Montana Demand for Payment of Account by Business to Debtor

Description

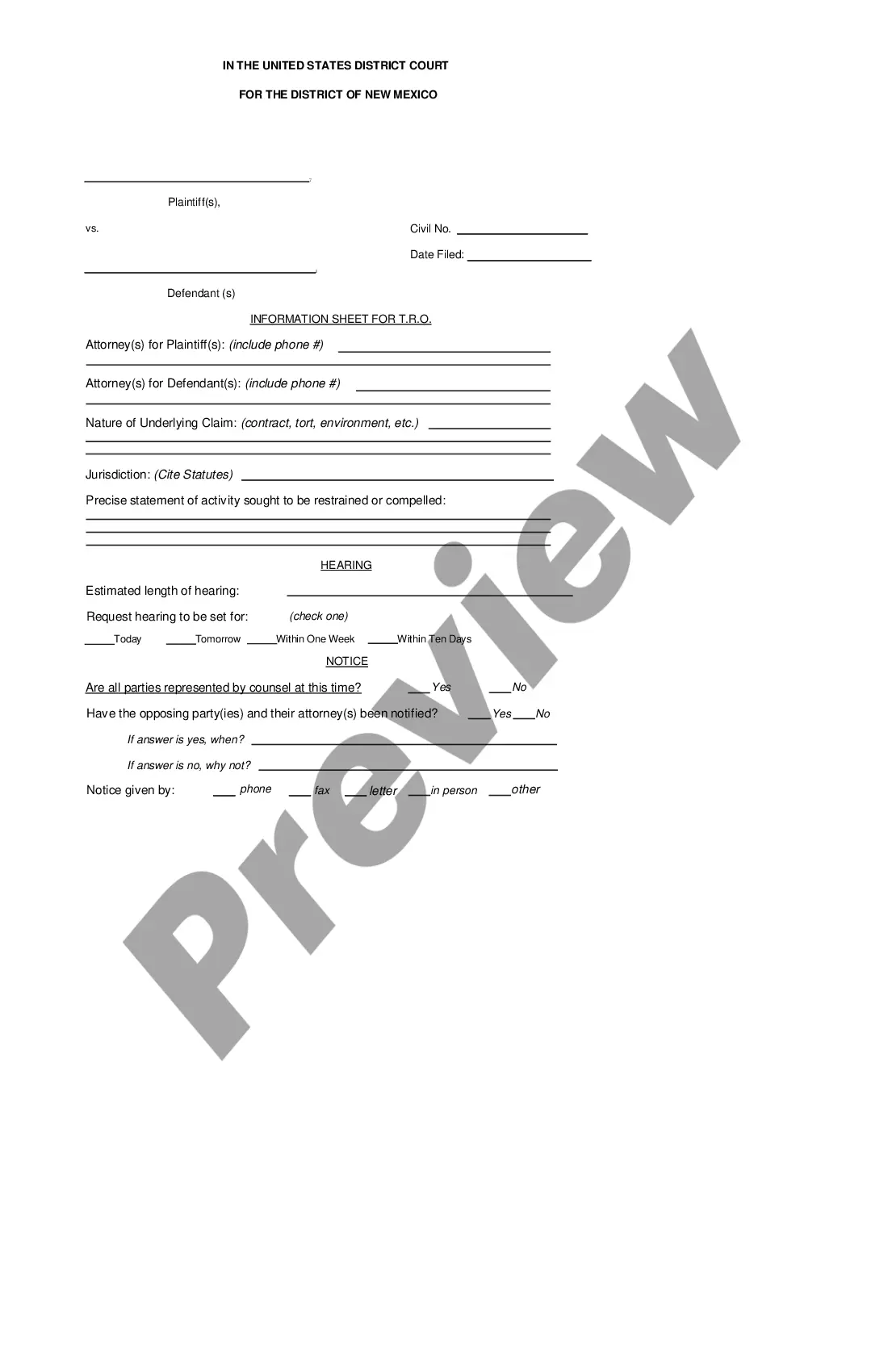

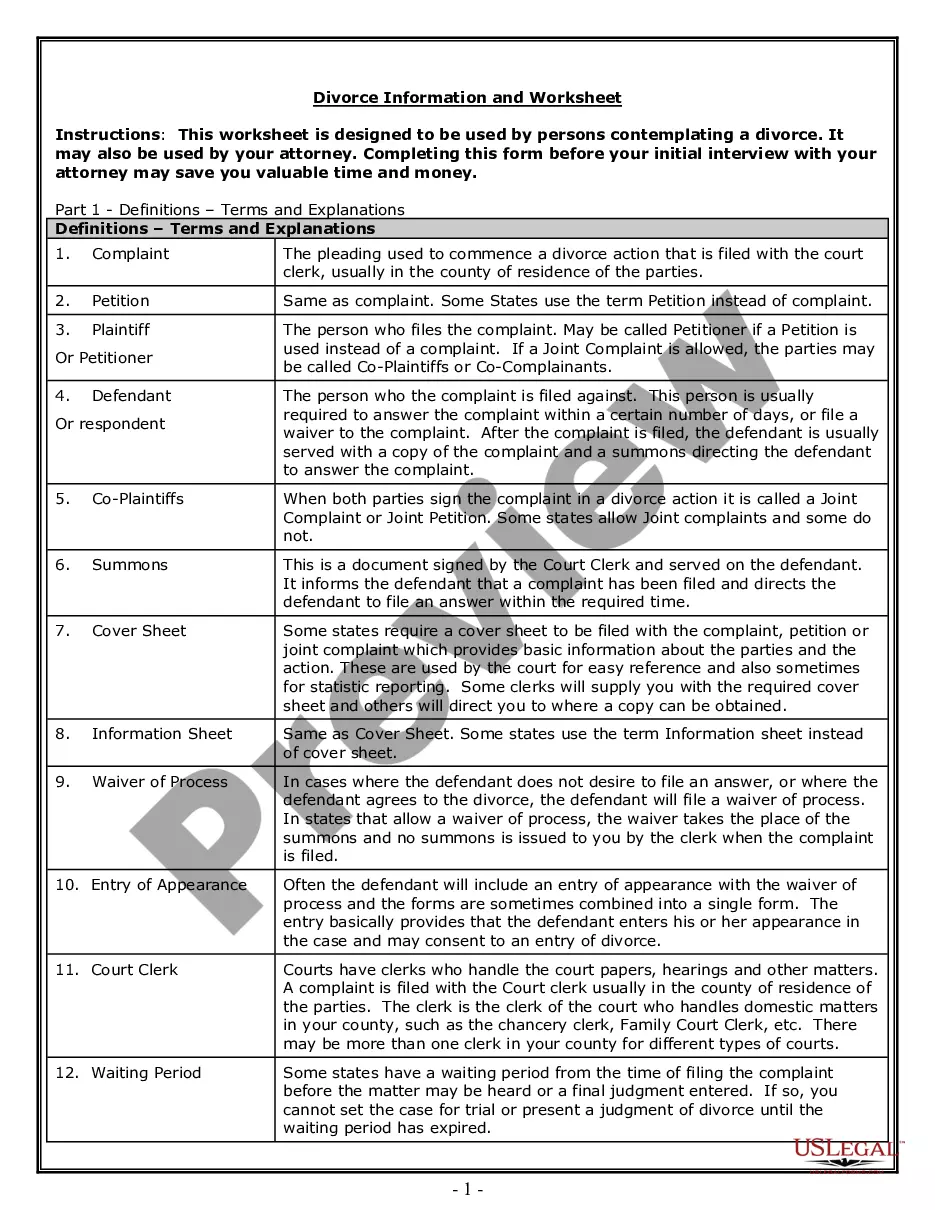

How to fill out Demand For Payment Of Account By Business To Debtor?

If you wish to complete, obtain, or print valid document templates, utilize US Legal Forms, the top choice of legitimate forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to discover the Montana Demand for Payment of Account by Business to Debtor with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to locate the Montana Demand for Payment of Account by Business to Debtor.

- You can also access forms you previously acquired in the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the instructions outlined below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Utilize the Review option to examine the form's content. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the template, use the Search section at the top of the page to find alternative models in the legal form template.

Form popularity

FAQ

The average fee ranges from 25 50 percent of the total amount of debt collected per account. Fees are contractually agreed upon. Factors that determine contingency fees include: The age of an account as consumer debt ages, the likelihood of recovery decreases.

If a Company Goes Bankrupt and Owes Me Money, Can I Collect?Stop Collection Efforts.Review Bankruptcy Documents.Attend Debtor's Initial Examination.File a Proof of Claim.Attend Debtor's Bankruptcy Hearing.Let the Bankruptcy Proceed.

Can a Business be Sent to Collections? The short answer to this is yes. The U.S. business debt collection laws give creditors the right to transfer a delinquent's account to a collection agency immediately after issuing a letter of demand.

You can use a statutory demand to ask for money you're owed from a person or business. If they ignore the statutory demand or cannot repay the money, you can apply to a court to: make someone bankrupt - if you're owed £5000 or more by an individual, including a sole trader or a member of a partnership.

Looking into how to send someone to collections before the 90 days are up is considered an overreaction in most circles.Step One Resend Outstanding Invoices.Step Two Speak to the Debtor.Step Three Contact a Lawyer and Send a Formal Demand.Average Collection Agency Fees.

The lender can file a civil suit for recovering the money he owed through promissory note or loan agreement. He can do so under Order 37 of CPC which allows the lender to file a summary suit. He can file this suit in any high court, City Civil Court, Magistrate Court, Small Causes Court.

Steps to take before sending someone to collectionsCall the debtor.Send debt collection letters.Resend your invoice with added late fees.Offer a settlement.Go to small claims court.Hire a lawyer.

What follows are some more helpful hints for small business debt collection:Avoid harassing the people that owe you money.Keep phone calls short.Write letters.Get a collection agency to write demand letters.Offer to settle for less than is due.Hire a collection agency.Small claims court.File a lawsuit.

Top 8 Debt Collection Tips for Small Business OwnersTake a Positive Stance. Don't take it personally if your customers aren't paying their bills on time.Increase Directness Gradually.Use Multiple Channels.Call the Heavy Hitters.Don't Ignore FDCPA.Always Check References.

Verbal contracts, accounts, or promises have a statute of limitation of 5 years. As for verbal obligations or liabilities that are not contracts, these have a statute of limitation of 3 years. For judgments of decrees in any U.S. court, creditors have 10 years to pursue Montana residents to collect debt.