Montana Self-Employed Window Washer Services Contract

Description

How to fill out Self-Employed Window Washer Services Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, categorized by groups, states, or keywords. You can discover the latest versions of forms such as the Montana Self-Employed Window Washer Services Contract in just a few minutes.

If you have a subscription, Log In and download the Montana Self-Employed Window Washer Services Contract from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Montana Self-Employed Window Washer Services Contract. Each template you add to your account has no expiration date and is yours forever. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Montana Self-Employed Window Washer Services Contract with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

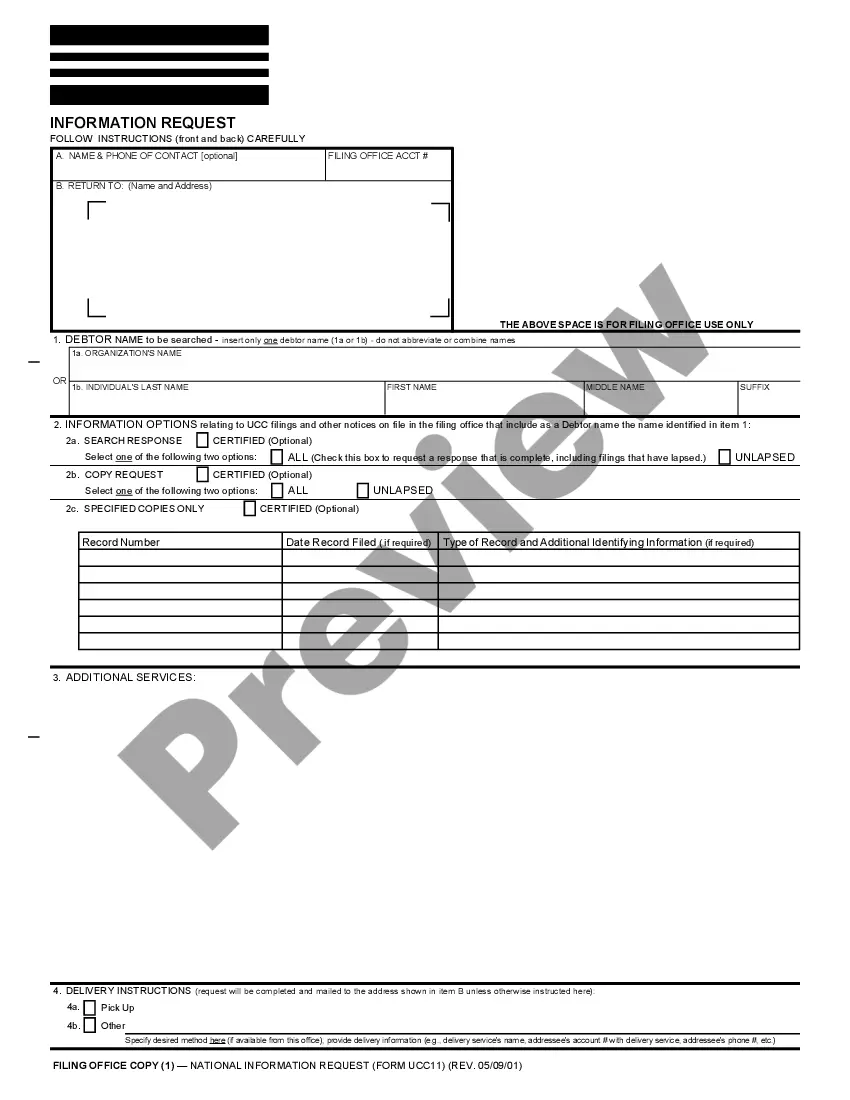

- Ensure you have selected the correct form for your city/county. Click the Preview option to examine the form's content.

- Review the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your information to create an account.

Form popularity

FAQ

To operate as an independent contractor in Montana, you will need to complete several steps. First, you must register your business name and obtain any necessary licenses related to window washing. Next, consider creating a Montana Self-Employed Window Washer Services Contract to outline your responsibilities and expectations with clients. Finally, familiarize yourself with state tax regulations and insurance requirements, as these will play a crucial role in establishing your legitimacy as an independent contractor.

To be classified as an independent contractor, you must demonstrate a level of control over your work and the manner in which you complete it. For instance, when offering window washing services under a Montana Self-Employed Window Washer Services Contract, it is vital to have specific equipment and a business plan in place. Additionally, you should maintain accurate financial records, as you are responsible for your own expenses and income. Understanding your rights and obligations will help ensure your success in this independent capacity.

To become an independent contractor, you must operate a business that provides services or products to clients without being an employee. Specifically, for Montana Self-Employed Window Washer Services Contract, this means establishing a valid business structure and maintaining your own business identity. You will need to ensure that you manage your own taxes, insurance, and work schedules. The flexibility this offers allows you to tailor your services to meet customer needs effectively.

In Montana, window cleaning typically does not require a specific license; however, checking local regulations is essential. Some areas may require a business license or permit, depending on the scope of your operation. Utilizing a Montana Self-Employed Window Washer Services Contract can help ensure that you comply with any local laws while protecting your business. It's always a good idea to consult with local authorities to understand any additional requirements.

Yes, window cleaning can be a profitable business if managed effectively. The demand for window cleaning services remains steady, especially in urban areas populated with homes and businesses that require maintenance. By using a Montana Self-Employed Window Washer Services Contract, you can enhance your professional image and better manage client relationships, which can lead to increased profitability. Investing in quality tools and marketing can further improve your revenue potential.

In Montana, a contractor's license may not be required specifically for window cleaning; however, it's important to check local regulations before starting your business. Some regions might have specific requirements that you must fulfill. Utilizing a Montana Self-Employed Window Washer Services Contract can provide clarity on necessary licenses and ensure that you operate within the law.

Income for a self-employed window cleaner can vary significantly based on several factors, including location, clientele, and the scale of operations. On average, self-employed window cleaners in Montana can earn a reasonable income, especially with a steady client base. Establishing a solid Montana Self-Employed Window Washer Services Contract can help you set competitive rates and attract more clients.

To become a window cleaner in Montana, you need to meet basic requirements such as age, experience, and safety training. It's also essential to have the necessary licenses and contracts in place. By using a Montana Self-Employed Window Washer Services Contract, you can ensure that you meet all legal requirements while focusing on building your business.

Typically, window cleaning requires a permit, especially if you plan to work on commercial properties or in high-rise buildings. The specifics may vary based on local regulations. A Montana Self-Employed Window Washer Services Contract can provide you with the necessary information to determine if you need additional permits for your window cleaning services.

Becoming an independent contractor in Montana involves several steps. First, you need to register your business and obtain an appropriate license. Completing a Montana Self-Employed Window Washer Services Contract can streamline this process and help you understand your rights and responsibilities as an independent contractor.