Montana Notice of Meeting of LLC Members To Consider Dissolution of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Dissolution Of The Company?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates that you can download or print.

By using the website, you'll access a vast array of forms for both business and personal purposes, categorized by types, states, or phrases. You can find the latest versions of forms such as the Montana Notice of Meeting of LLC Members to Consider Dissolution of the Company in just minutes.

If you possess a subscription, Log In and download the Montana Notice of Meeting of LLC Members to Consider Dissolution of the Company from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Gain access to the Montana Notice of Meeting of LLC Members to Consider Dissolution of the Company with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a wide variety of professional and state-specific templates that meet your business or personal needs and requirements.

- First-time users of US Legal Forms should follow these simple instructions to get started.

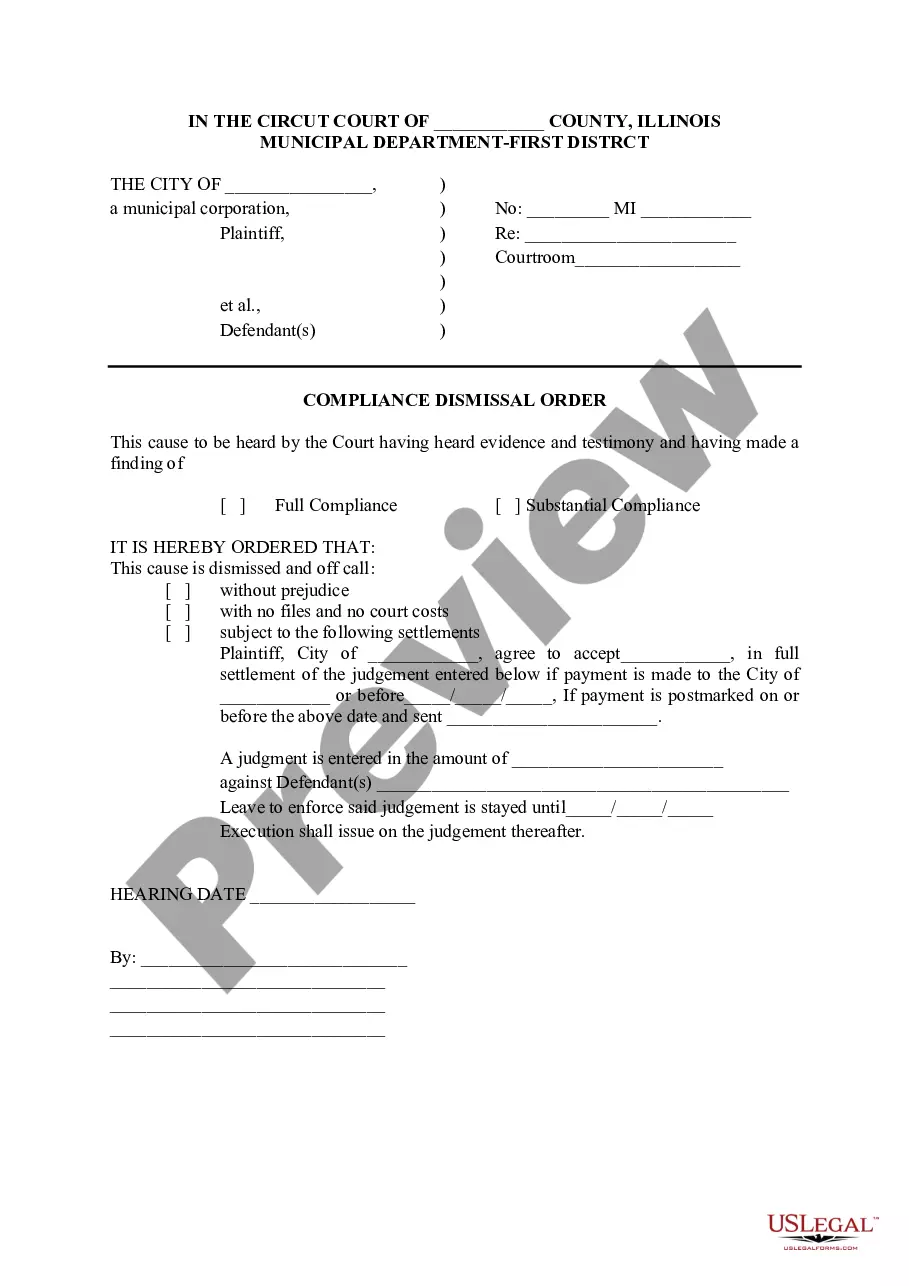

- Ensure you have selected the correct form for your area/state. Click the Preview button to review the contents of the form.

- Check the form details to confirm you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find the appropriate one.

- If you are satisfied with the form, confirm your choice by clicking the Download Now button. Then, select your preferred payment plan and provide your information to create an account.

- Complete the purchase. Use your Visa or MasterCard or PayPal account to finalize the transaction.

- Choose the format and download the form to your device.

- Make edits. Complete, modify, print, and sign the downloaded Montana Notice of Meeting of LLC Members to Consider Dissolution of the Company.

Form popularity

FAQ

(ii) Dissolution by Notice: A partnership at will can be dissolved when a partner gives a notice,in writing, to all the other partners about his/her intentions about dissolution of the firm.

To dissolve an LLC in Montana, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Montana LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

Dissolution is a process to bring about the end of an unwanted company. When a company has been dissolved, it will cease to exist as a legal entity. All trade will stop, the company's name will be removed from the Companies House register, and it will have no further filing requirements.

To dissolve your Montana Corporation, you submit the completed Articles of Dissolution for Profit Corporation form as well as a Tax Certificate from the Department of Revenue, to the Secretary of State by mail, fax or in person. Submit your dissolution along with the filing fee.

To dissolve an LLC in Montana, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Montana LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.17-Jan-2022

Involuntary Dissolution -- ProcedureBy reason of the default, the limited liability company may be involuntarily dissolved by order of the secretary of state, thereby forfeiting its right to transact any business in this state.

Dissolution, also called winding up, is a process that members of an LLC will go through in preparation to cancel with the secretary of state and terminate the existence of the LLC. Cancellation is on the secretary of state's side, which terminates the rights, privileges, and powers of an LLC.

The certificate of intent to dissolve serves as public notice that the corporation is no longer carrying on its activities, except to the extent necessary for the liquidation.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

To dissolve your Montana Corporation, you submit the completed Articles of Dissolution for Profit Corporation form as well as a Tax Certificate from the Department of Revenue, to the Secretary of State by mail, fax or in person. Submit your dissolution along with the filing fee.