Montana Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

Are you presently in a position where you require documents for both organizational or personal purposes almost every working day.

There are numerous authentic document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers a vast array of form templates, including the Montana Wage Withholding Authorization, designed to comply with federal and state regulations.

Once you find the appropriate form, click on Get now.

Select a suitable pricing plan, complete the necessary information to create your account, and make the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Montana Wage Withholding Authorization template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify it is for the correct city/state.

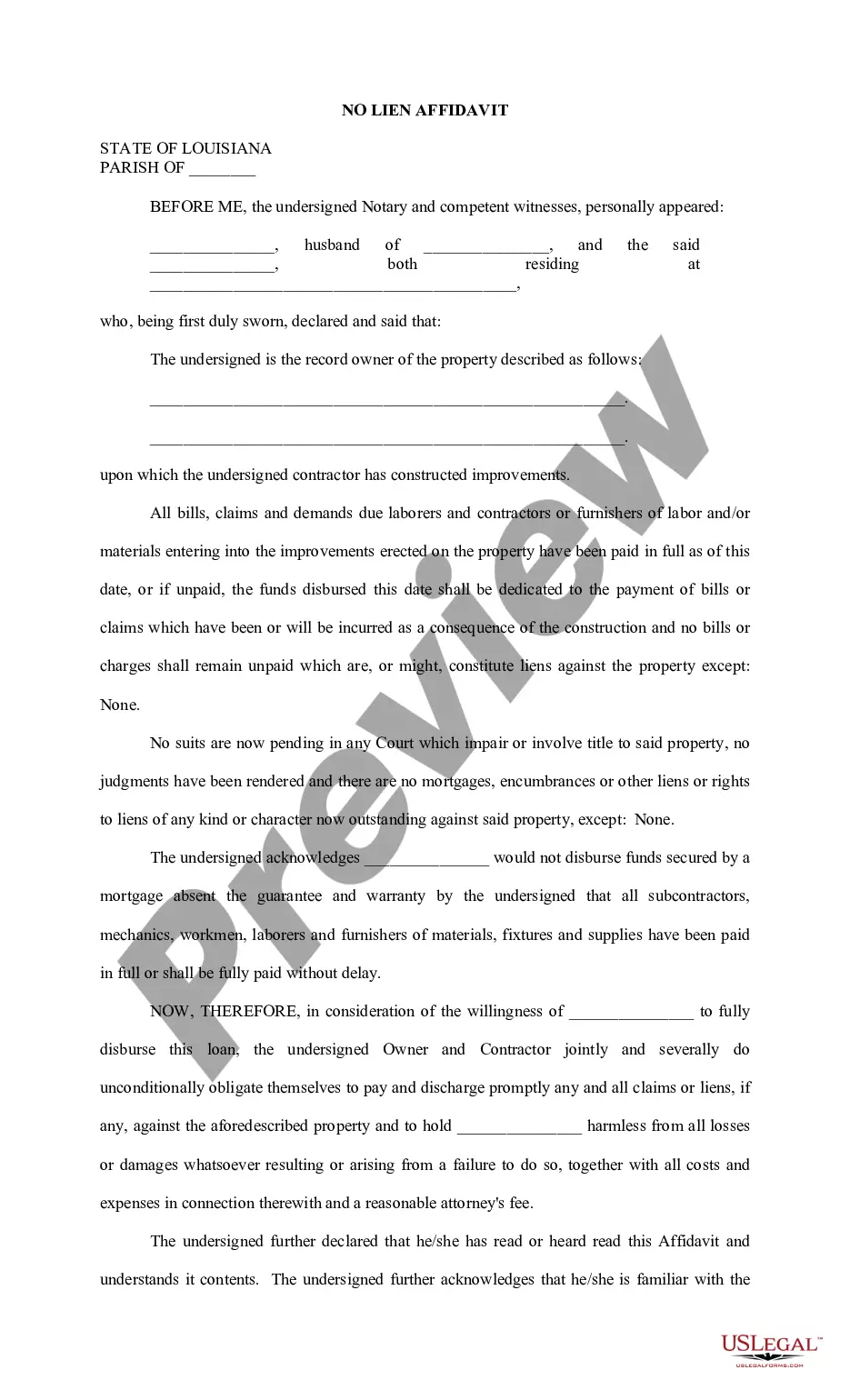

- Use the Preview button to view the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.

Payroll tax withholding is when an employer withholds a portion of an employee's gross wages for taxes. Payroll withholding is mandatory when you have employees. The amount you withhold is based on the employee's income. Remit the withheld payroll taxes to the appropriate agencies (e.g., IRS).

Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Every employer in Montana that pays wages must withhold the state tax. Nonresident employers must withhold tax from wages paid for service provided within Montana.

Montana does not recognize the federal exempt status available on the federal Form W-4. Therefore, exemption from withholding for federal purposes does not exempt you from Montana income tax withholding.

Montana Employee's Withholding Allowance and Exemption Certificate (Form MW-4) A completed Form MW-4 is used by employers to determine the amount of Montana income tax to withhold from wages paid. This form allows each employee to claim allowances or an exemption to Montana wage withholding when applicable.

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

Companies who pay employees in Montana must register with the MT Department of Revenue (DOR) for a Withholding Account Number and the MT Department of Labor and Industry (DLI) for a Unemployment Insurance (UI) Account Number. Apply online at the DOR's to receive the number within 2 days.

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

Legally, no, an employer may not withhold a final check. However, in order to avoid disputes or disruptions in pay, workers are advised to turn in keys, uniforms, tools and equipment upon termination.

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.