Montana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

Choosing the best authorized document format can be quite a battle. Of course, there are a lot of templates accessible on the Internet, but how will you obtain the authorized type you will need? Take advantage of the US Legal Forms web site. The support gives a huge number of templates, like the Montana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights, that can be used for company and private needs. All of the forms are inspected by professionals and fulfill state and federal specifications.

When you are already listed, log in for your profile and then click the Acquire button to obtain the Montana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights. Make use of your profile to look from the authorized forms you possess purchased formerly. Go to the My Forms tab of your profile and have an additional copy of the document you will need.

When you are a fresh customer of US Legal Forms, listed here are basic directions for you to comply with:

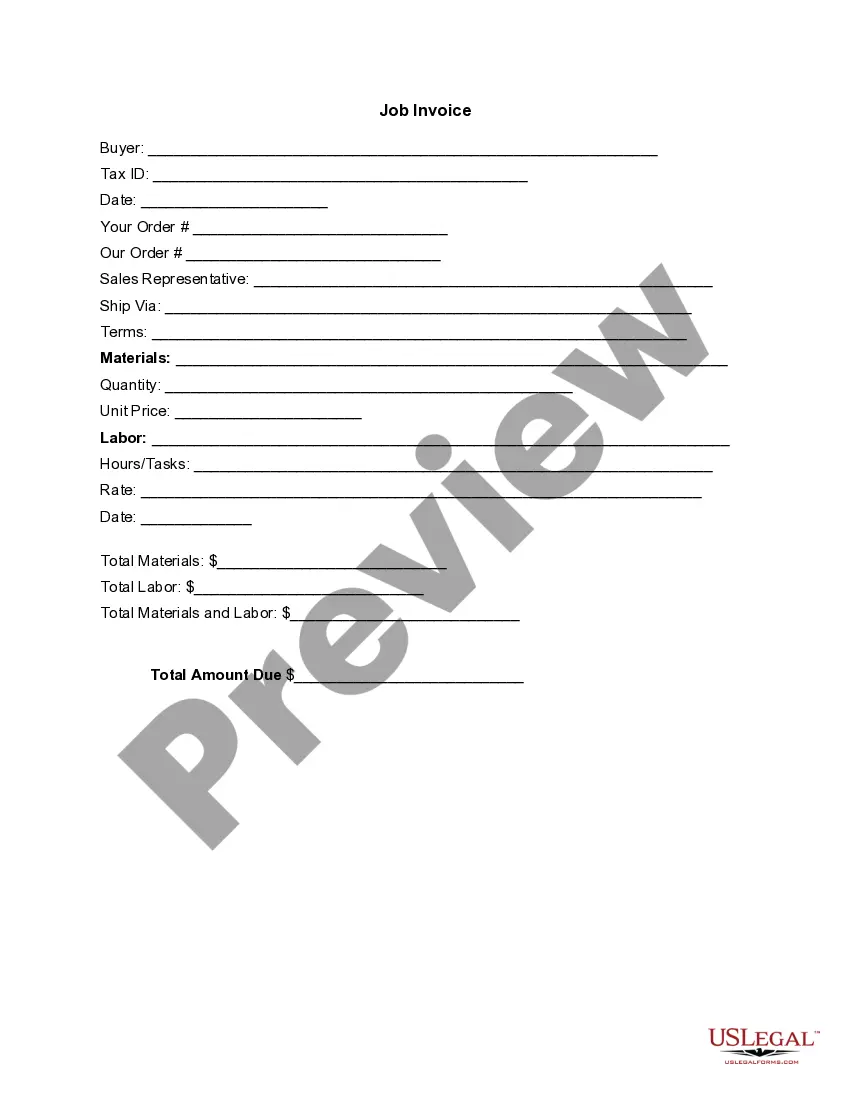

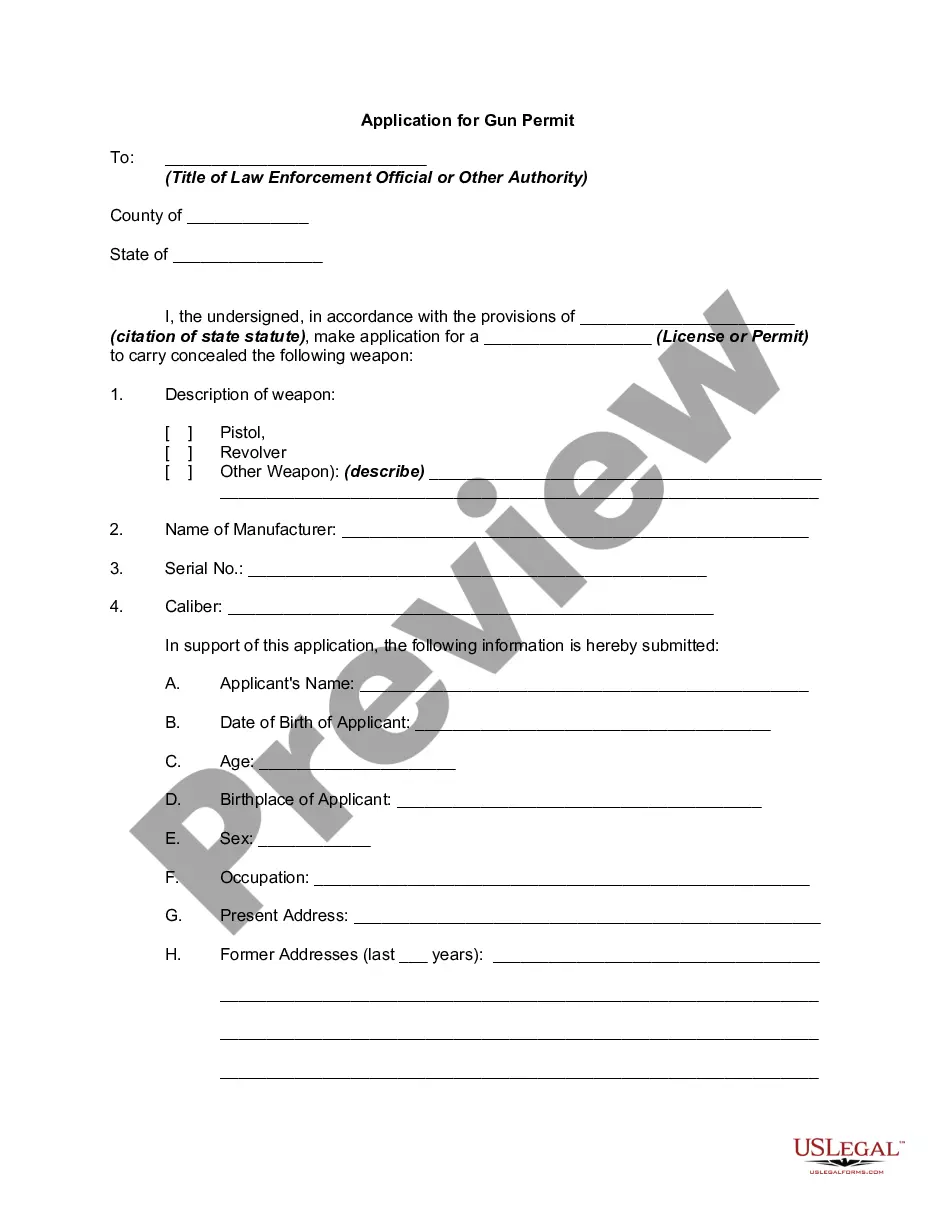

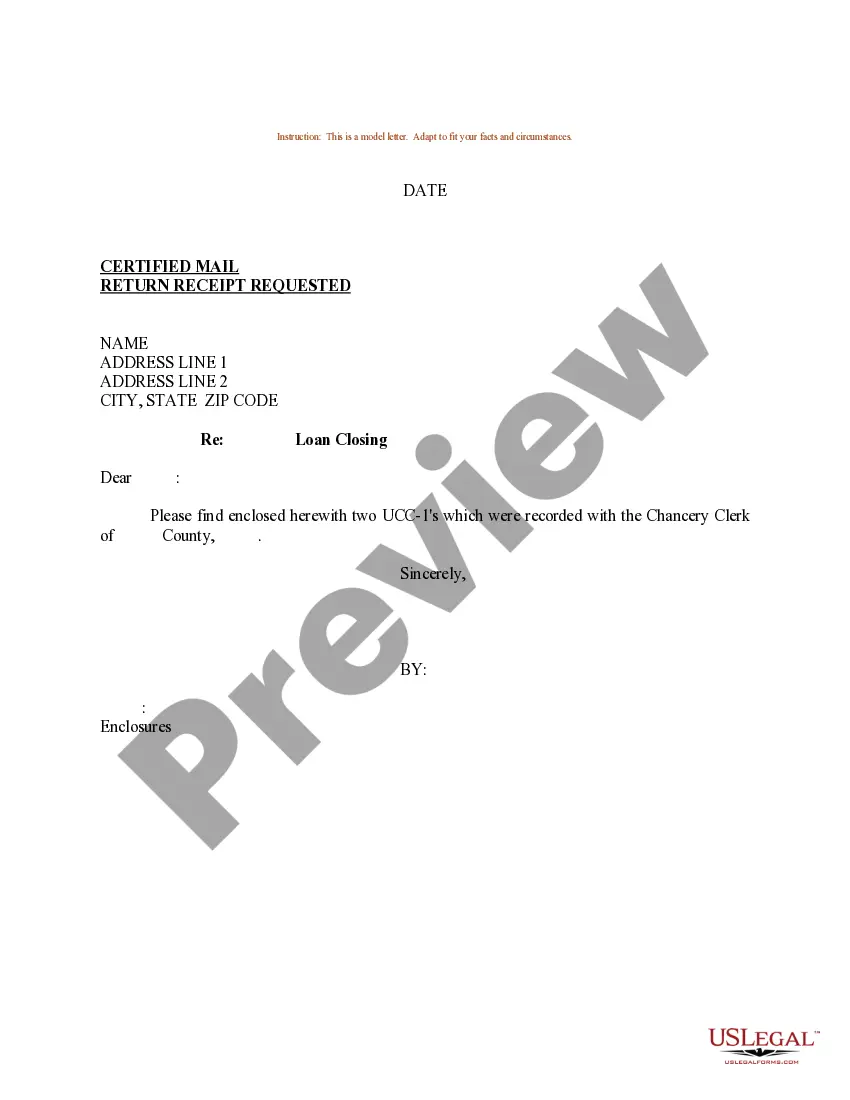

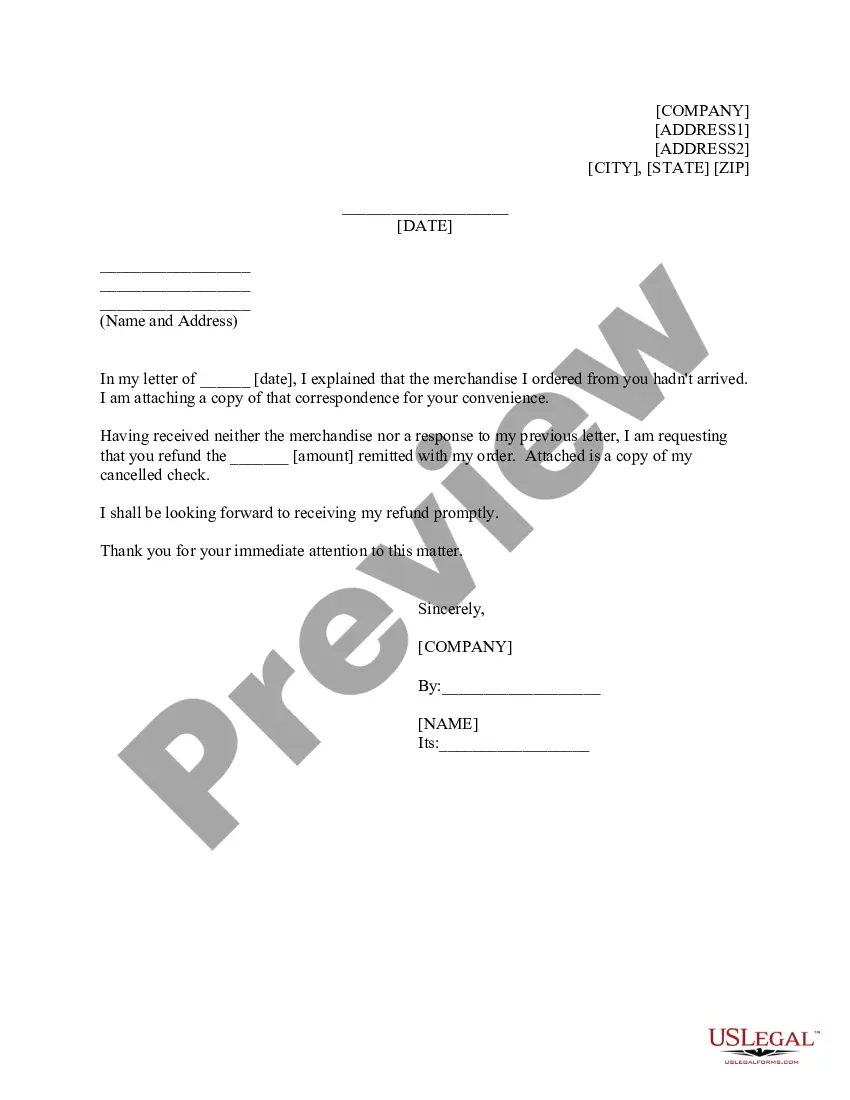

- Very first, be sure you have selected the correct type for the metropolis/region. You are able to look over the shape utilizing the Preview button and look at the shape information to make sure this is the right one for you.

- When the type fails to fulfill your expectations, make use of the Seach field to obtain the proper type.

- Once you are certain the shape would work, click the Get now button to obtain the type.

- Choose the costs program you want and type in the essential details. Build your profile and buy the transaction using your PayPal profile or bank card.

- Choose the file format and down load the authorized document format for your device.

- Comprehensive, modify and print and indicator the received Montana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

US Legal Forms will be the biggest catalogue of authorized forms where you can find numerous document templates. Take advantage of the company to down load expertly-made documents that comply with status specifications.

Form popularity

FAQ

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

Who uses Employee Stock Options? Employee stock options are most commonly used by high-level employees of a company, such as executives or managers.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.