Montana Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

You are able to spend time on-line trying to find the legal record format that meets the federal and state requirements you need. US Legal Forms supplies a large number of legal types which can be examined by pros. It is possible to download or produce the Montana Direction For Payment of Royalty to Trustee by Royalty Owners from the support.

If you already have a US Legal Forms profile, it is possible to log in and click on the Obtain switch. Following that, it is possible to complete, modify, produce, or sign the Montana Direction For Payment of Royalty to Trustee by Royalty Owners. Every single legal record format you buy is the one you have eternally. To get yet another version of any acquired type, check out the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms internet site the very first time, keep to the easy directions below:

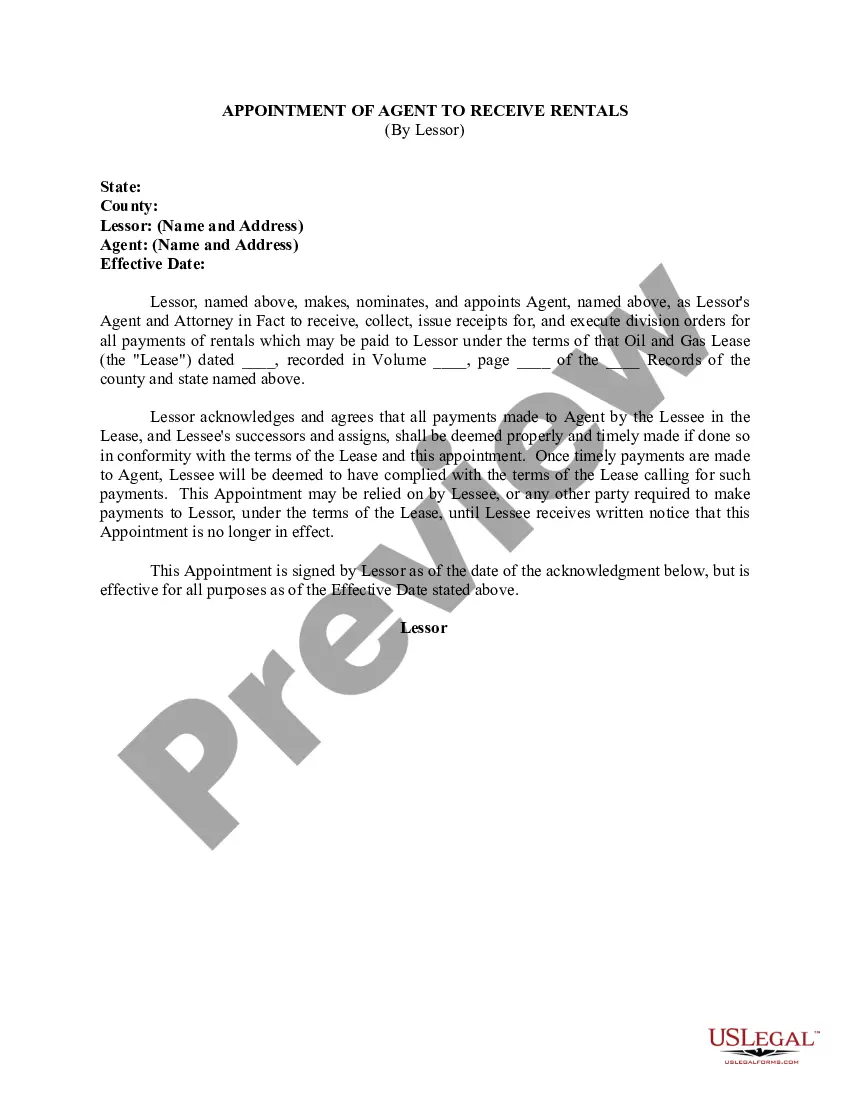

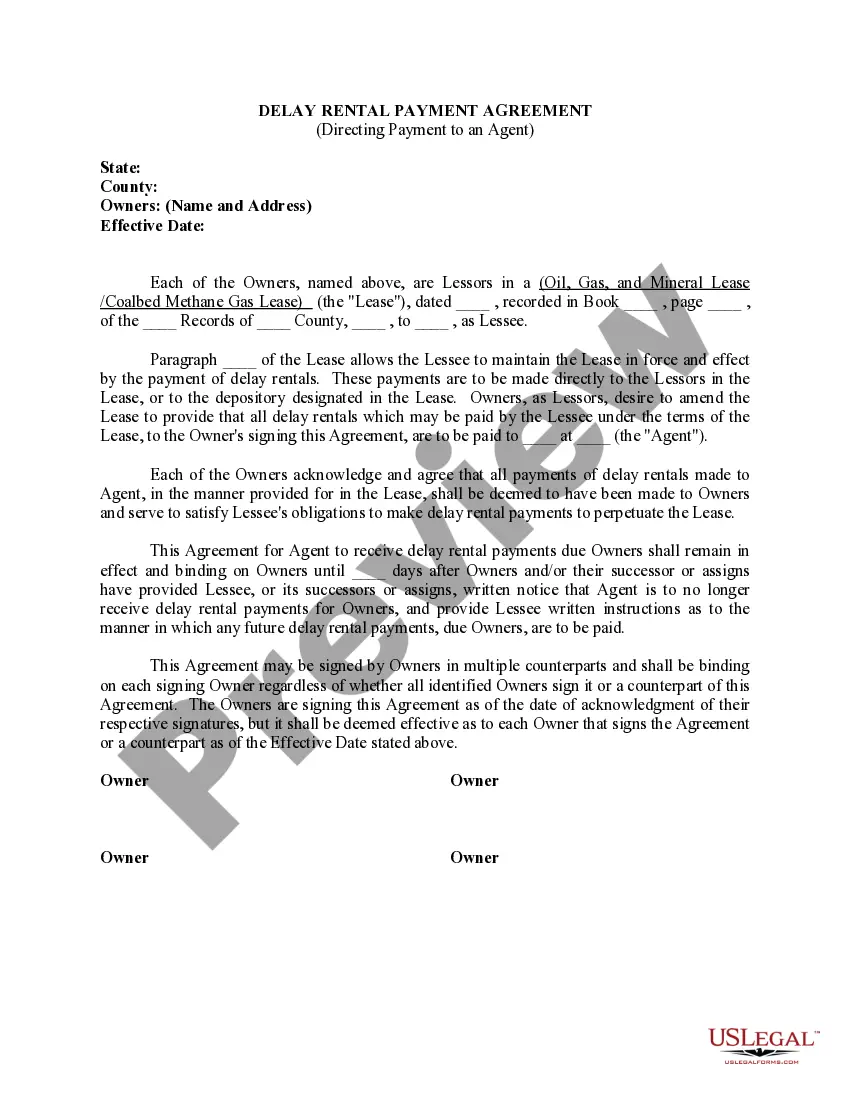

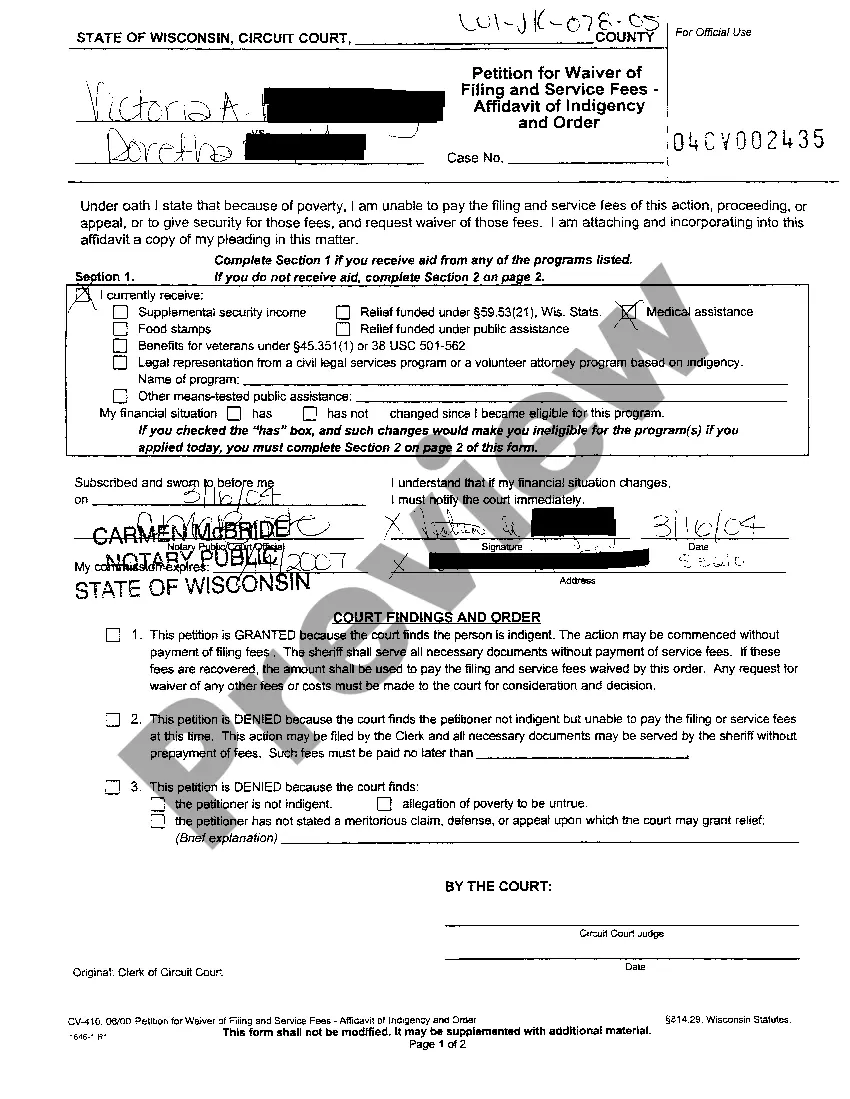

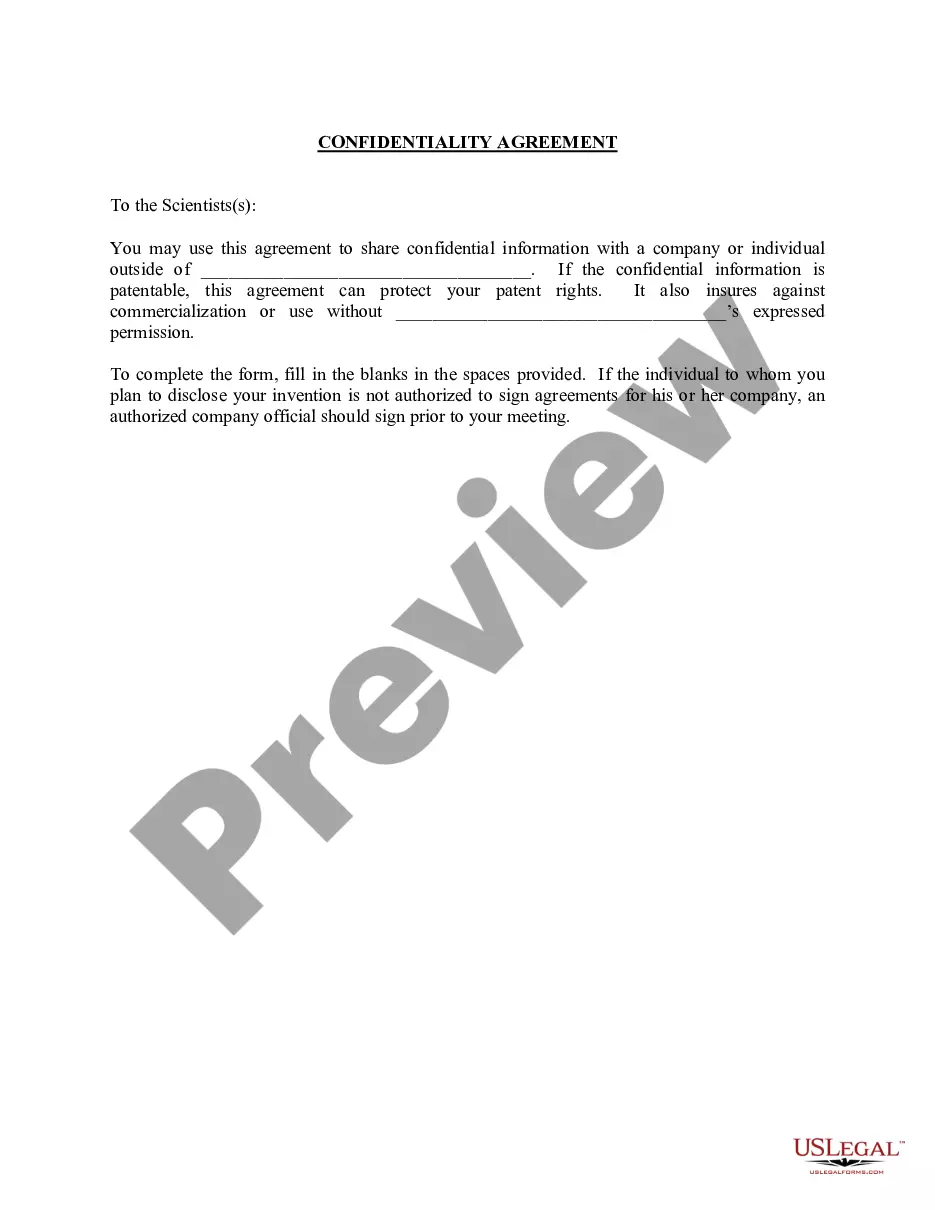

- Initially, make sure that you have chosen the best record format to the county/city that you pick. Browse the type description to make sure you have chosen the right type. If offered, utilize the Preview switch to appear through the record format as well.

- If you want to get yet another variation from the type, utilize the Look for field to get the format that fits your needs and requirements.

- Upon having discovered the format you need, click Buy now to continue.

- Choose the prices prepare you need, key in your qualifications, and sign up for an account on US Legal Forms.

- Full the deal. You may use your credit card or PayPal profile to cover the legal type.

- Choose the file format from the record and download it to the device.

- Make alterations to the record if possible. You are able to complete, modify and sign and produce Montana Direction For Payment of Royalty to Trustee by Royalty Owners.

Obtain and produce a large number of record web templates using the US Legal Forms website, which offers the biggest variety of legal types. Use skilled and express-specific web templates to deal with your business or individual needs.

Form popularity

FAQ

In most cases, you'll report your royalties in Part I of Schedule E on your Form 1040 or Form 1040-SR, identified as Supplemental Income and Loss.

Royalties can arise in things such as: Patents. Copyright and software. Arts, including literature and music.

Completing your tax return If your royalties are from a work or invention and there are no associated expenses, report the income on line 10400 of your return. If there were associated expenses, report the income on line 13500 of your return. Report all other royalties on line 12100 of your return.

Royalty payments are negotiated once through a legal agreement and paid on a continuing basis by licensees to owners granting a license to use their intellectual property or assets over the term of the license period. Royalty payments are often structured as a percentage of gross or net revenues.

Montana's itemized deductions are the same as federal itemized deductions with a few differences: Montana law allows a federal income tax deduction of up to $5,000 (or $10,000 for MFJ). Taxpayers itemizing on the federal return receive the deduction for state income taxes paid.

In most cases, you'll report your royalties in Part I of Schedule E on your Form 1040 or Form 1040-SR, identified as Supplemental Income and Loss.

Montana offers a standard deduction that's 20% of your adjusted gross income (AGI), but the amount is subject to a lower and upper limit.

Royalties are both taxable as income and deductible as a business expense. These payments must be reported to the IRS and are usually recorded on Schedule E: Supplemental Income and Loss. However, this depends on whether you own a business, the type of property in question, and who retains ownership of the property.