Montana Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

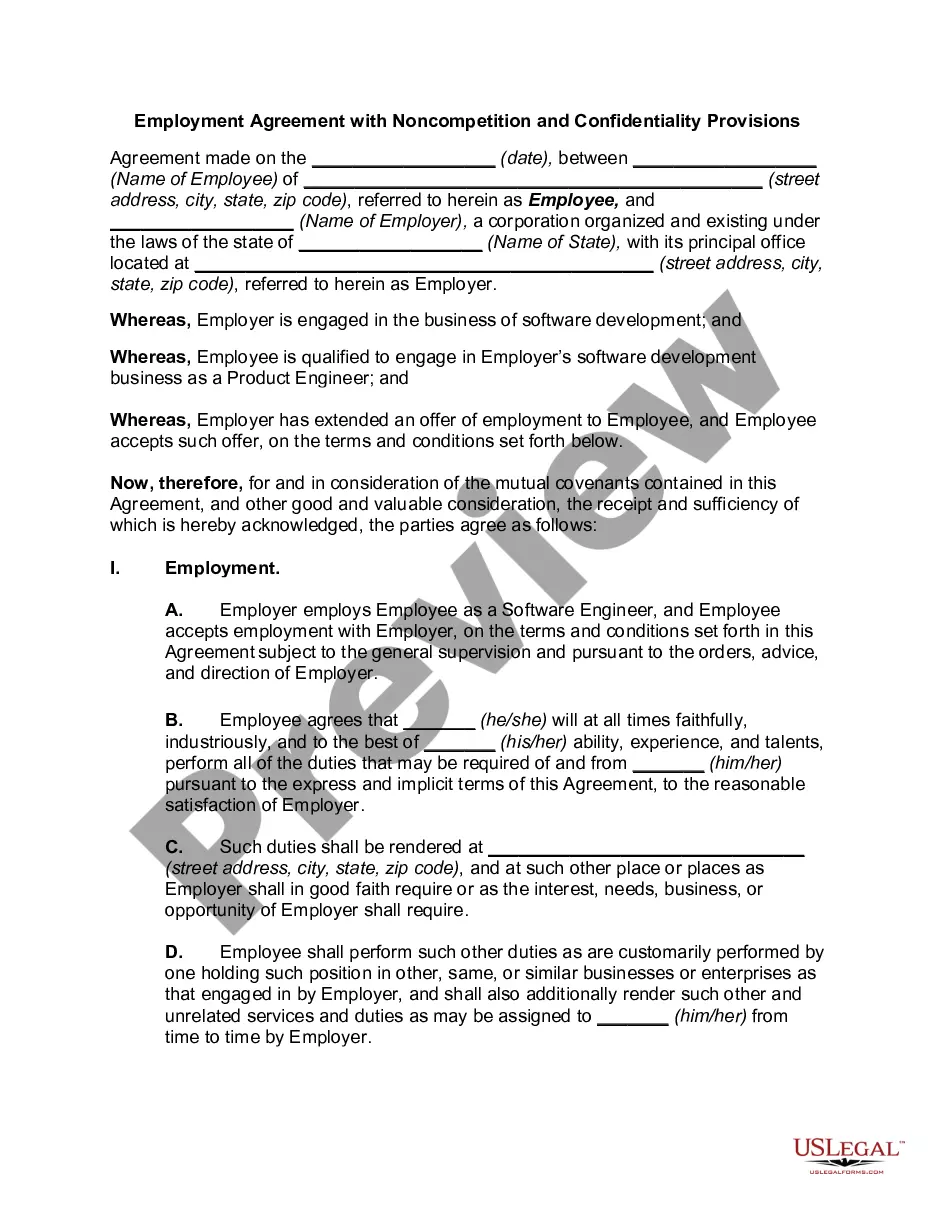

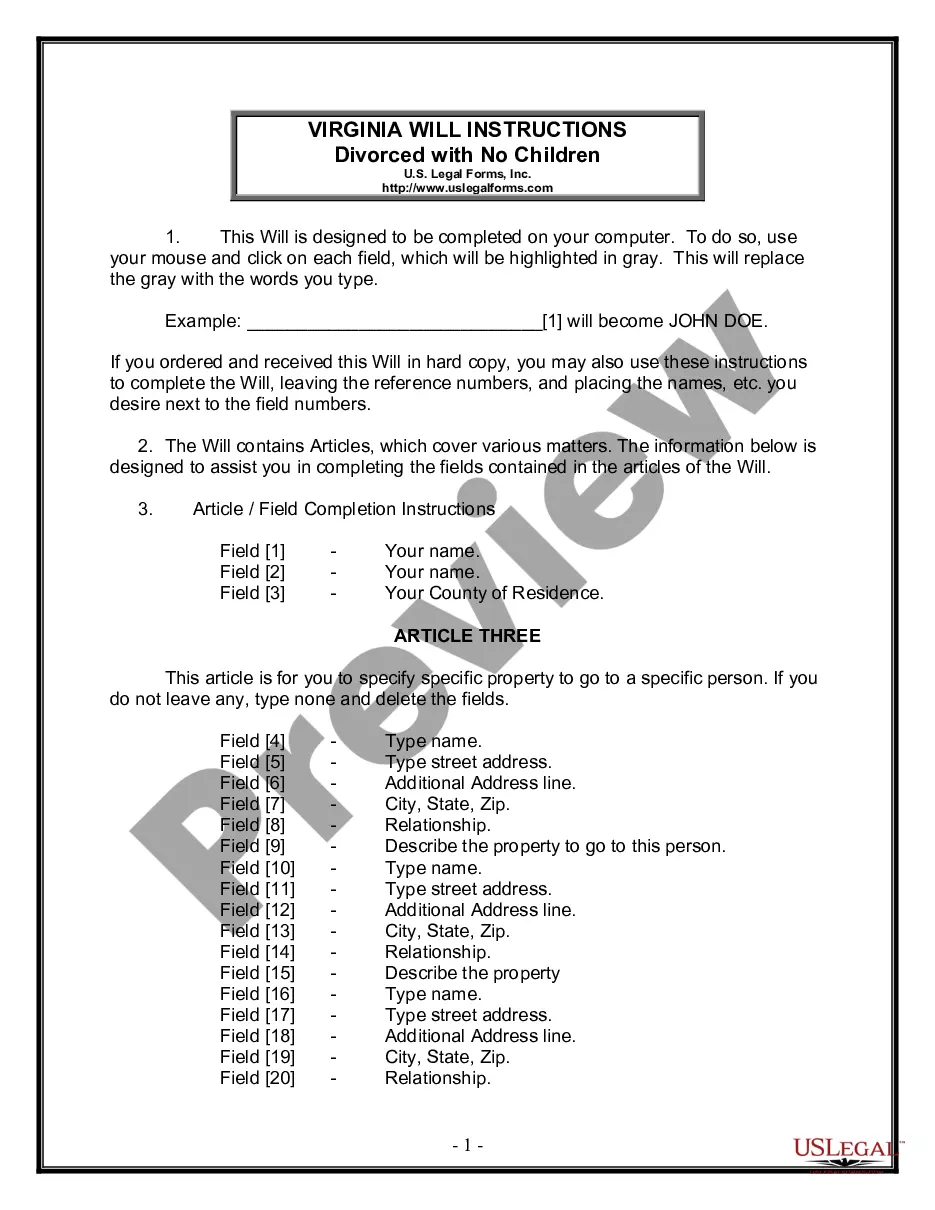

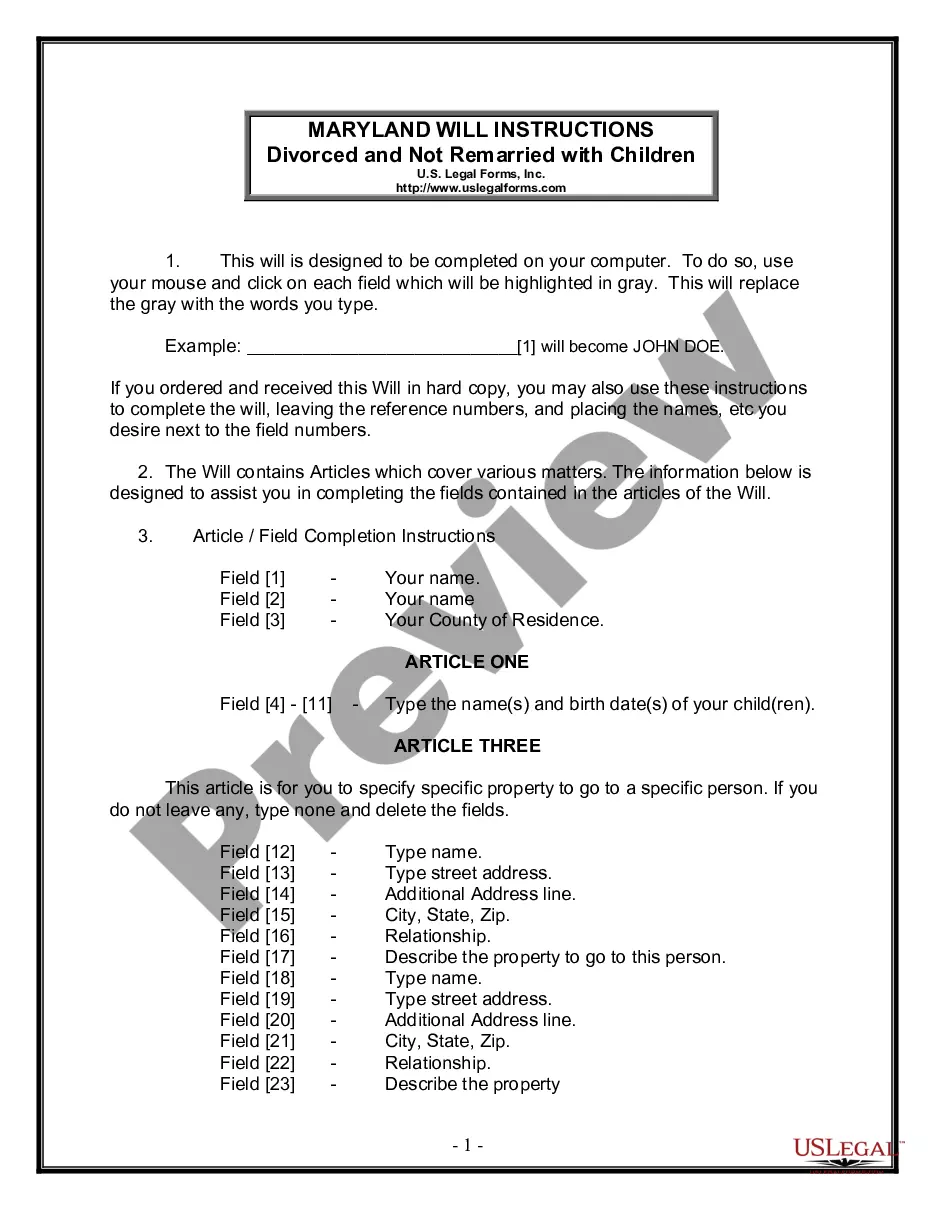

How to fill out Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

It is possible to invest time on-line searching for the lawful file template which fits the state and federal demands you want. US Legal Forms supplies a large number of lawful types that are examined by specialists. You can easily download or produce the Montana Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association from our support.

If you already have a US Legal Forms account, you can log in and click the Acquire option. Afterward, you can full, modify, produce, or indication the Montana Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association. Each and every lawful file template you purchase is your own forever. To have an additional copy for any obtained form, visit the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website initially, keep to the basic guidelines beneath:

- First, be sure that you have chosen the right file template to the region/metropolis that you pick. Look at the form information to ensure you have picked the appropriate form. If readily available, use the Review option to appear from the file template as well.

- If you want to discover an additional variation of the form, use the Look for industry to obtain the template that suits you and demands.

- After you have located the template you want, just click Get now to carry on.

- Find the costs prepare you want, enter your credentials, and sign up for your account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal account to purchase the lawful form.

- Find the formatting of the file and download it for your device.

- Make modifications for your file if possible. It is possible to full, modify and indication and produce Montana Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association.

Acquire and produce a large number of file web templates making use of the US Legal Forms Internet site, which offers the greatest selection of lawful types. Use skilled and state-specific web templates to deal with your company or person requirements.

Form popularity

FAQ

PSA is used primarily to derive an implied prepayment speed of new production loans. 00% PSA assumes a prepayment rate of 2% per month in the first month following the date of issue, increasing at 2% percentage points per month thereafter until the 30th month. PSA Prepayment Rate Definition - Nasdaq nasdaq.com ? glossary ? psa-prepayment-rate nasdaq.com ? glossary ? psa-prepayment-rate

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

An MBS is made up of a pool of mortgages purchased from issuing banks and then sold to investors. An MBS allows investors to benefit from the mortgage business without needing to buy or sell home loans themselves. What Are Mortgage-Backed Securities? rocketmortgage.com ? learn ? mortgage-bac... rocketmortgage.com ? learn ? mortgage-bac...

Status: CLOSED. shut down GreenPoint in the third quarter of 2007.

A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. What Is a Mortgage Pool? - The Balance thebalancemoney.com ? what-is-a-mortgage... thebalancemoney.com ? what-is-a-mortgage...

North Fork Bancorp acquired GreenPoint Financial in October 2004 for $6.3 billion in stock. Parent/subsidiary companies: bought GreenPoint parent company North Fork Bancorp on December 1, 2006. Status: CLOSED.

North Fork Bancorp acquired GreenPoint Financial in October 2004 for $6.3 billion in stock. In December 2006, purchased North Fork. shut down GreenPoint by the third quarter of 2007 at an after-tax loss of $1 billion.

Acquired GreenPoint and its Melville, New York, headquarters for $14.6 billion U.S. dollars. It was only the second bank bought by , and was the larger of two acquisitions comprising 's 2005-06 expansion into retail banking.

What is a Pooling Agreement? A pooling agreement is a type of contract where corporate shareholders create a voting trust by pooling their voting rights and transferring them to a trustee. This is also called a voting agreement or shareholder-control agreement since it is used to control the affairs of the corporation. Pooling Agreement: Definition & Sample - Contracts Counsel contractscounsel.com ? pooling-agreement contractscounsel.com ? pooling-agreement