Montana Gift of Stock to Spouse for Life with Remainder to Children

Description

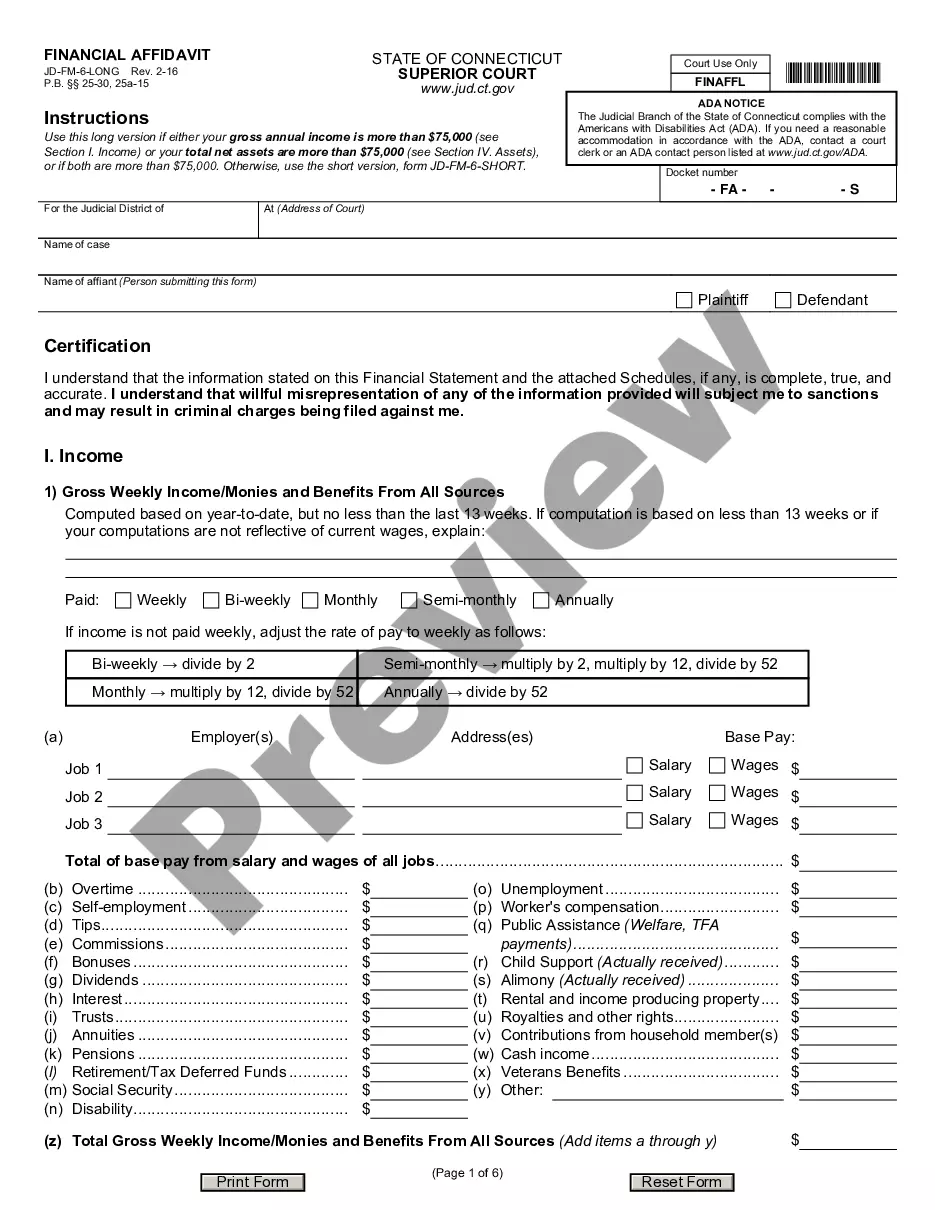

How to fill out Gift Of Stock To Spouse For Life With Remainder To Children?

You might spend time online looking for the valid document template that meets the state and federal requirements you desire.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

You can easily obtain or print the Montana Gift of Stock to Spouse for Life with Remainder to Children from our platform.

To get another version of the document, use the Search field to find the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Montana Gift of Stock to Spouse for Life with Remainder to Children.

- Every valid document template you purchase is yours forever.

- To obtain another copy of the purchased form, navigate to the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form details to ensure you have selected the right one.

Form popularity

FAQ

More specifically, each person becomes the owner of half of their community property, but also half of their collective debt, according to California inheritance laws. The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.

According to federal tax law, if an individual makes a gift of property within 3 years of the date of their death, the value of that gift is included in the value of their gross estate. The gross estate is the dollar value of their estate at the time of their death.

Spouses in Montana Inheritance Law Die with a surviving spouse and no parents or children or other descendants, and your spouse inherits your entire estate. And if you leave behind a spouse and descendants with that spouse, your spouse also inherits everything.

The three-year rule prevents individuals from gifting assets to their descendants or other parties once death is imminent in an attempt to avoid estate taxes.

Montana law requires that an heir must survive the decedent for five days (120 hours) to inherit under intestate statutes. Otherwise, the heir is considered to have predeceased the decedent, and the decedent's heirs are determined accordingly.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

A Gift of a Remainder Interest in a Personal Residence or Farm (GRIPROF) to Charity is a statutorily sanctioned transaction that produces a current income tax charitable deduction for the donor with no current out-of-pocket cost.

Simply put, if you have a legally binding will when you pass away then the dictates of that document will determine what happens to your assets- so if you have listed your spouse as sole beneficiary, they will receive everything, or exactly how much you have given to them in the will.

Tax-free gifts.You can give up to $16,000 per calendar year (in 2022) per recipient without paying gift tax. You can also pay someone's tuition or medical bills, or give to a charity, without paying gift tax on the amount.

Give now or later: The IRS doesn't care The U.S. tax code makes it fairly easy to give your children money, stocks or other investments or a piece of the family business. You can transfer up to a certain amount during your lifetime as a gift or at death through a will, free from federal gift and estate taxes.