Montana Visiting Professor Agreement - Self-Employed Independent Contractor

Description

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

If you need to detailed, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search function to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Montana Visiting Professor Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Act now and obtain, and print the Montana Visiting Professor Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to receive the Montana Visiting Professor Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your specific city/state.

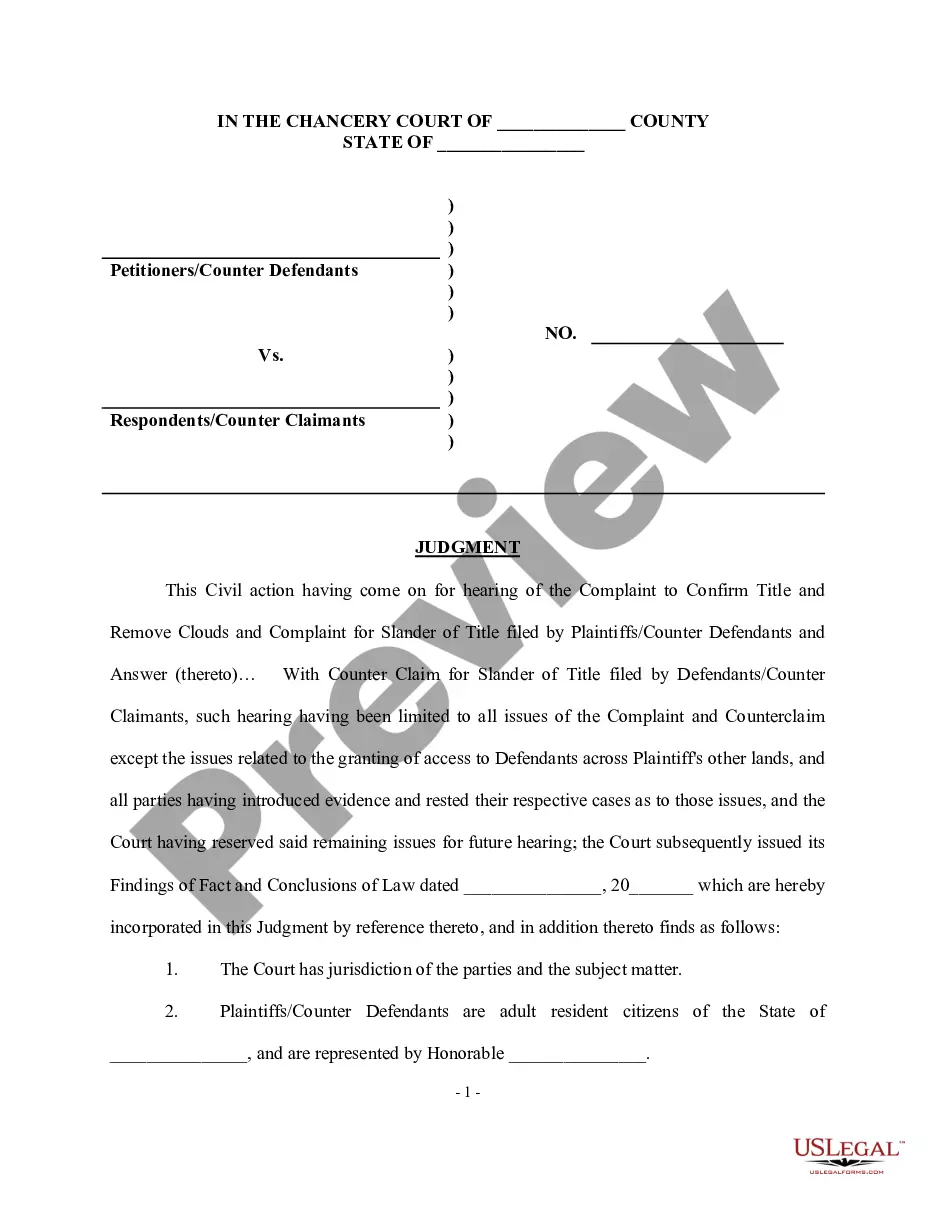

- Step 2. Use the Review option to examine the form’s contents. Remember to read the instructions.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your credentials to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Montana Visiting Professor Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Yes, adjuncts are generally classified as independent contractors, which aligns with the Montana Visiting Professor Agreement - Self-Employed Independent Contractor. This status grants them the flexibility to teach at multiple institutions while managing their teaching commitments. Understanding this relationship is key for both adjuncts and educational institutions.

In most cases, adjunct professors are not considered employees. They typically hold a status as independent contractors under the Montana Visiting Professor Agreement - Self-Employed Independent Contractor. This distinction is important because it affects tax responsibilities and eligibility for benefits.

Writing a contract as an independent contractor involves several key components, including defining the scope of work, payment details, and deadlines. Utilizing the Montana Visiting Professor Agreement - Self-Employed Independent Contractor can guide you through this process. It's advisable to focus on clear, concise language to avoid misunderstandings.

Many adjunct professors operate as independent contractors rather than full-time employees. This classification supports the Montana Visiting Professor Agreement - Self-Employed Independent Contractor, which emphasizes the professional autonomy of adjuncts. Therefore, understanding your status is crucial for managing tax obligations and benefits appropriately.

Yes, having a written contract is essential for independent contractors, including adjunct professors. The Montana Visiting Professor Agreement - Self-Employed Independent Contractor serves as a legal framework, outlining payment terms, responsibilities, and rights. A well-defined contract protects both parties and ensures clear expectations.

Adjunct professors often qualify as independent contractors, meaning they typically receive a 1099 tax form instead of a W2. This classification aligns with the Montana Visiting Professor Agreement - Self-Employed Independent Contractor. Being a 1099 contractor enables adjuncts to have a flexible schedule and manage multiple teaching assignments.

Yes, an adjunct professor is often classified as an independent contractor. This status allows them to teach courses on a part-time basis without the benefits typically afforded to full-time faculty. For many, a Montana Visiting Professor Agreement - Self-Employed Independent Contractor outlines the essential terms of employment and provides clarity in their educational role.

Teachers may be considered employees in traditional school settings, but many also work as independent contractors, particularly in online tutoring or adjunct teaching roles. Understanding the differences is essential, especially when it comes to compensation and benefits. A Montana Visiting Professor Agreement - Self-Employed Independent Contractor is ideal for those seeking to teach flexibly.

Determining if you are an independent contractor or an employee involves evaluating the degree of control in your work arrangement and how you receive payment. For instance, if you have the freedom to set your own hours, you may be classified as an independent contractor. Exploring a Montana Visiting Professor Agreement - Self-Employed Independent Contractor can help clarify your status and rights.

Professors can operate as either employees or independent contractors. Full-time positions typically classify professors as employees with certain benefits, while adjunct professors often work as independent contractors. When navigating these roles, a Montana Visiting Professor Agreement - Self-Employed Independent Contractor can provide clear terms for those seeking more flexible arrangements.