Montana Merger Agreement for Type A Reorganization

Description

How to fill out Merger Agreement For Type A Reorganization?

Are you in a situation in which you require files for both organization or person purposes just about every working day? There are a variety of lawful file templates available online, but locating versions you can trust isn`t simple. US Legal Forms offers 1000s of type templates, much like the Montana Merger Agreement for Type A Reorganization, that are composed in order to meet federal and state requirements.

In case you are currently familiar with US Legal Forms web site and also have your account, just log in. Afterward, it is possible to down load the Montana Merger Agreement for Type A Reorganization design.

Unless you offer an account and need to begin to use US Legal Forms, follow these steps:

- Find the type you will need and ensure it is for your proper area/county.

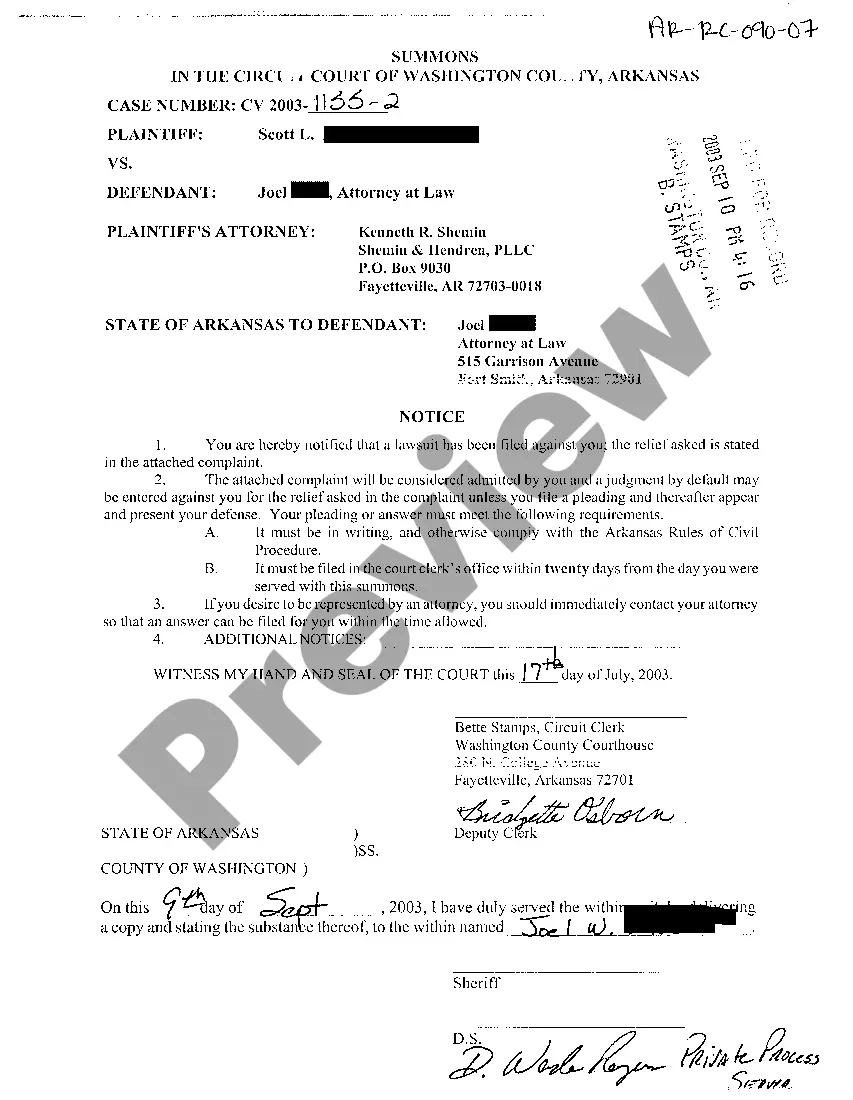

- Make use of the Review switch to analyze the shape.

- See the explanation to actually have selected the correct type.

- In case the type isn`t what you`re seeking, make use of the Research field to discover the type that suits you and requirements.

- Once you discover the proper type, click on Buy now.

- Opt for the costs prepare you want, fill out the desired information and facts to create your money, and pay for an order with your PayPal or Visa or Mastercard.

- Pick a handy paper format and down load your version.

Get all of the file templates you may have bought in the My Forms menus. You can get a extra version of Montana Merger Agreement for Type A Reorganization anytime, if possible. Just click the needed type to down load or print the file design.

Use US Legal Forms, probably the most extensive variety of lawful forms, to conserve time as well as prevent mistakes. The service offers professionally made lawful file templates that can be used for an array of purposes. Make your account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

Joint ventures are created on a short-term basis and mostly for short projects. On the contrary, mergers and acquisitions are long-term strategies. Whereas mergers and acquisitions have no time limit, a joint venture partnership usually has a defined time horizon.

Sec. 76. Plan or merger of consolidation. - Two or more corporations may merge into a single corporation which shall be one of the constituent corporations or may consolidate into a new single corporation which shall be the consolidated corporation.

Some of the most famous and successful examples of M&A transactions that have occurred over the last few decades include: Google's acquisition of Android. Disney's acquisition of Pixar and Marvel. Exxon and Mobile merger (a great example of a successful horizontal merger).

There are three basic structures we will cover here: Asset Acquisition: the buyer buys the assets of the business. Stock Purchase: the buyer buys the stock of the business. Merger: the buyer merges or ?combines? with the business.

Merger: Usually the companies involved are of same size and value. Acquisition: Often companies bigger in size when it comes to the terms of valuation acquires/purchase the company worth less valuation. Amalgamation: The size of amalgamating companies are considerably same. v Basis of Difference: Impact on shares.

A merger occurs when two separate entities combine forces to create a new, joint organization. Meanwhile, an acquisition refers to the takeover of one entity by another. Mergers and acquisitions may be completed to expand a company's reach or gain market share in an attempt to create shareholder value.

The acquiring organisation is independently stronger in terms of financial capability than the acquired business. The merged companies are of similar stature, operations, size, and scale of business. The acquired company has no say in terms of power or authority by the acquiring company.

There are five commonly-referred to types of business combinations known as mergers: conglomerate merger, horizontal merger, market extension merger, vertical merger and product extension merger.