Montana General Partnership for Business

Description

How to fill out General Partnership For Business?

Finding the appropriate legal document template can be a challenge.

Clearly, there are numerous templates accessible online, but how can you acquire the official form you need.

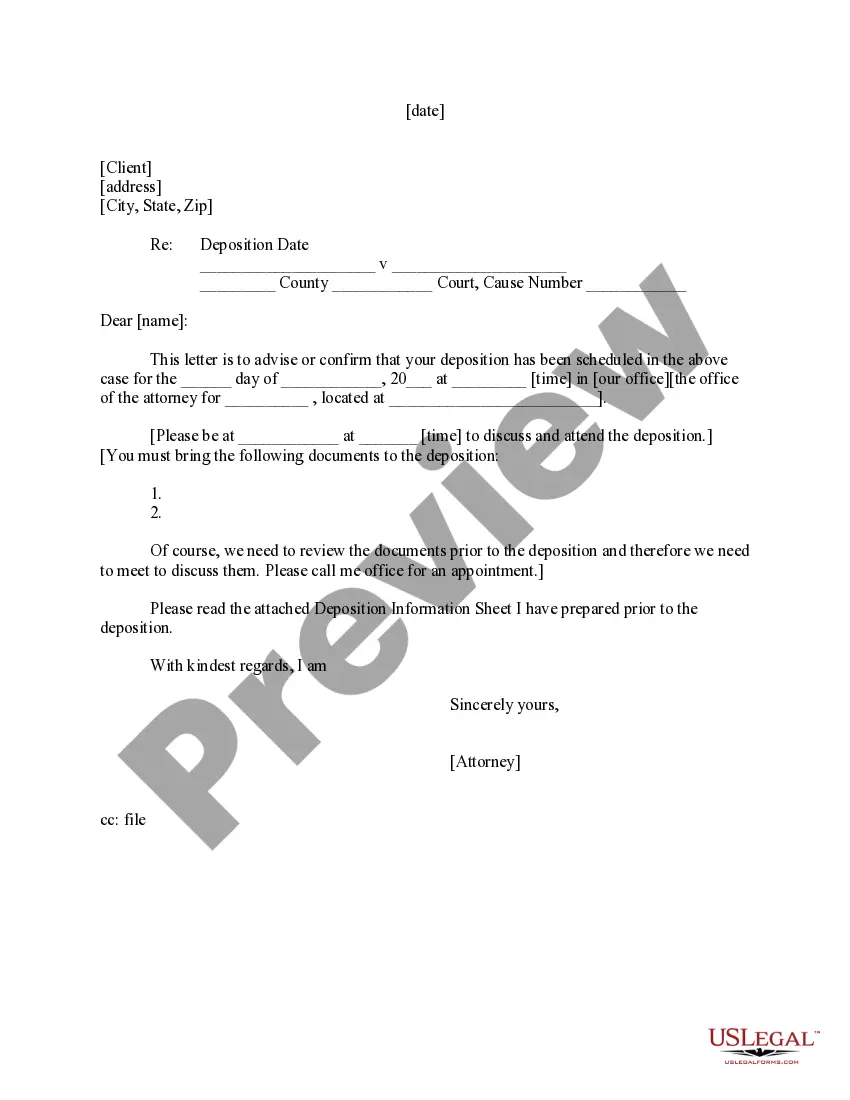

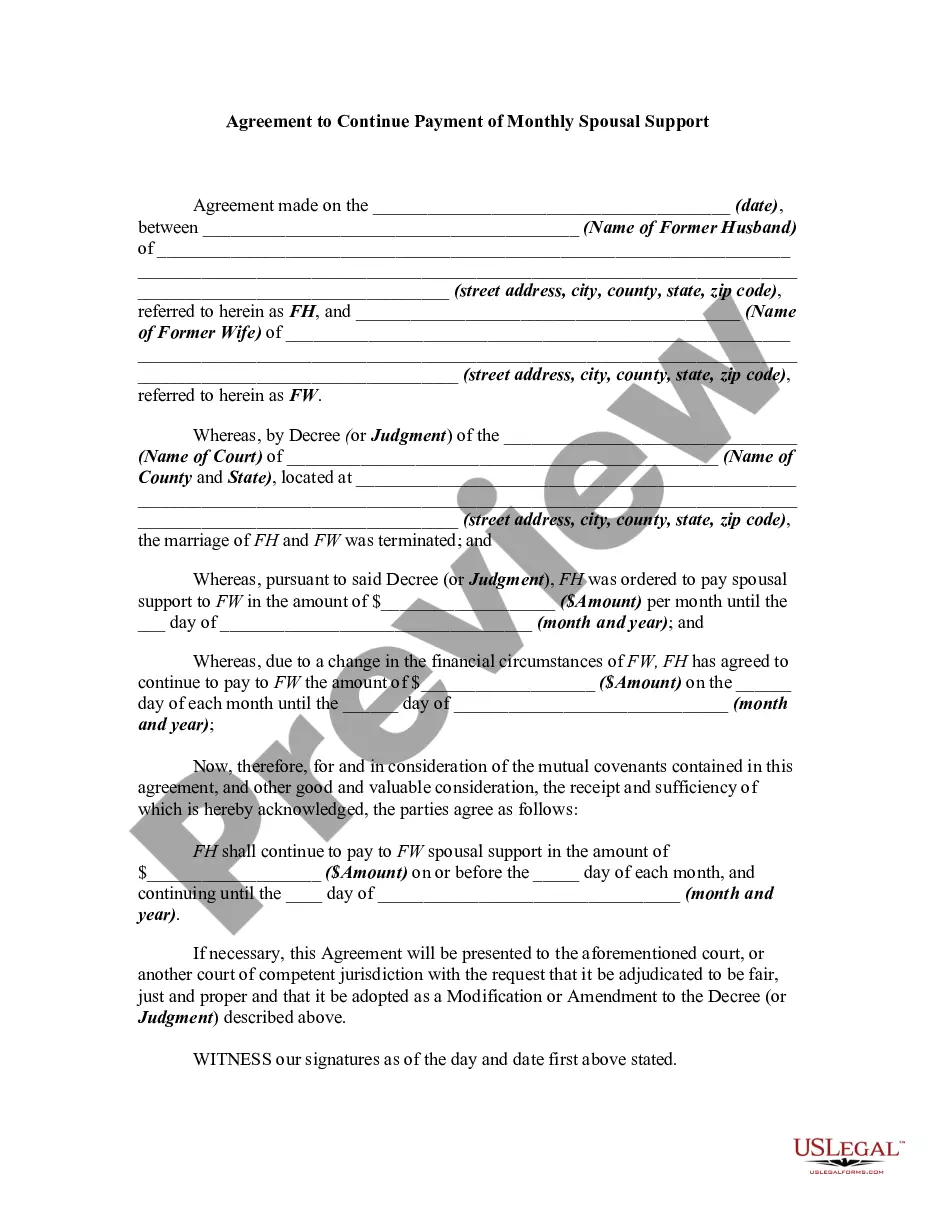

Utilize the US Legal Forms website. The service provides thousands of templates, including the Montana General Partnership for Business, suitable for both business and personal purposes.

If the form does not meet your criteria, utilize the Search field to find the appropriate form.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already a registered user, Log In to your account and select the Download option to access the Montana General Partnership for Business.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

- First, ensure you have chosen the correct form for your city/region. You can browse the form using the Review feature and examine the form details to confirm it is suitable for you.

Form popularity

FAQ

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

To have a general partnership, two conditions must be true: The company must have two or more owners. All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

Aside from formation requirements, the main difference between a partnership and an LLC is that partners are personally liable for any business debts of the partnership -- meaning that creditors of the partnership can go after the partners' personal assets -- while members (owners) of an LLC are not personally liable

An LLC is not a partnership, though many LLC owners casually refer to their co-owners as business partners." All LLC ownersknown formally as members"are protected from personal liability for business debts. Limited liability partnership. Most states allow limited liability partnerships.

For example, let's say that Dottie and Dave decide to open a clothing store. They decide to name the store D.D.'s Duds. Dottie and Dave don't need to do anything special in order to form a general partnership. Once Dottie and Dave agree to form the business, it's automatically considered to be a general partnership.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

Example of a General Partnership For example, let's say that Fred and Melissa decide to open a baking store. The store is named F&M Bakery. By opening a store together, Fred and Melissa are both general partners in the business, F&M Bakery.

A general partner LLC, one of the most common types of partnerships, is arranged by two partners that have sole ownership of and liability for the business. This means they control all aspects of the business and are held financially responsible for its obligations and debts.