Montana Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

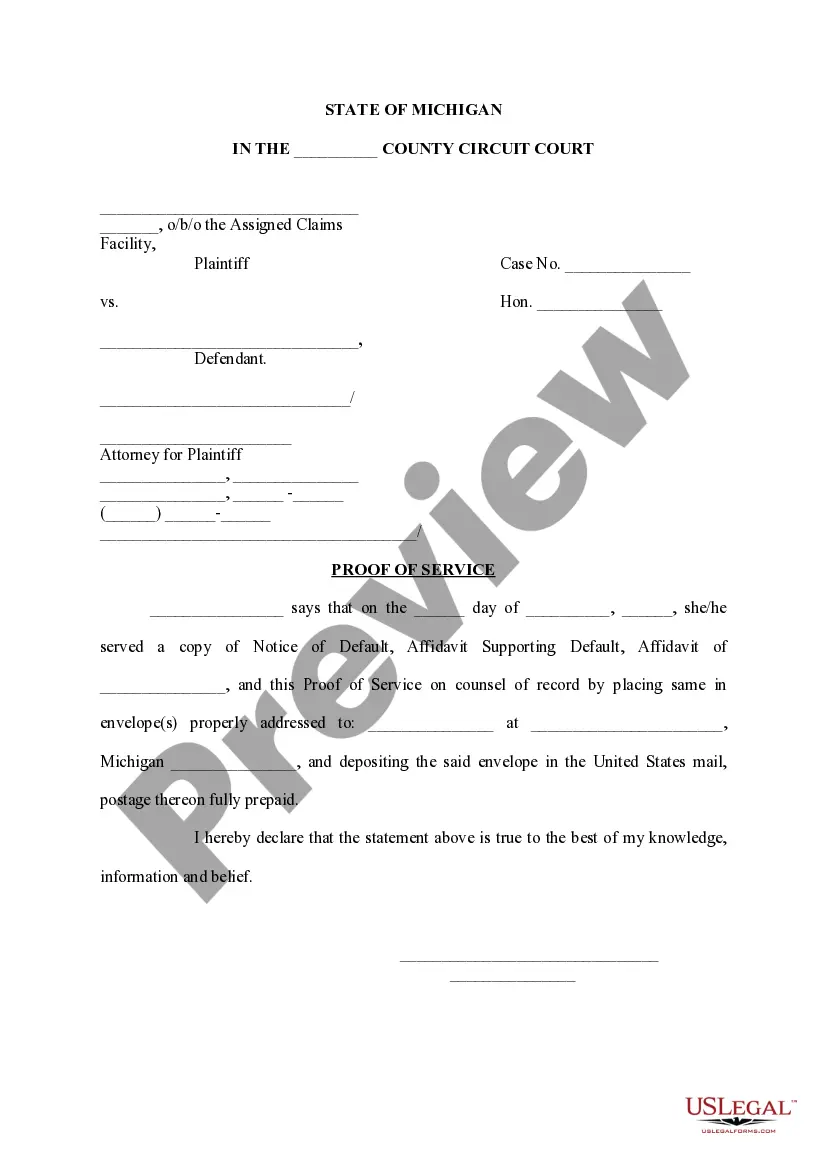

How to fill out Sample Identity Theft Policy For FCRA And FACTA Compliance?

If you wish to full, acquire, or printing lawful document themes, use US Legal Forms, the most important variety of lawful kinds, that can be found on the Internet. Make use of the site`s easy and practical lookup to obtain the paperwork you will need. Different themes for company and person uses are sorted by categories and suggests, or keywords. Use US Legal Forms to obtain the Montana Sample Identity Theft Policy for FCRA and FACTA Compliance in just a couple of click throughs.

Should you be already a US Legal Forms buyer, log in for your accounts and then click the Down load key to find the Montana Sample Identity Theft Policy for FCRA and FACTA Compliance. You can also gain access to kinds you formerly delivered electronically from the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for your proper town/country.

- Step 2. Utilize the Review method to look over the form`s content material. Never overlook to learn the information.

- Step 3. Should you be unsatisfied with the develop, use the Look for discipline near the top of the display to locate other types of your lawful develop web template.

- Step 4. When you have found the shape you will need, click on the Buy now key. Pick the costs program you favor and add your accreditations to sign up for an accounts.

- Step 5. Approach the financial transaction. You can use your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Find the format of your lawful develop and acquire it on the device.

- Step 7. Full, change and printing or sign the Montana Sample Identity Theft Policy for FCRA and FACTA Compliance.

Each lawful document web template you acquire is your own for a long time. You might have acces to each develop you delivered electronically within your acccount. Click the My Forms area and select a develop to printing or acquire once again.

Compete and acquire, and printing the Montana Sample Identity Theft Policy for FCRA and FACTA Compliance with US Legal Forms. There are thousands of professional and express-particular kinds you can use for your company or person demands.

Form popularity

FAQ

A copy of your FTC Identity Theft Report. A government-issued ID with a photo. Proof of your address (mortgage statement, rental agreement, or utilities bill) Any other proof you have of the theft?bills, Internal Revenue Service (IRS) notices, etc.

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to ?red flags??patterns, practices or specific activities?that could indicate identity theft.

What Are Identity Theft and Identity Fraud? Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses another person's personal data in some way that involves fraud or deception, typically for economic gain.

The provisions in the Fair and Accurate Credit Transactions Act impacting banks include those related to: requirements that furnishers adopt identity theft prevention policies; fraud and active duty alerts; blocking the reporting of information a consumer identifies as related to identity theft; creditor requirements ...

While the credit fraud alert is in effect, the lender receiving any credit requests is expected to take additional steps to verify that the request is authentic. Initial, extended, and active military are the three types of credit fraud alerts.

The Fair and Accurate Credit Transactions (FACT) Act (PDF) requires financial institutions with covered accounts to develop and implement a written identity theft prevention program designed to detect, prevent, and mitigate identity theft in connection with opening new accounts and operating existing accounts.

The FACT Act: Your Protection Against Identity Theft Consumers may receive a free copy of their credit report once a year. Consumers may receive additional free reports if identity theft is suspected.

What is the Average Cost of Identity Theft? Most victims, ing to the ITRC, lose less than $500. The FTC reports that the median amount of money lost to identity theft is $800.