Montana Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

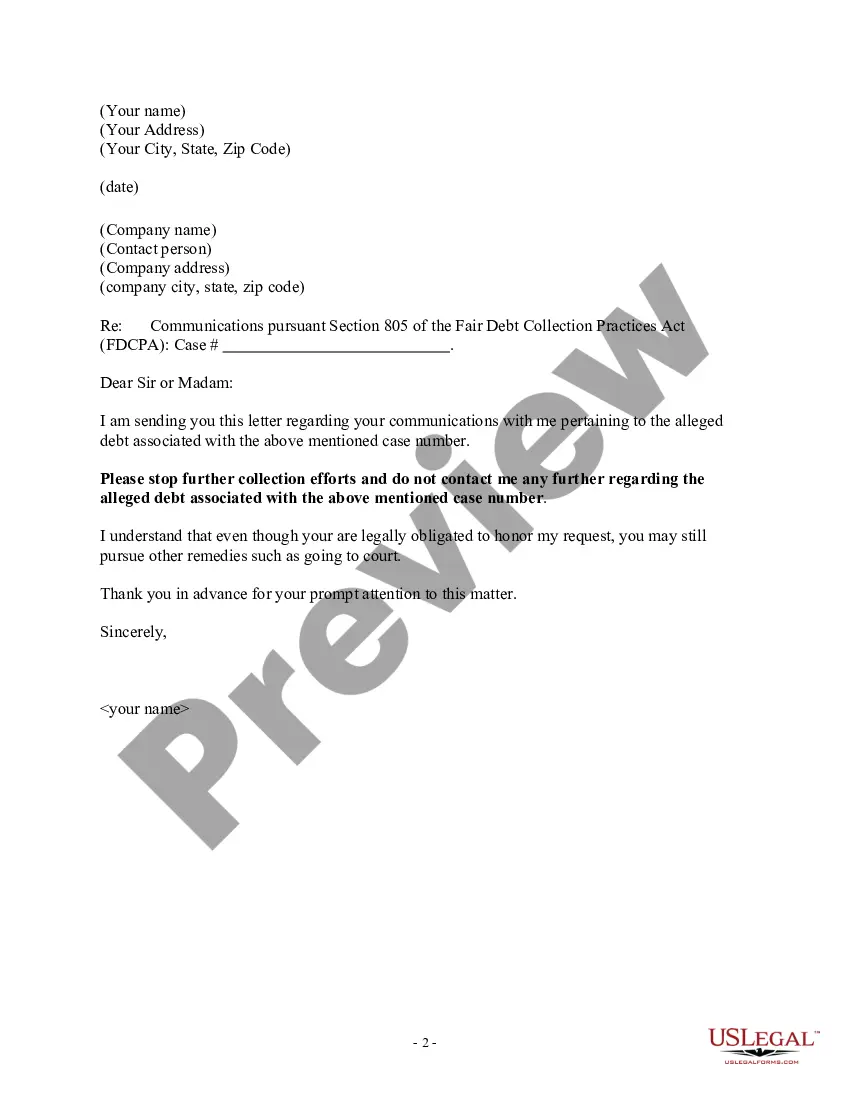

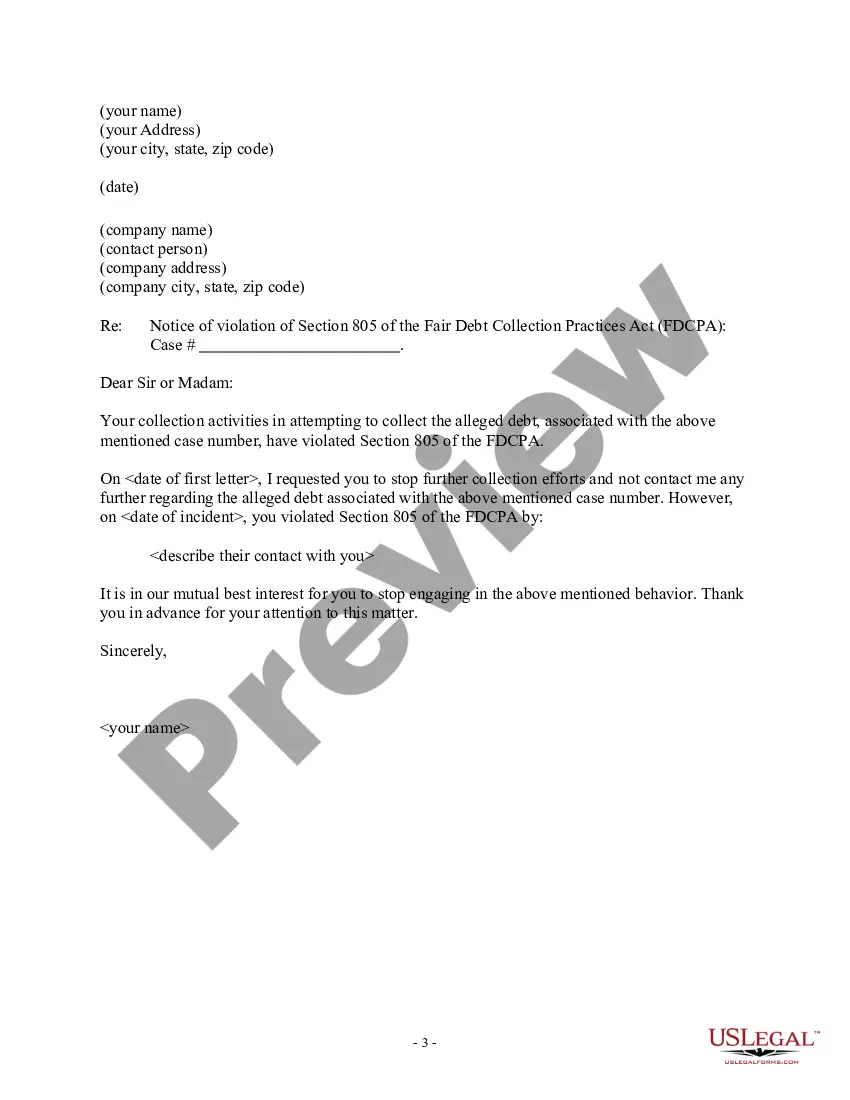

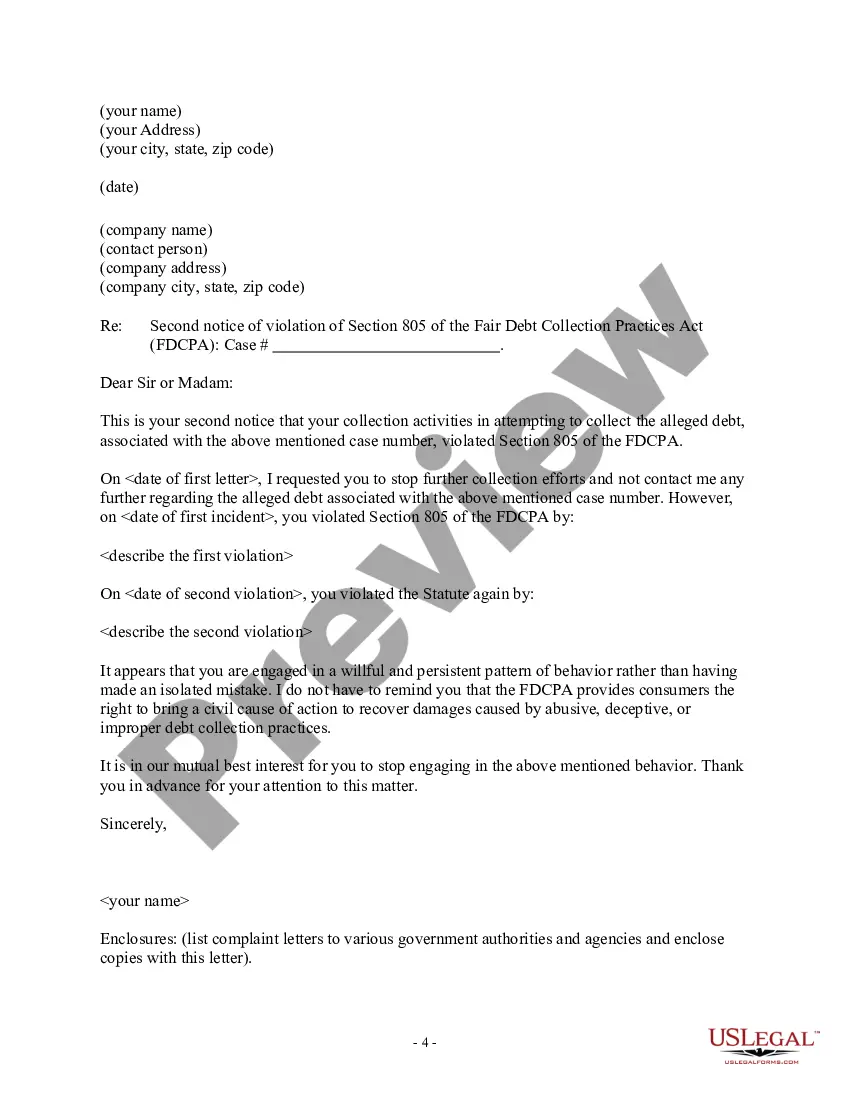

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

Locating the correct legal document format can be quite a challenge.

Clearly, there are numerous templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website.

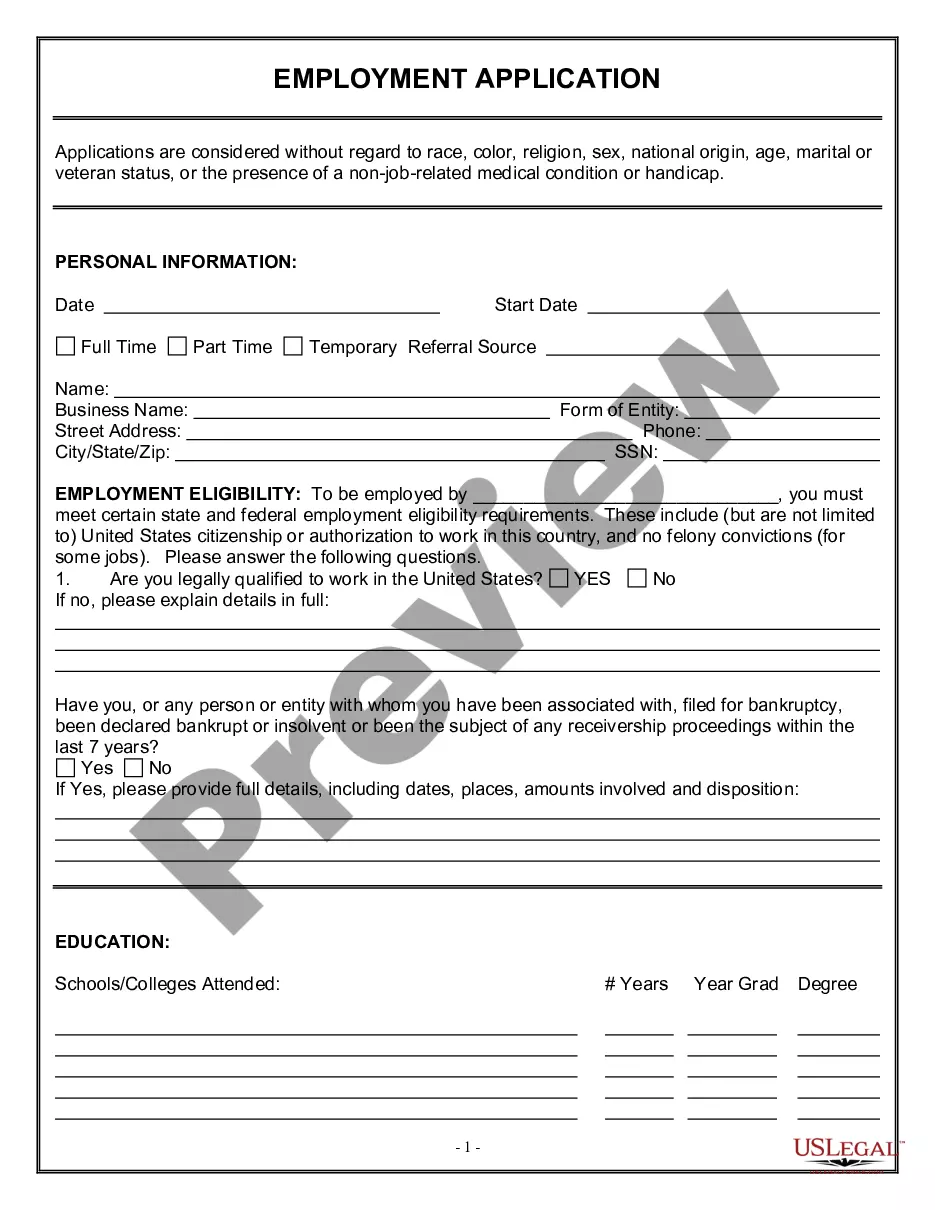

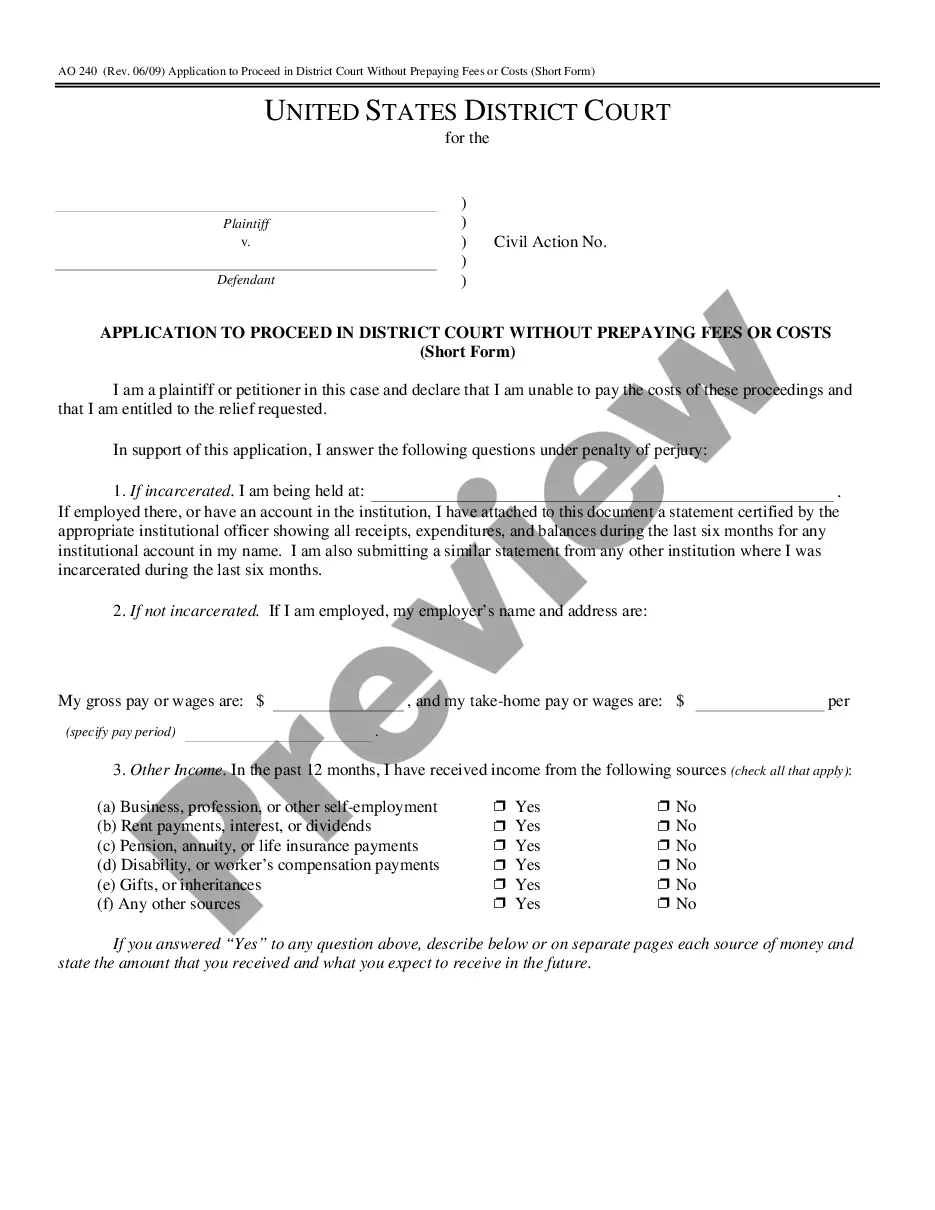

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to confirm it is the correct one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Download now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and place an order using your PayPal account or credit card. Select the file format and download the legal document format to your system. Complete, modify, and print the Montana Notice of Violation of Fair Debt Act - Notice to Stop Contact you received. US Legal Forms is the largest repository of legal forms where you can explore various document templates. Take advantage of the service to obtain professionally-crafted documents that adhere to state requirements.

- The service offers thousands of templates, such as the Montana Notice of Violation of Fair Debt Act - Notice to Stop Contact, which can be utilized for both business and personal purposes.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Download button to acquire the Montana Notice of Violation of Fair Debt Act - Notice to Stop Contact.

- Use your account to search through the legal forms you have purchased previously.

- Go to the My documents section of your account and download an additional copy of the document you need.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

You have 30 days to dispute a debt or part of a debt within 30 days from when you first receive the required information from the debt collector.

If, within the 30-day period, the consumer disputes in writing any portion of the debt or requests the name and address of the original creditor, the collector must stop all collection efforts until he or she mails the consumer a copy of a judgment or verification of the debt, or the name and address of the original

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

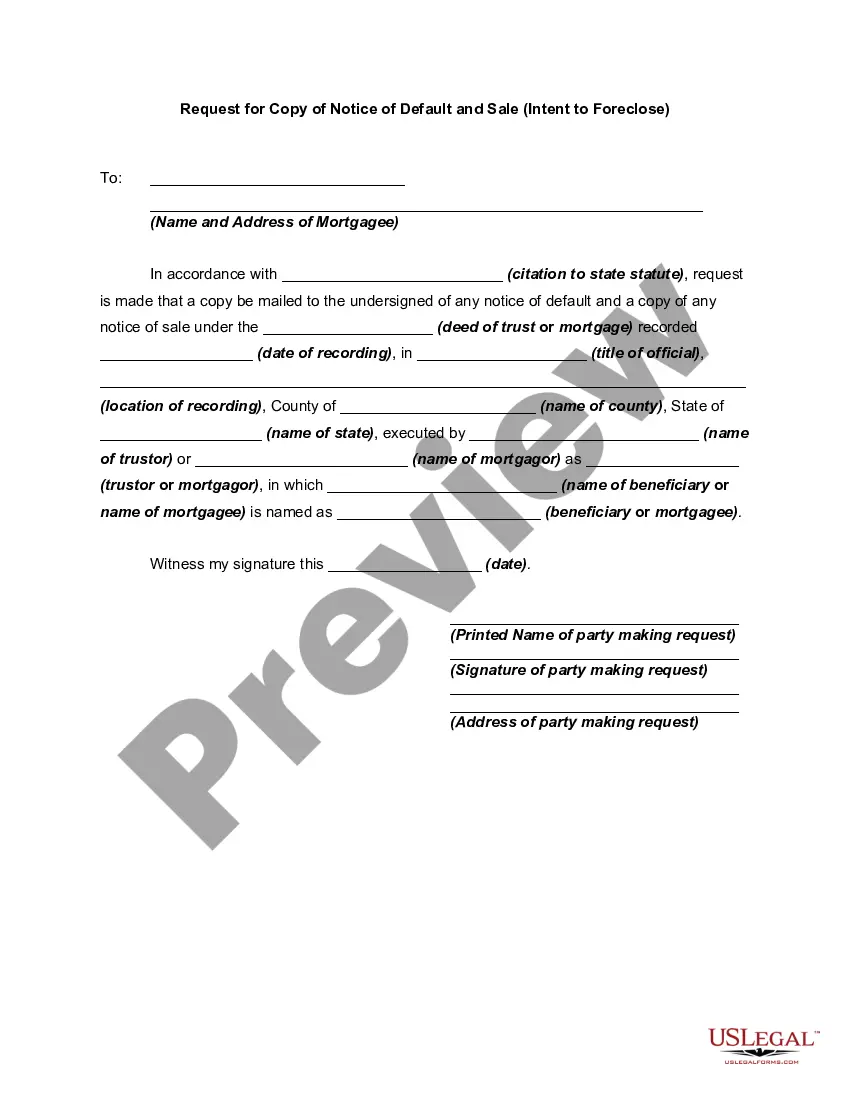

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

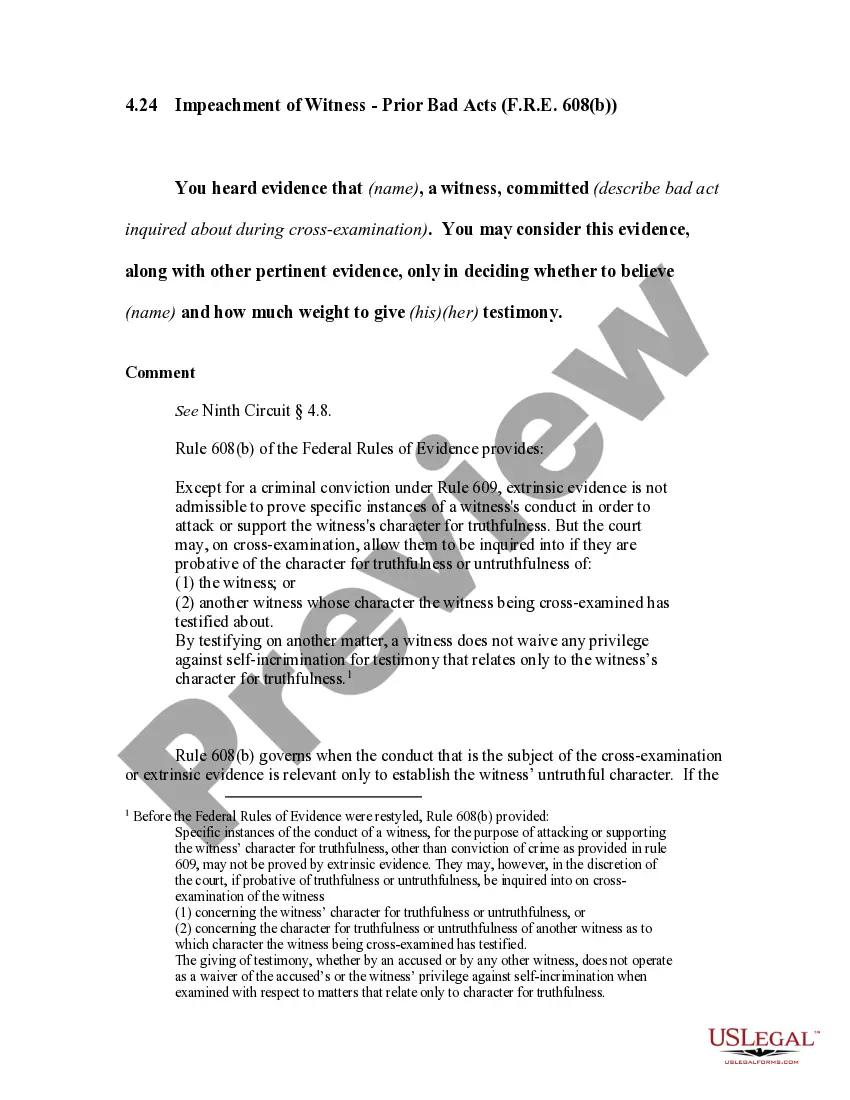

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The CFPB explicitly states that the final rule does not require a debt collector to use the model validation notice and that use of the model notice is one way to comply to comply with the content and format requirements in Regulation F. It states further that debt collectors who choose not to use the model