Montana Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

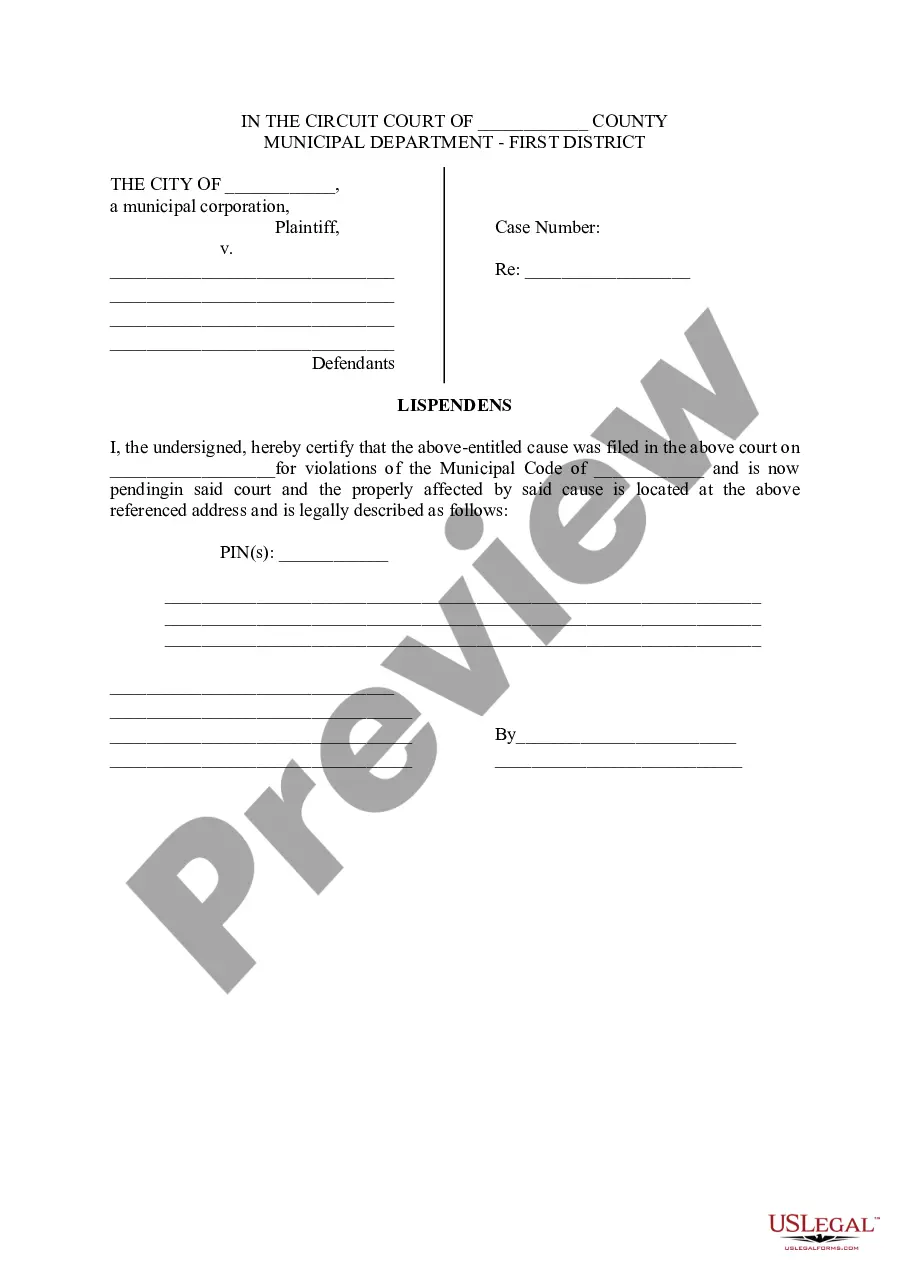

How to fill out Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

Are you presently in a scenario where you require documents for either business or personal purposes almost every day? There are numerous legal document templates available online, but finding ones you can trust isn't easy. US Legal Forms offers thousands of form templates, such as the Montana Irrevocable Power of Attorney for Transfer of Stock by Executor, that are created to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, just Log In. After that, you can download the Montana Irrevocable Power of Attorney for Transfer of Stock by Executor template.

If you don’t have an account and want to start using US Legal Forms, follow these steps: Find the form you need and make sure it is for the correct area/county. Use the Preview button to review the form. Read the description to ensure you have selected the correct form. If the form isn’t what you are looking for, use the Search field to find the form that meets your needs and requirements. If you locate the correct form, just click Buy now. Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card. Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Montana Irrevocable Power of Attorney for Transfer of Stock by Executor anytime you need. Just click the required form to download or print the document template.

- Utilize US Legal Forms, one of the most extensive selections of legal forms, to save time and avoid errors.

- The service provides professionally crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Yes, in Montana, a power of attorney generally needs to be notarized to be valid. This requirement applies to the Montana Irrevocable Power of Attorney for Transfer of Stock by Executor, ensuring authenticity and legal recognition. To streamline this process, consider using USLegalForms, which offers templates and guidance for creating and notarizing your documents efficiently.

A power of attorney cannot make decisions that are outside the scope of the authority granted in the document. For instance, the Montana Irrevocable Power of Attorney for Transfer of Stock by Executor does not permit the agent to change a will or make personal decisions about health care unless specifically stated. It is crucial to understand the limitations of a POA to avoid any legal complications.

A power of attorney can change a beneficiary on a brokerage account, provided the document grants this authority. When using a Montana Irrevocable Power of Attorney for Transfer of Stock by Executor, it is essential to ensure the document clearly outlines this capability. If you are unsure, consulting with an attorney or using a reliable platform like USLegalForms can help clarify the powers granted.

While Montana does not technically require you to get your POA notarized, notarization is strongly recommended. Under Montana law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuinemeaning your POA is more ironclad.

Do All Estates Have to Go Through Probate in Montana? Unless the estate is in a living trust, it will need to go through probate in Montana. However, it may be eligible for informal probate, which allows for the executor to handle all of the process without court intervention.

Registration of power of attorney is optional In India, where the 'Registration Act, 1908', is in force, the Power of Attorney should be authenticated by a Sub-Registrar only, otherwise it must be properly notarized by the notary especially where in case power to sell land is granted to the agent.

Transfers to an irrevocable trust are generally subject to gift tax. This means that even though assets transferred to an irrevocable trust will not be subject to estate tax, they will generally be subject to gift tax.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Irrevocable Trust DisadvantagesInflexible structure. You don't have any wiggle room if you're the grantor of an irrevocable trust, compared to a revocable trust.Loss of control over assets. You have no control to retrieve or even manage your former assets that you assign to an irrevocable trust.Unforeseen changes.

In Montana, a Health Care Power of Attorney is effective upon your signature, without having your signature notarized or witnessed.