Montana Contract Administrator Agreement - Self-Employed Independent Contractor

Description

How to fill out Contract Administrator Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the website, you can find thousands of forms for business and personal use, categorized by types, states, or keywords. You can locate the most recent forms such as the Montana Contract Administrator Agreement - Self-Employed Independent Contractor in just a few minutes.

If you have a monthly subscription, Log In and download the Montana Contract Administrator Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some straightforward tips to help you get started: Ensure you have selected the correct form for your city/county. Click the Preview button to examine the contents of the form. Review the form description to confirm that you have chosen the appropriate form. If the form does not meet your requirements, use the Search field at the top of the screen to locate one that does. Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred payment plan and provide your credentials to register for the account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make adjustments. Fill out, edit, print, and sign the downloaded Montana Contract Administrator Agreement - Self-Employed Independent Contractor.

With US Legal Forms, you can easily find and download the necessary legal forms tailored to your specific needs.

Take advantage of the extensive library to ensure that you have the correct and most current documents available.

- Each document you add to your account has no expiration date and is yours indefinitely.

- Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Montana Contract Administrator Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- The platform is user-friendly and designed to streamline your document needs.

- Experience convenience and efficiency by using US Legal Forms for all your legal documentation.

Form popularity

FAQ

Creating a contract agreement for a freelancer starts with defining the work scope and deliverables. Clearly state payment terms, deadlines, and review processes to ensure clarity. Including clauses for confidentiality and ownership of work can protect both parties. Using uslegalforms can assist you in developing a robust Montana Contract Administrator Agreement - Self-Employed Independent Contractor that meets your specific needs.

To register as an independent contractor in Montana, you need to obtain a business license and register with the Montana Secretary of State. Generally, you must complete the necessary forms and provide documentation to verify your identity and business intentions. Additionally, understanding state-specific tax obligations is crucial. For comprehensive guidance, refer to resources like uslegalforms when preparing your Montana Contract Administrator Agreement - Self-Employed Independent Contractor.

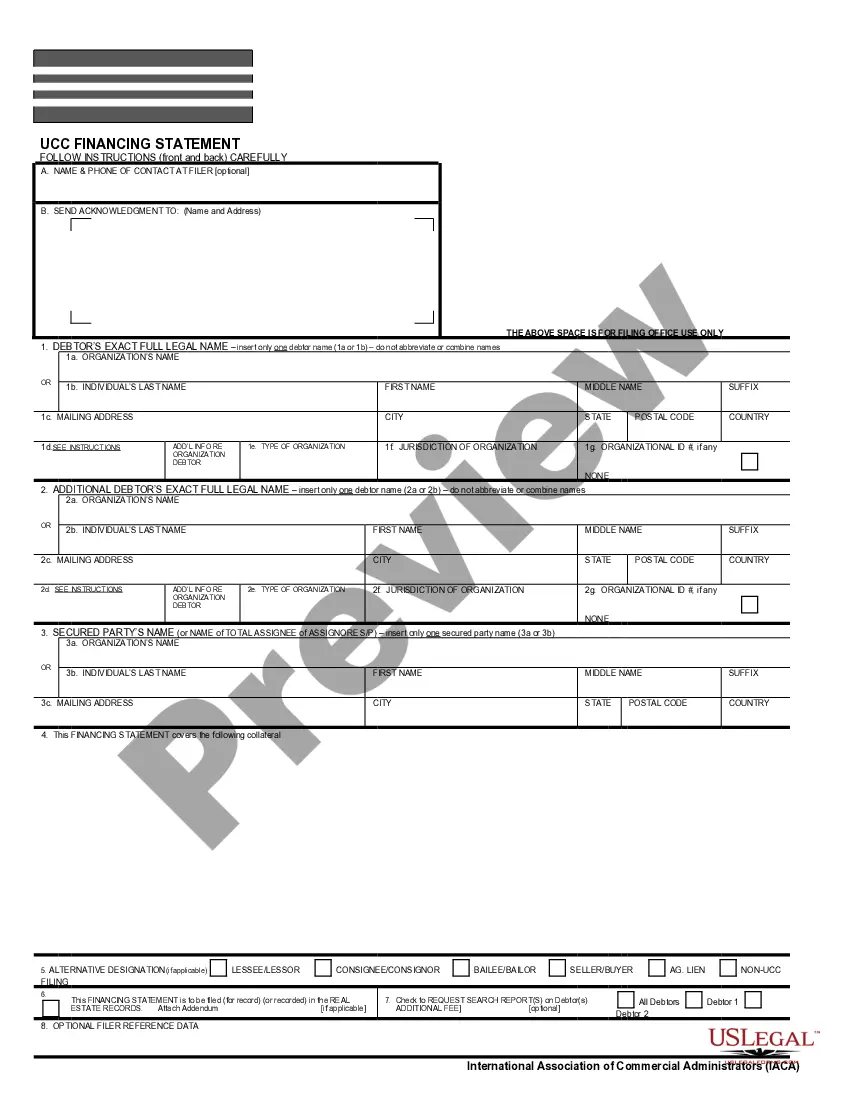

Filling out an independent contractor form involves providing essential information about both the contractor and the hiring party. Include details such as names, addresses, and tax identification numbers. After that, clarify the services to be provided and terms of payment. Utilizing platforms like uslegalforms can simplify this process by providing well-designed templates for the Montana Contract Administrator Agreement - Self-Employed Independent Contractor.

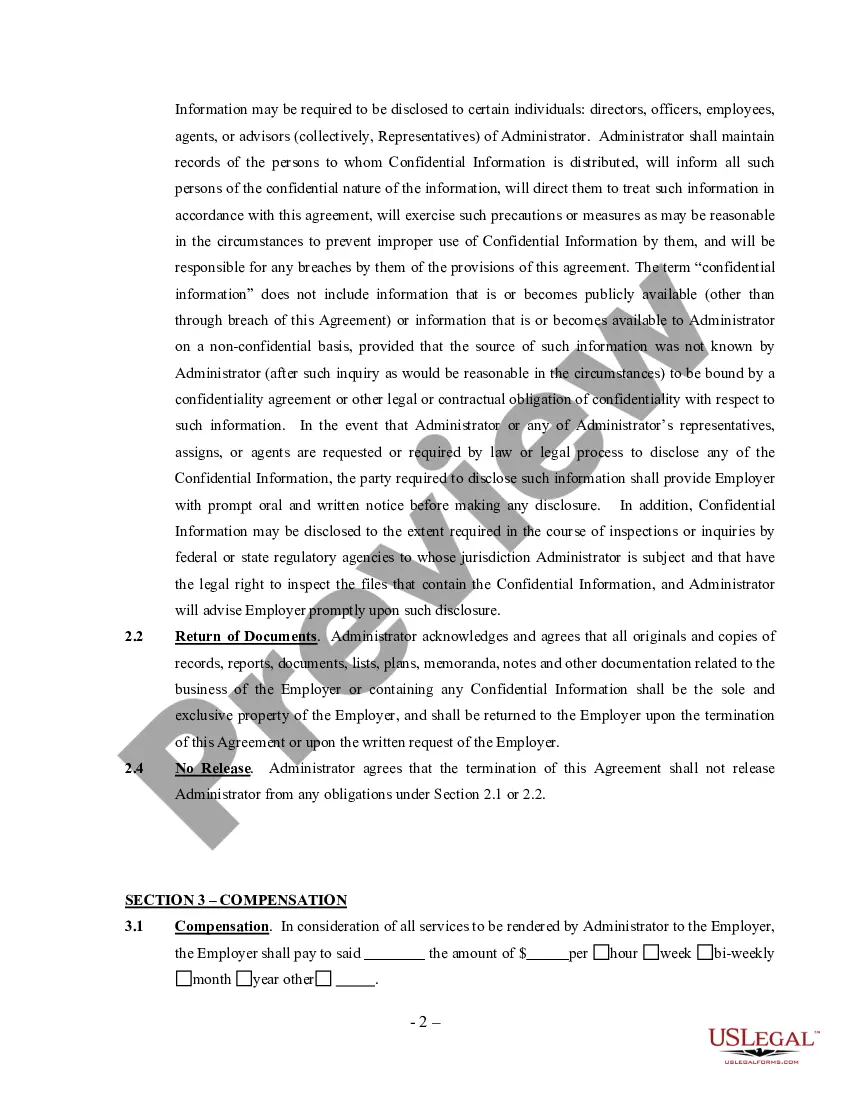

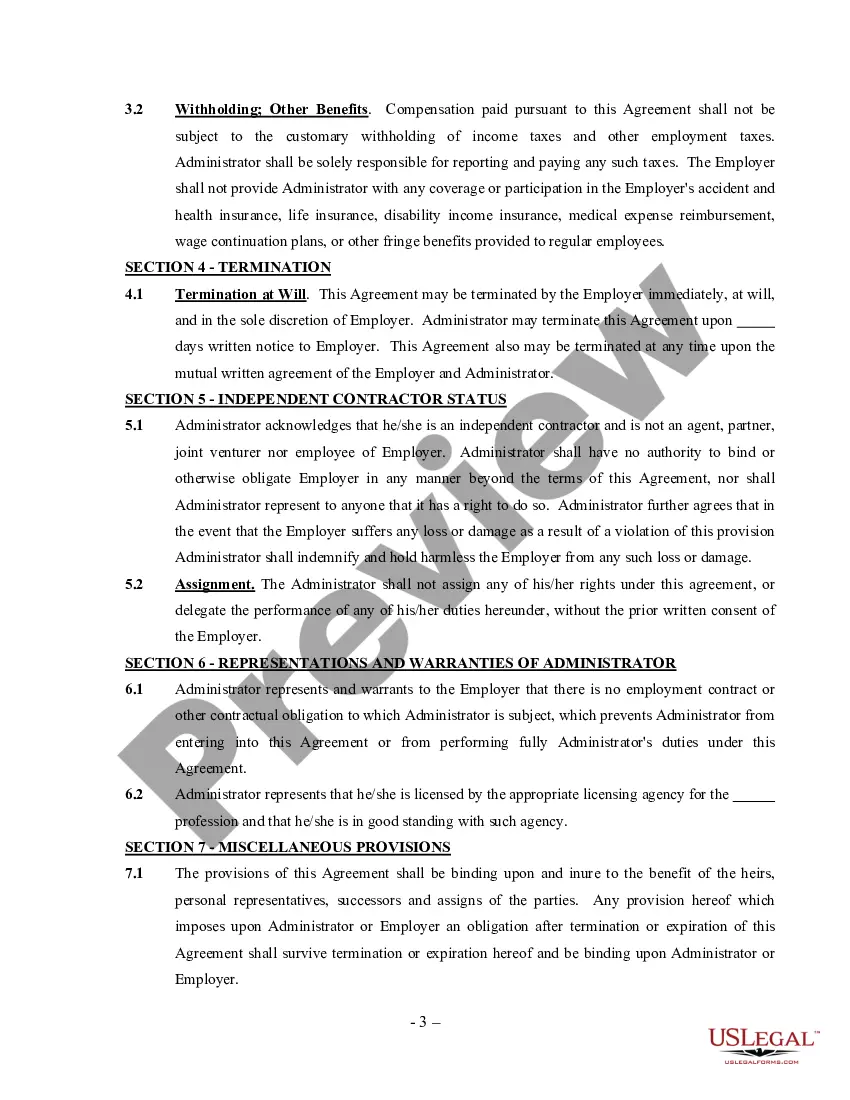

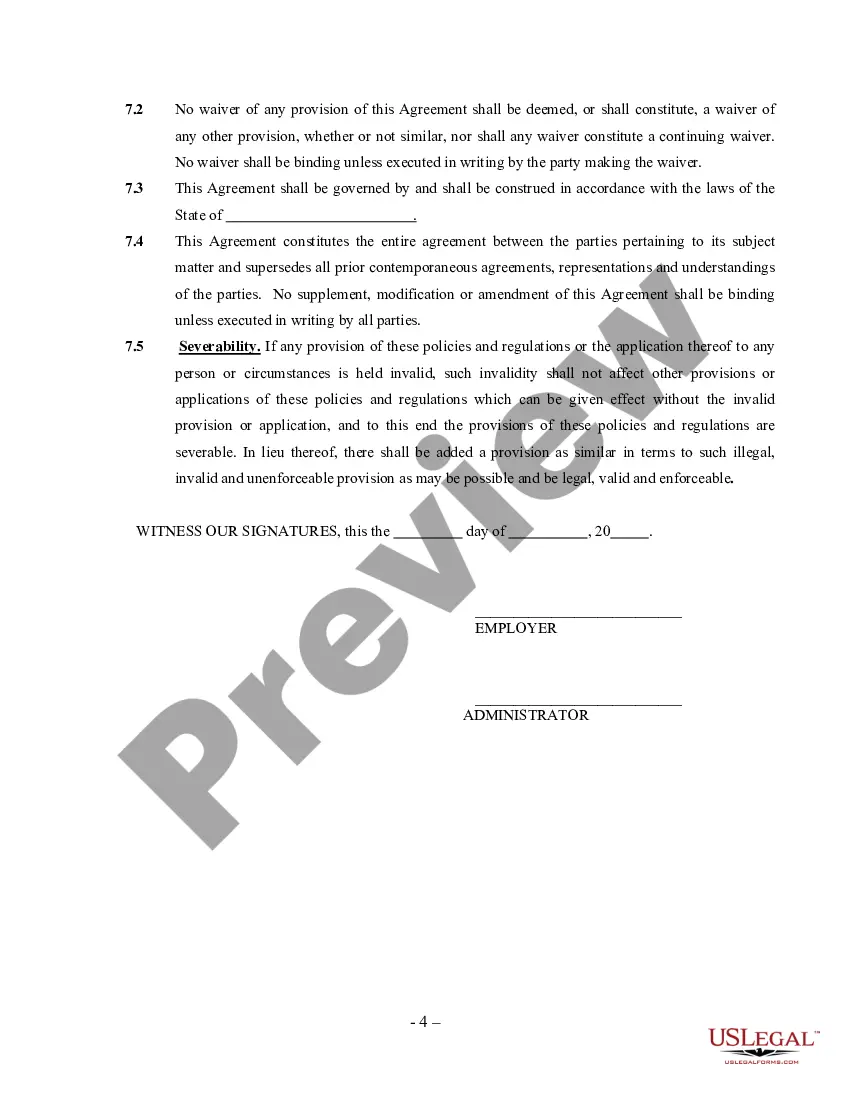

To write an independent contractor agreement, begin by clearly defining the scope of work and responsibilities. Include important details, such as payment terms, deadlines, and any necessary compliance with laws in Montana. Additionally, specify the duration of the contract and the conditions for termination. A well-structured Montana Contract Administrator Agreement - Self-Employed Independent Contractor ensures clarity for both parties.

To become an independent contractor in Montana, you need to meet several requirements. First, you must have the right skills and experience in your field. Additionally, you should obtain any necessary licenses and permits depending on your specific industry. Finally, consider drafting a Montana Contract Administrator Agreement - Self-Employed Independent Contractor to formalize your work arrangements and protect your interests.

Yes, having a contract as an independent contractor is highly recommended. A formal Contract Administrator Agreement - Self-Employed Independent Contractor protects both you and your client by clearly outlining expectations, payments, and deliverables. Utilizing platforms like US Legal Forms can help you create a robust agreement tailored to your specific needs, ensuring clarity and security throughout your working relationship.

The new federal rule regarding independent contractors focuses on clarifying the criteria for classification. This rule aims to provide consistency in determining whether a worker qualifies as an independent contractor or an employee. For anyone in Montana using a Contract Administrator Agreement - Self-Employed Independent Contractor, it's essential to stay informed about these regulations to ensure proper compliance and avoid potential legal issues.

Yes, there is a key difference between a contract employee and an independent contractor. A contract employee often works under the employer’s control and may receive benefits, while an independent contractor has greater control over how they complete their tasks. For those considering a Montana Contract Administrator Agreement - Self-Employed Independent Contractor, understanding this distinction is crucial for compliance and successful business relationships.

Creating an independent contractor agreement is straightforward. Start by outlining the specific duties, payment details, and duration of the work. The Montana Contract Administrator Agreement - Self-Employed Independent Contractor can simplify this process, providing you with a well-structured template. To create your agreement, customize the template to fit your unique situation, ensuring clarity and mutual understanding between you and the hiring party.

Yes, having a contract is essential if you're self-employed. A contract clearly outlines the scope of your work, payment terms, and responsibilities, protecting both you and your client. By using the Montana Contract Administrator Agreement - Self-Employed Independent Contractor, you can avoid misunderstandings and establish a professional relationship. This agreement serves as a reliable reference point for both parties throughout the project.