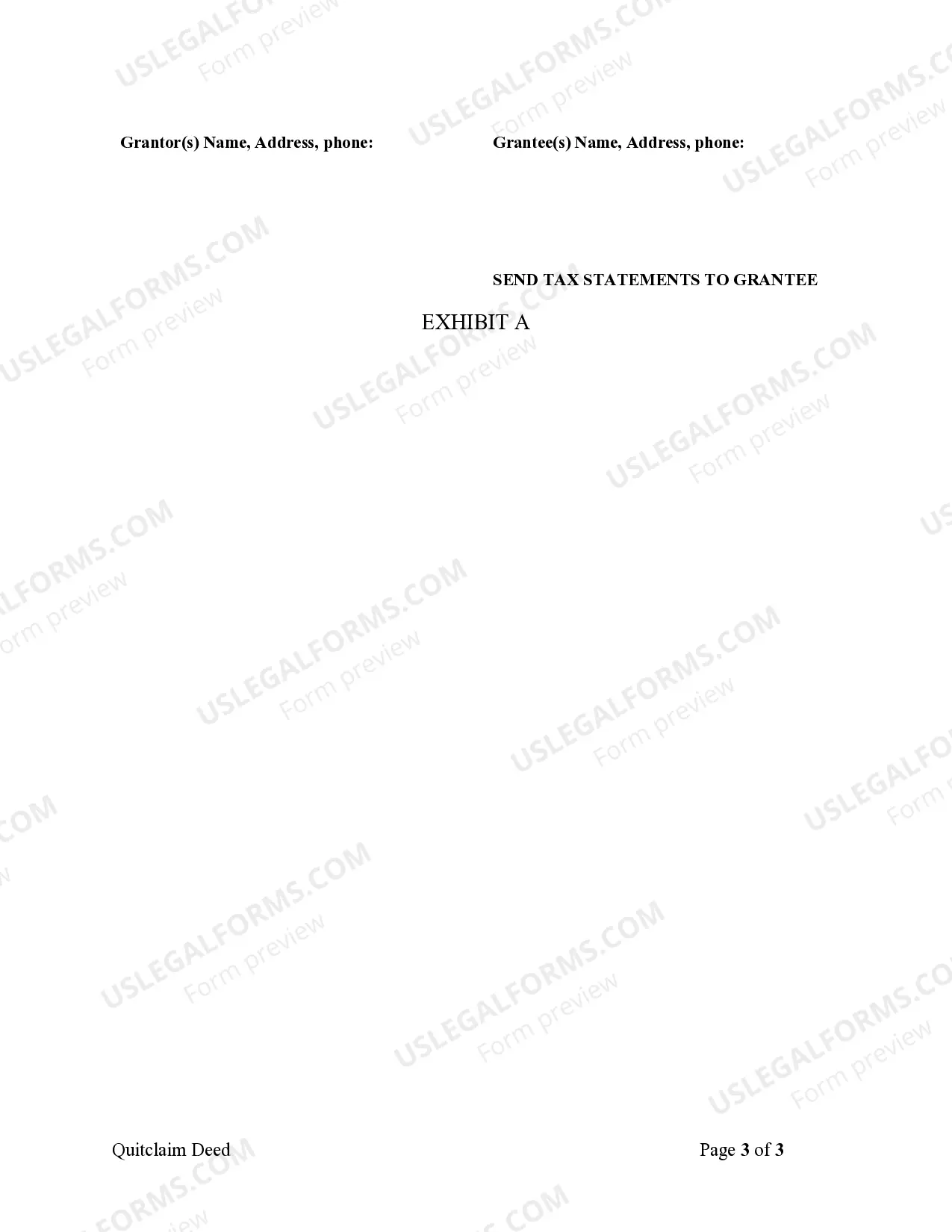

North Carolina Quitclaim Deed from Husband to Himself and Wife

Description

How to fill out North Carolina Quitclaim Deed From Husband To Himself And Wife?

Steer clear of expensive lawyers and locate the North Carolina Quitclaim Deed from Husband to Himself and Wife you require at an affordable price on the US Legal Forms site.

Utilize our straightforward categorization feature to search for and acquire legal and tax documents. Review their descriptions and preview them prior to downloading.

Choose to download the form in PDF or DOCX format. Click Download and locate your template in the My documents section. You can easily save the template to your device or print it out. After downloading, you may complete the North Carolina Quitclaim Deed from Husband to Himself and Wife either by hand or with editing software. Print it and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Moreover, US Legal Forms provides users with detailed instructions on how to obtain and fill out each template.

- Subscribers of US Legal Forms simply need to Log In and download the specific form they require to their My documents section.

- Those who have not subscribed yet should follow the guidelines below.

- Verify that the North Carolina Quitclaim Deed from Husband to Himself and Wife is appropriate for use in your area.

- If possible, examine the description and utilize the Preview feature before downloading the template.

- If you believe the template suits your requirements, click on Buy Now.

- If the template is incorrect, use the search bar to find the correct one.

- Next, create your account and choose a subscription plan.

- Make payment via card or PayPal.

Form popularity

FAQ

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.