Montana Debt Adjustment Agreement with Creditor

Description

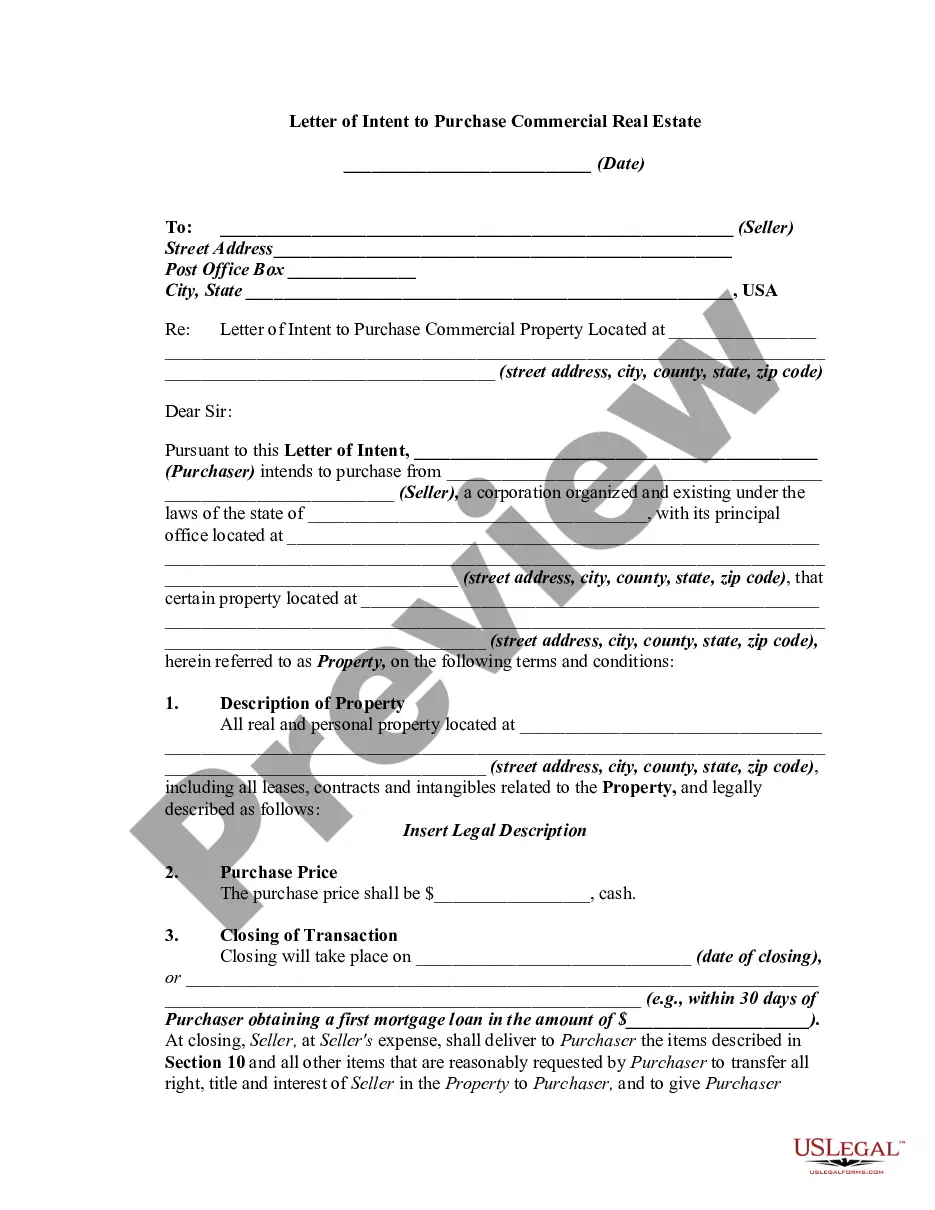

How to fill out Debt Adjustment Agreement With Creditor?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a variety of legal document formats that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords.

You can quickly find the latest versions of documents such as the Montana Debt Adjustment Agreement with Creditor.

Read the form description to ensure you have the right type.

If the form does not meet your expectations, use the Search field at the top of the page to locate one that does.

- If you are already registered, Log In and obtain the Montana Debt Adjustment Agreement with Creditor from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To start using US Legal Forms for the first time, follow these simple steps:

- Make sure you've selected the correct form for your locality.

- Click the Preview button to review the form's details.

Form popularity

FAQ

Verbal contracts, accounts, or promises have a statute of limitation of 5 years. As for verbal obligations or liabilities that are not contracts, these have a statute of limitation of 3 years. For judgments of decrees in any U.S. court, creditors have 10 years to pursue Montana residents to collect debt.

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly.

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent.

A creditor agreement is a contract concluded between the debtor and all the creditors. This agreement pays for some part or a percentage of each debt, and the debtor receives a final discharge for the remaining amount due. The debtor can make a new start and the creditors receive their payments immediately.

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

Occasionally, when a debt goes to collections you may be able to negotiate with the collector to accept a smaller amount than what you originally owed. An agent may decide it's worthwhile to accept partial payment now rather than go through a prolonged collection process.