Montana Leased Personal Property Workform

Description

How to fill out Leased Personal Property Workform?

It is feasible to spend hours online searching for the legal documents template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can easily download or print the Montana Leased Personal Property Workform from my service.

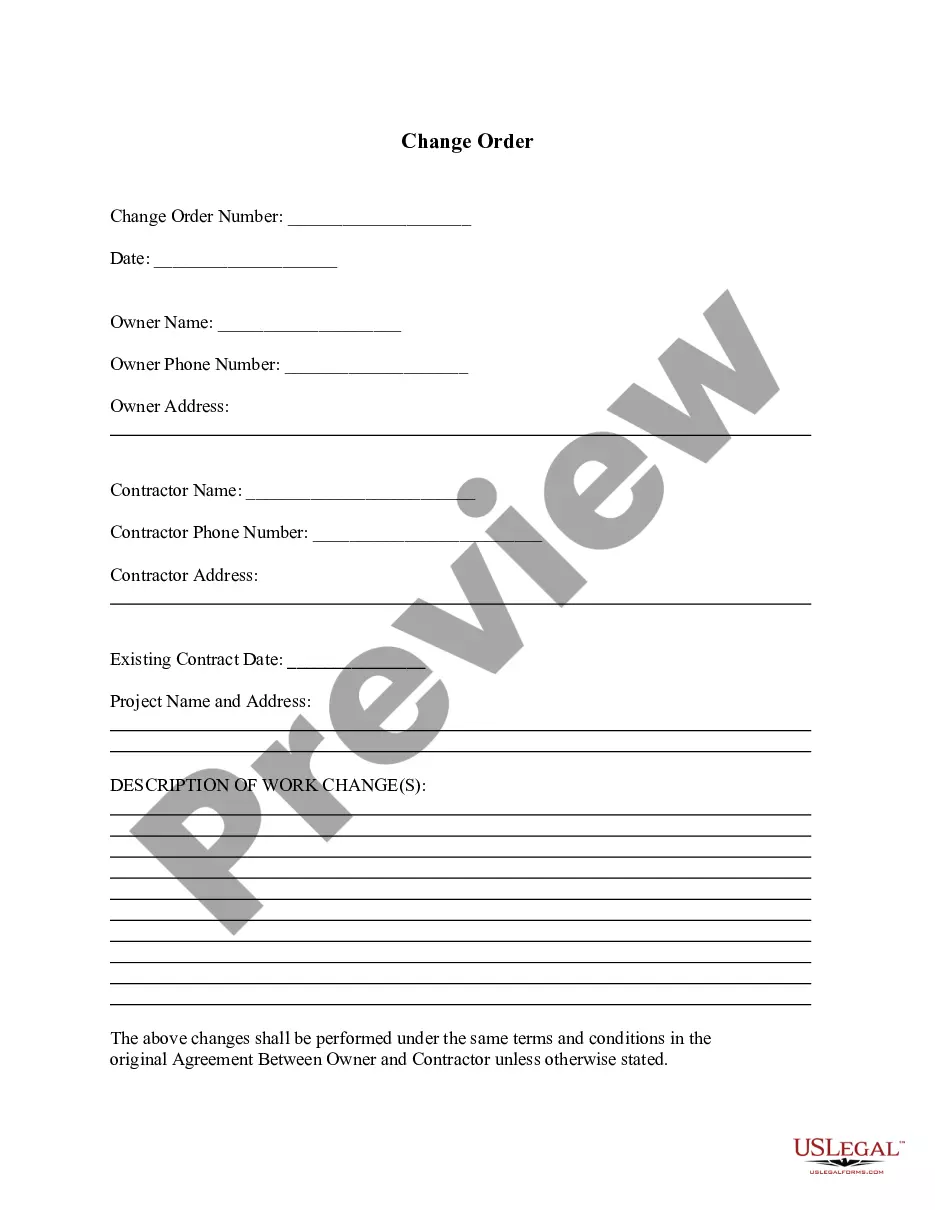

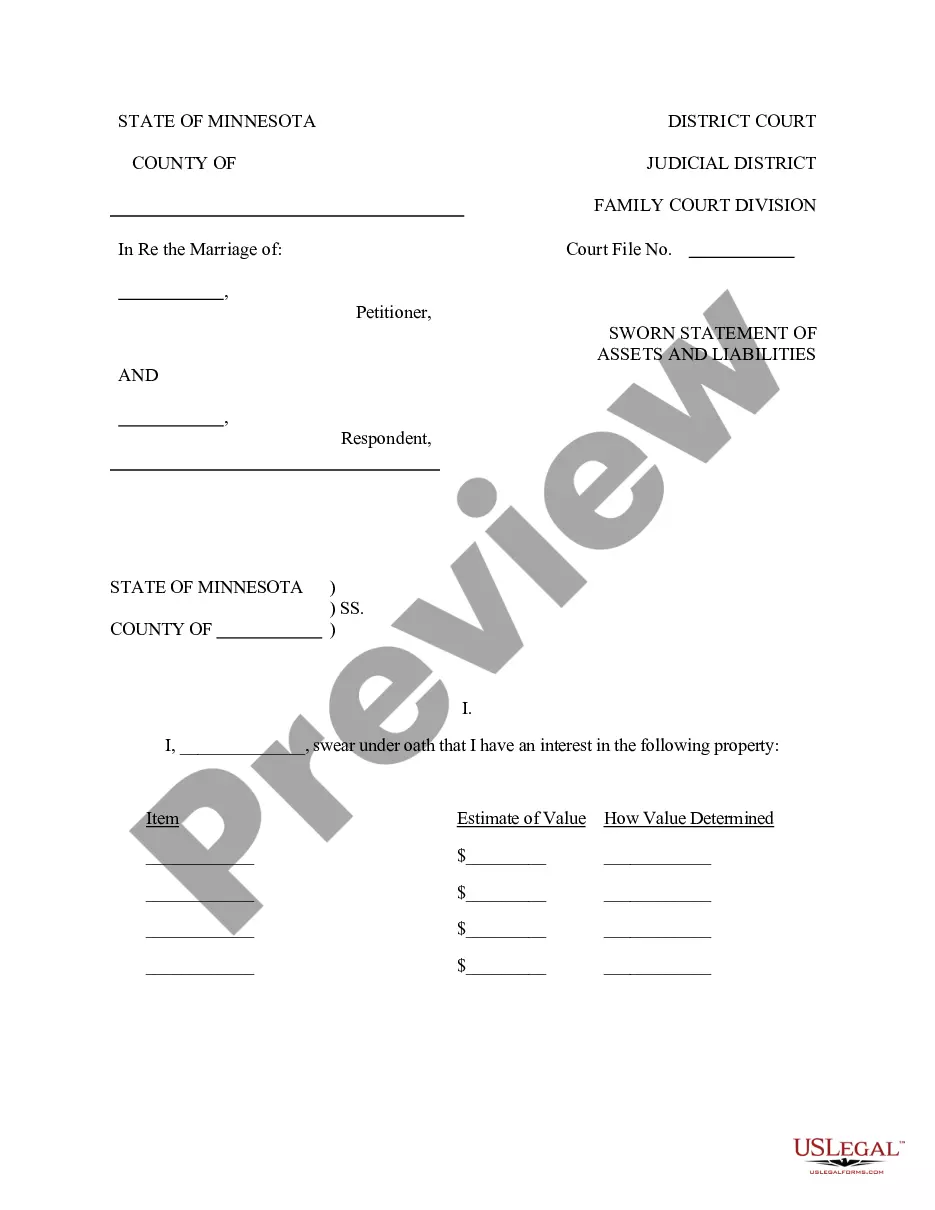

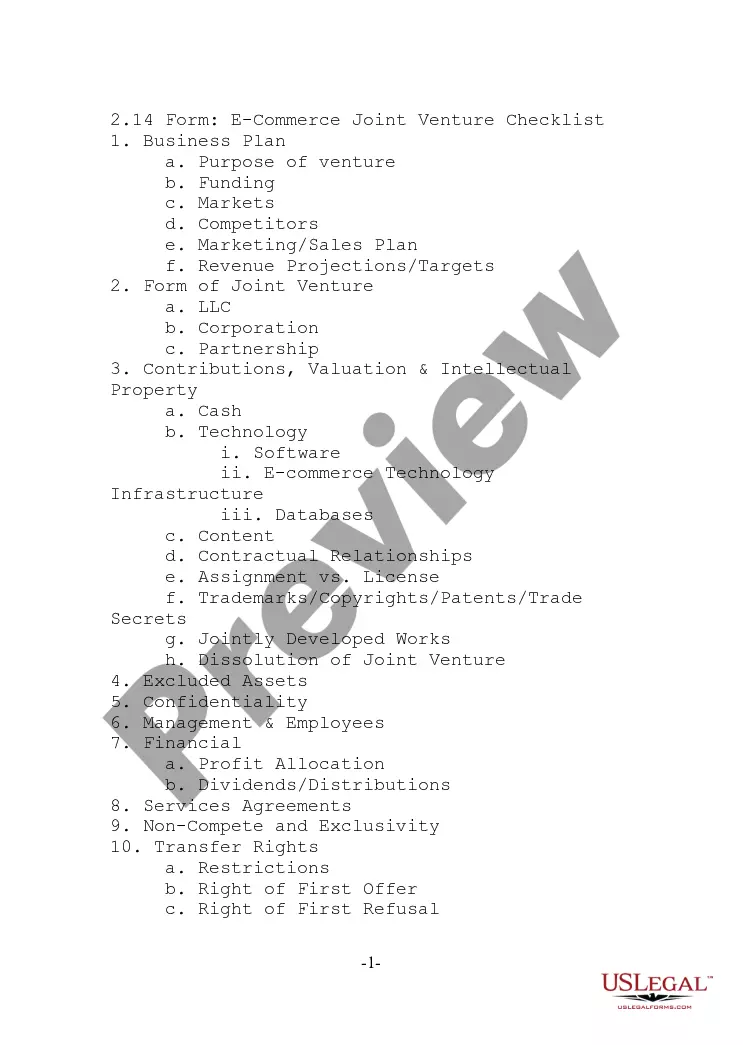

If available, utilize the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can fill out, edit, print, or sign the Montana Leased Personal Property Workform.

- Every legal document template you obtain is yours for a long time.

- To get another copy of the purchased form, visit the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your preference.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

Yes, Montana does impose a vehicle property tax on certain types of vehicles. This tax is assessed annually based on the market value of the vehicle at the beginning of the year. When filling out the Montana Leased Personal Property Workform, be sure to include all relevant vehicle information. This will help ensure accurate tax calculations and compliance with Montana's vehicle tax regulations.

Personal property tax in Montana refers to taxes assessed on movable assets not classified as real estate. This includes vehicles, equipment, and certain leased personal property. It's crucial to accurately report your personal property using the Montana Leased Personal Property Workform to assess the right tax amount. This form simplifies the process and helps you remain compliant with state tax laws.

Several states do not impose a personal property tax, including Delaware, New Hampshire, and Montana. However, it's essential to remember that while Montana does have some property taxes, they may not apply to leased personal property under certain conditions. Using the Montana Leased Personal Property Workform will guide you in determining whether your lease obligations fall under state tax requirements. This clarity can aid in effective financial planning.

Montana does not specifically have a 183-day rule like some other states. Instead, residency is often determined by your physical presence and intent to stay in Montana. If you lease personal property in Montana, it's important to understand your residency status for tax obligations. The Montana Leased Personal Property Workform helps to clarify your tax responsibilities based on your residency.

Yes, a car is considered personal property for tax purposes. In Montana, personal property includes vehicles and any belongings not permanently attached to land. When completing the Montana Leased Personal Property Workform, you will need to account for your vehicle as part of your taxable property. This ensures compliance with state tax laws.

Registering for Montana withholding tax requires you to fill out an employer registration form with the Montana Department of Revenue. You will need to provide specific information about your business and your federal Employer Identification Number. Once registered, the Montana Leased Personal Property Workform can support your efforts by keeping all tax documents organized.

To register as an employer in Montana, you must complete the registration process through the Montana Department of Revenue and the Department of Labor and Industry. You'll need to provide your business details and select your type of business structure. Once registered, the Montana Leased Personal Property Workform can help you manage your responsibilities and ensure compliance.

Yes, Montana does impose a personal property tax on various assets owned by individuals and businesses. This tax is assessed on items such as equipment and vehicles that are used for commercial purposes. For an efficient way to keep track of these liabilities, the Montana Leased Personal Property Workform can serve as a valuable tool.

Montana does have its own version of the W-4 form, known as the MT W-4. This form is used by employees to designate their state withholding allowances. Employers should ensure that they provide this form to their employees to help accurately calculate state taxes. Incorporating the Montana Leased Personal Property Workform into your workflow will further assist in maintaining accurate records.

To register as an employer for state withholding in Montana, visit the Montana Department of Revenue website to complete the registration process. You will need to provide your federal Employer Identification Number and other relevant business details. After registration, utilizing the Montana Leased Personal Property Workform can help you track your withholding obligations effectively.