Montana Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

You are able to devote hours on the web attempting to find the legal file design that meets the federal and state requirements you require. US Legal Forms provides 1000s of legal kinds which can be examined by professionals. It is simple to down load or print the Montana Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. from my services.

If you have a US Legal Forms bank account, you can log in and click the Download key. Next, you can full, modify, print, or indication the Montana Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.. Every single legal file design you buy is yours eternally. To get yet another copy of the purchased type, check out the My Forms tab and click the corresponding key.

If you use the US Legal Forms web site initially, keep to the simple recommendations listed below:

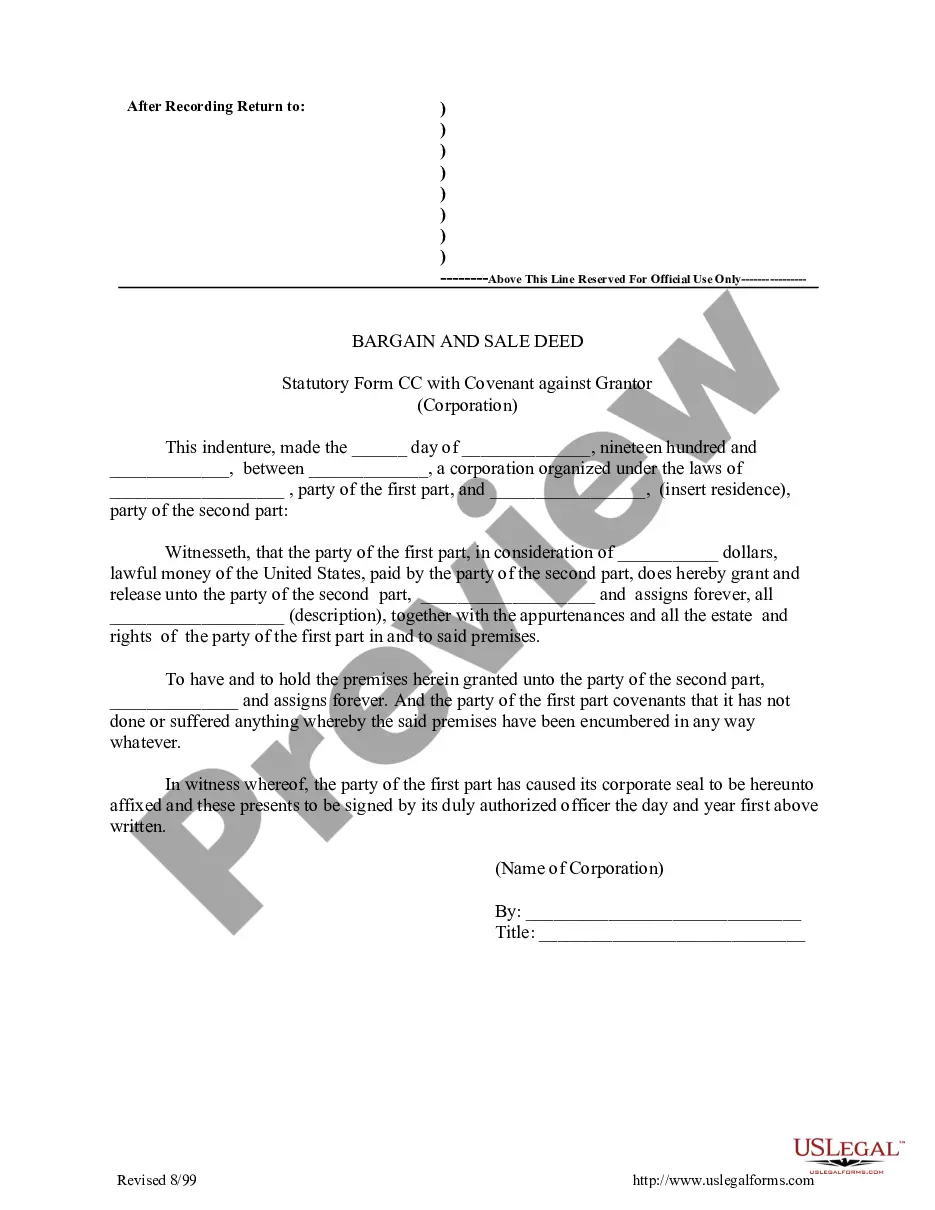

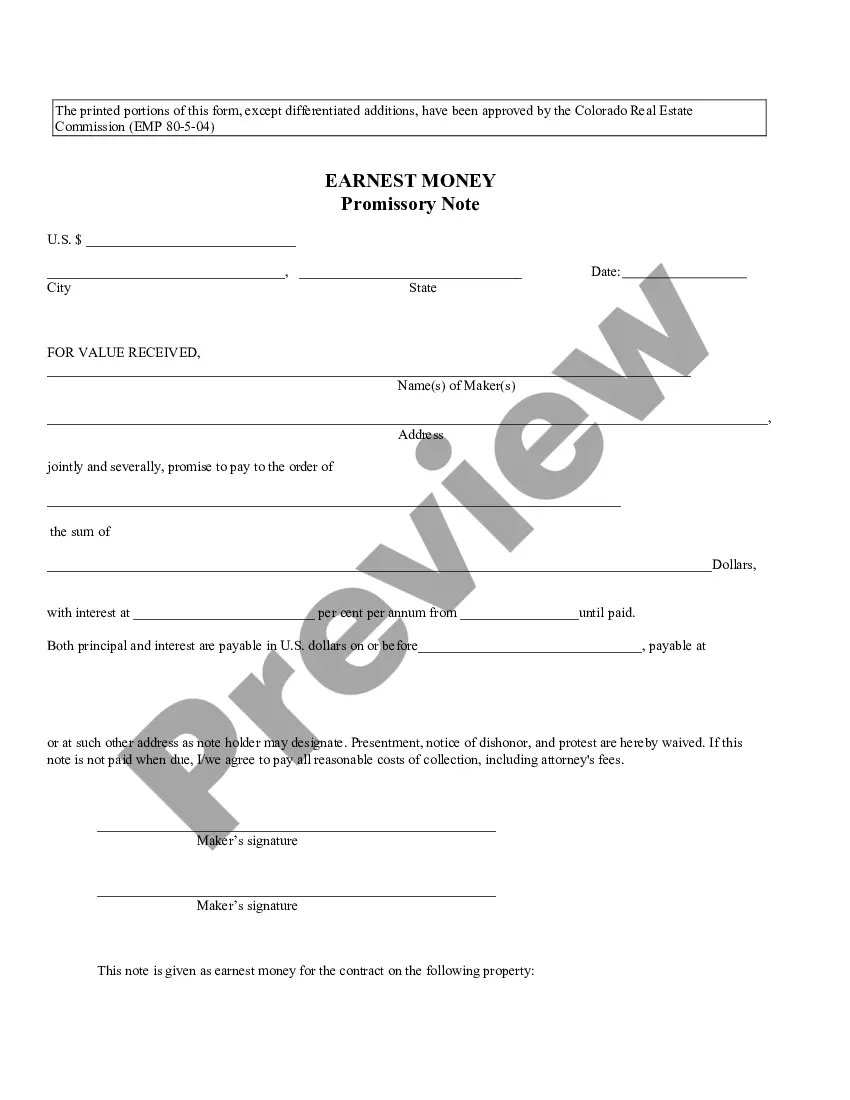

- Very first, make sure that you have chosen the proper file design to the state/metropolis of your liking. Read the type description to make sure you have picked the right type. If accessible, utilize the Review key to check through the file design as well.

- In order to find yet another version of the type, utilize the Research industry to find the design that meets your requirements and requirements.

- When you have located the design you need, just click Get now to continue.

- Pick the prices plan you need, type your references, and register for a free account on US Legal Forms.

- Complete the financial transaction. You should use your charge card or PayPal bank account to fund the legal type.

- Pick the format of the file and down load it to the product.

- Make adjustments to the file if required. You are able to full, modify and indication and print Montana Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

Download and print 1000s of file layouts while using US Legal Forms website, that offers the most important variety of legal kinds. Use specialist and state-distinct layouts to deal with your business or specific needs.