Montana IRS 20 Quiz to Determine 1099 vs Employee Status

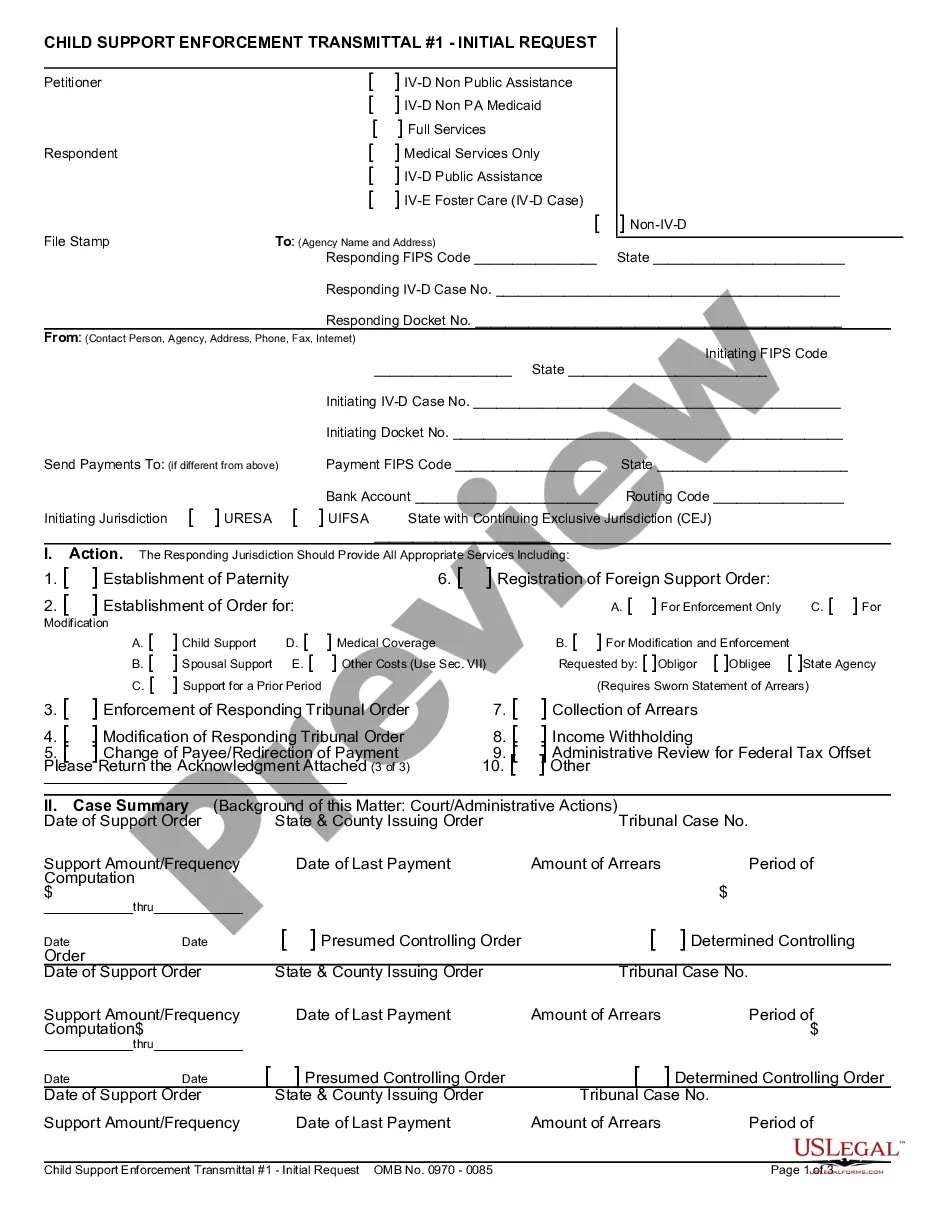

Description

How to fill out IRS 20 Quiz To Determine 1099 Vs Employee Status?

Selecting the most suitable legal document template can be a challenge. Of course, there are numerous designs available online, but how do you locate the legal form you need? Utilize the US Legal Forms website.

The service provides a wide range of templates, such as the Montana IRS 20 Quiz to Determine 1099 vs Employee Status, which can be utilized for both business and personal purposes. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the Montana IRS 20 Quiz to Determine 1099 vs Employee Status. Use your account to browse the legal forms you have previously purchased. Go to the My documents tab within your account and download another copy of the document you need.

Complete, edit, print, and sign the acquired Montana IRS 20 Quiz to Determine 1099 vs Employee Status. US Legal Forms is the largest library of legal forms that provides numerous document templates. Use the service to obtain professionally crafted paperwork that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure that you have selected the correct form for your city/state. You can preview the form using the Preview button and review the form description to confirm it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are convinced the form is right, click the Get Now button to obtain the form.

- Select the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

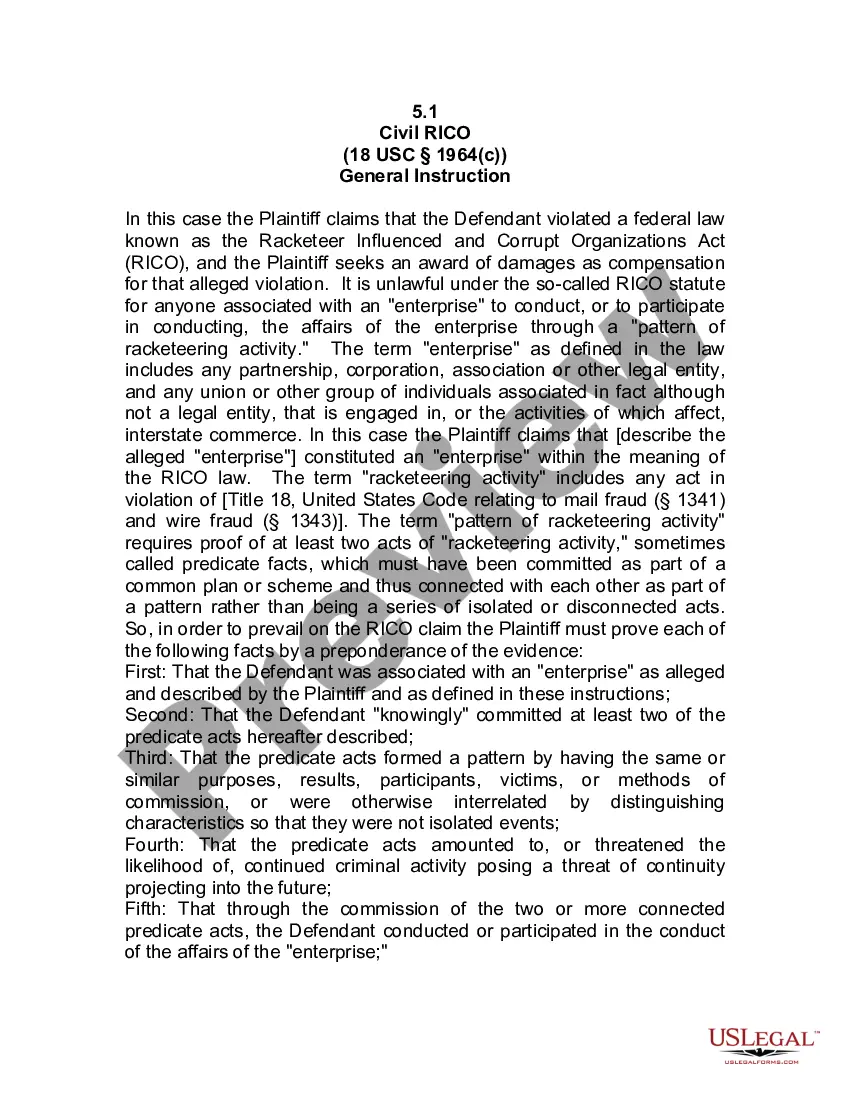

The most crucial IRS criterion is the issue of control. The IRS evaluates how much control a business has over the worker's tasks and how they are performed. If you can dictate aspects such as how, when, and where the work is done, this typically indicates an employee relationship. For those seeking clarity on their status, the Montana IRS 20 Quiz to Determine 1099 vs Employee Status provides valuable insights into making informed decisions.

The three tests to determine if someone is an employee include the behavioral test, financial test, and relationship test. Each test focuses on control aspects, financial independence, and the established relationship between the worker and employer. Taking the Montana IRS 20 Quiz to Determine 1099 vs Employee Status can help you navigate these tests successfully.

The IRS determines if someone is an independent contractor by evaluating the relationship's specific aspects. This includes assessing control over work details, financial arrangements, and the intended relationship. Engaging with the Montana IRS 20 Quiz to Determine 1099 vs Employee Status will provide insights into how these factors apply to various work situations.

To determine independent contractor status, ask questions regarding their work process, control over their schedule, and financial management. Inquire about the tasks they perform and how they invoice for their services. Utilizing the Montana IRS 20 Quiz to Determine 1099 vs Employee Status can help guide your inquiry and provide essential clarity.

The distinction between an employee and an independent contractor is determined by several criteria set forth by the IRS. Key factors include behavioral control, financial control, and the type of relationship established. Completing the Montana IRS 20 Quiz to Determine 1099 vs Employee Status will help you understand these criteria more clearly.

Determining whether a person is an employee or an independent contractor involves assessing their relationship with the employer. You should consider factors such as the level of control, the nature of the work, and how payment is made. Engaging with the Montana IRS 20 Quiz to Determine 1099 vs Employee Status can guide you through this assessment effectively.

You can determine if someone is a W-2 employee or a 1099 independent contractor by reviewing how payments are structured. A W-2 employee typically receives regular paychecks with taxes withheld, whereas a 1099 contractor receives payments directly without tax withholding. Taking the Montana IRS 20 Quiz to Determine 1099 vs Employee Status can help you clarify these distinctions.

To determine whether a person is an employee or an independent contractor, the IRS considers several factors. These include the degree of control the employer has over the work, the financial arrangement, and the relationship nature. Understanding these factors is essential, so you can take the Montana IRS 20 Quiz to Determine 1099 vs Employee Status for better clarity.