Montana Request For Information on Payout Status

Description

How to fill out Request For Information On Payout Status?

Finding the right lawful file design might be a struggle. Obviously, there are tons of templates available on the net, but how can you discover the lawful type you require? Make use of the US Legal Forms internet site. The service gives a large number of templates, for example the Montana Request For Information on Payout Status, which you can use for company and private needs. Every one of the kinds are checked out by pros and fulfill federal and state needs.

If you are previously listed, log in in your profile and then click the Obtain button to have the Montana Request For Information on Payout Status. Make use of profile to appear from the lawful kinds you may have acquired previously. Go to the My Forms tab of your own profile and have yet another version of your file you require.

If you are a new consumer of US Legal Forms, here are simple directions so that you can follow:

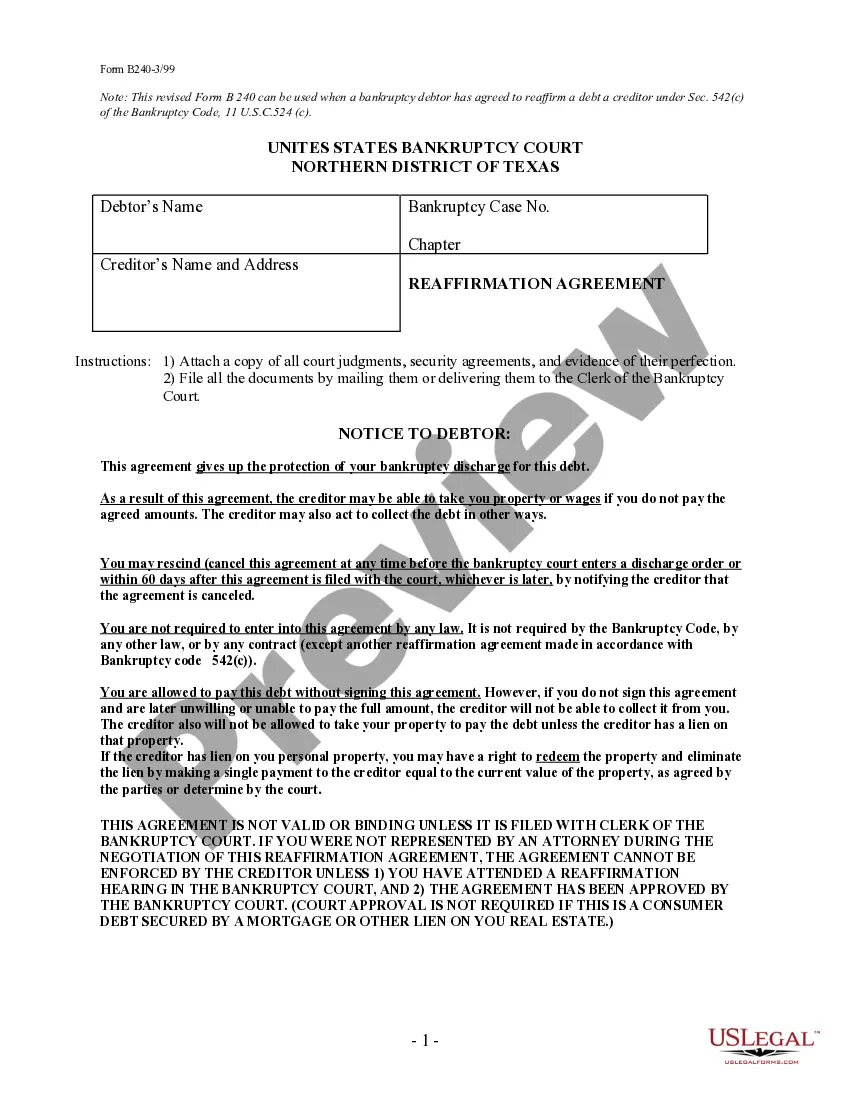

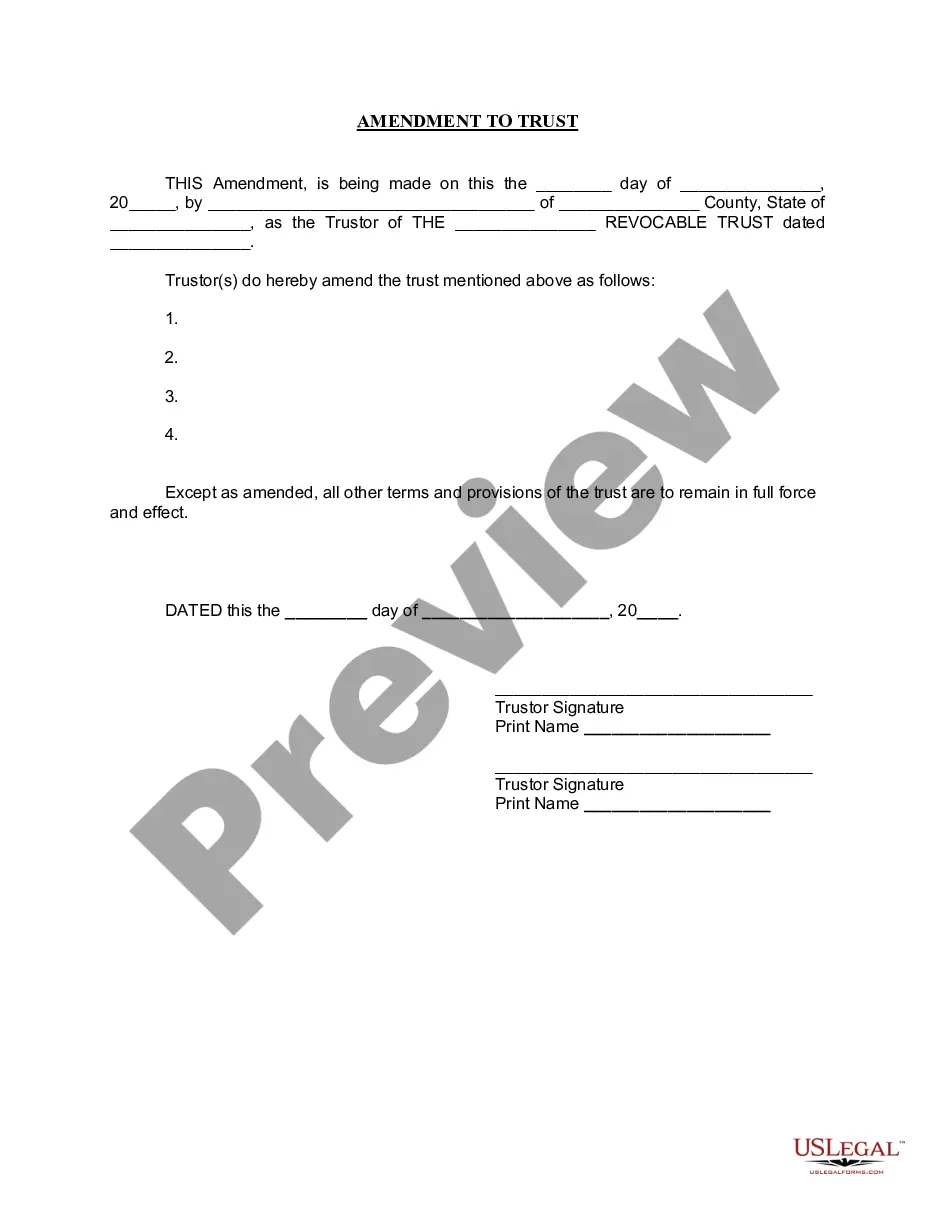

- Very first, ensure you have chosen the right type for your personal metropolis/area. It is possible to look over the shape utilizing the Review button and read the shape information to ensure this is the best for you.

- When the type is not going to fulfill your requirements, use the Seach area to obtain the right type.

- Once you are certain that the shape would work, select the Buy now button to have the type.

- Opt for the rates program you would like and enter the essential information and facts. Design your profile and buy the transaction with your PayPal profile or Visa or Mastercard.

- Opt for the data file formatting and down load the lawful file design in your gadget.

- Complete, edit and printing and indication the received Montana Request For Information on Payout Status.

US Legal Forms may be the most significant collection of lawful kinds that you can discover different file templates. Make use of the company to down load skillfully-produced paperwork that follow express needs.

Form popularity

FAQ

Check the status of your tax refund using these resources. State: Mississippi. Refund Status Website: Mississippi Department of Revenue. Refund Status Phone Support: 1-601-923-7801 (24 hours refund line) Hours: 8 a.m. ? 5 p.m. General Tax Information: 1-601-923-7089, 1-601-923-7700.

We will begin issuing Individual Income Tax Rebates in July 2023. Individual Income Tax Rebates will be issued in the order that a 2021 tax return was filed. All Individual Income Tax Rebates will be issued by December 31, 2023.

Delays can be due to issues like return errors, unpaid taxes, or old debts. Typically, simple returns take under 3 weeks, while complex ones might take 60-90 days. To make the process smoother, ensure accurate filing, settle any debts, and use IRS tools.

It can take up to 90 days to issue your refund. It can take up to 90 days to issue your refund and we may need to ask you to verify your return. Please check your refund status using Where's My Refund in our TransAction Portal (TAP).

If you file a complete and accurate paper tax return, your refund should be issued in about six to eight weeks from the date IRS receives your return. If you file your return electronically, your refund should be issued in less than three weeks, even faster when you choose direct deposit.

You can find more information about your refund process and check your refund status at .

Call Us. To speak to a Citizen Service Representative, call our Call Center: Phone. (406) 444-6900.