Montana Assignment of Contract as Security for Loan

Description

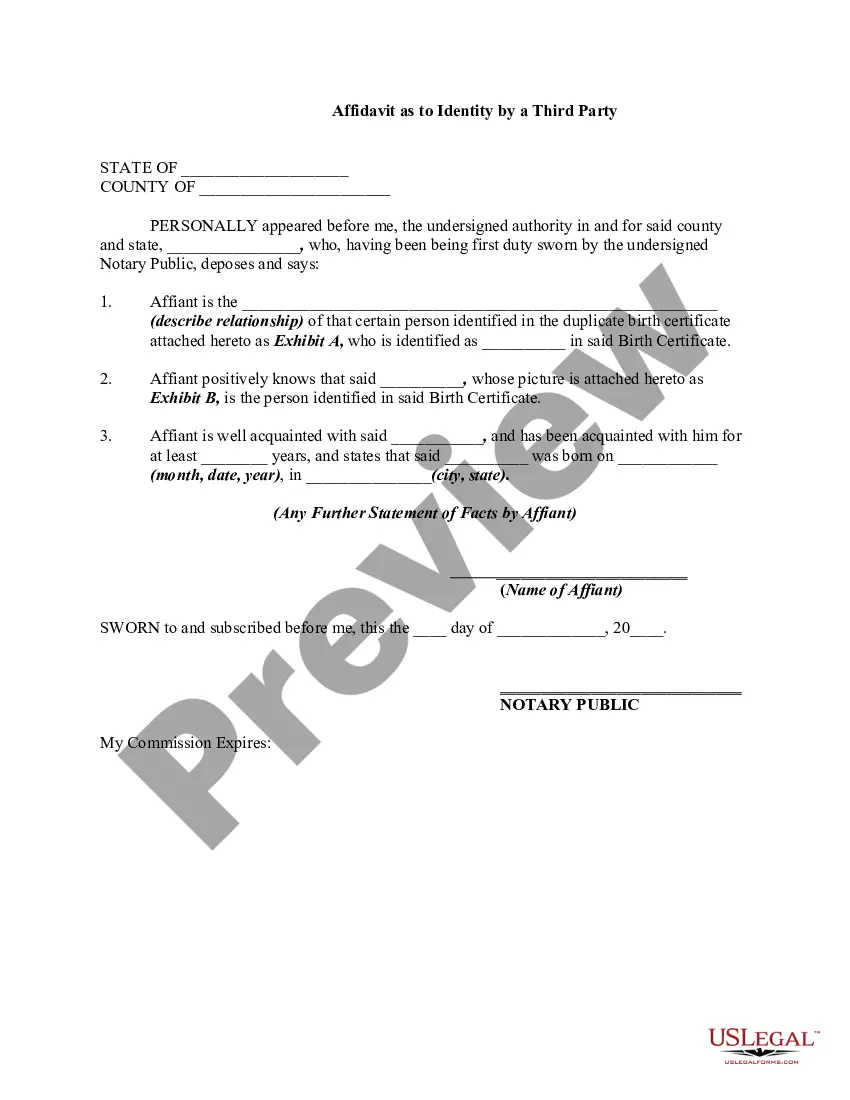

How to fill out Assignment Of Contract As Security For Loan?

If you require comprehensive, obtain, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's simple and efficient search feature to locate the documents you require.

A range of templates for business and personal purposes are organized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select the payment plan you prefer and provide your details to sign up for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Montana Assignment of Contract as Collateral for Loan with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to acquire the Montana Assignment of Contract as Collateral for Loan.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner.

The assignment agreement definition is a portion of the common law that is in charge of transferring the rights of an individual or party to another person or party. The assignment agreement is often seen in real estate but can occur in other contexts as well.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

What is an Assignment Of Loan? Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned.

The lender has the right to amend the agreement at any time by adding, deleting, or changing provisions of the agreement. The lender has the right to charge late or interest fees if the borrower fails to pay the credit back on time.

Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Updated October 04, 2021. A loan assignment agreement is when another entity agrees to take over the debt of someone else. This is when the debtor has changed for any type of event such as when a business or real estate is purchased.

Once the rights under the Loan Agreement are assigned in favour of the petitioner, the rights under the Arbitration Agreement, being only in nature of remedy for enforcement of such rights, are equally assignable and have been duly assigned in favour of the petitioner in the present case by way of the Assignment

Non-institutional lender or non-institutional source means a person other than a state or federally regulated banking or financial institution, a credit union, an investment company, a development company, or other regulated lender as defined in 31-1-111, MCA, who loans money to the applicant for a license or to