Montana Partnership Agreement for Business

Description

How to fill out Partnership Agreement For Business?

If you need to finalize, obtain, or print authorized document templates, utilize US Legal Forms, the primary collection of legal forms available online.

Benefit from the website's straightforward and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Montana Partnership Agreement for Business. Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded within your account. Check the My documents section and choose a form to print or download again. Stay competitive and obtain and print the Montana Partnership Agreement for Business with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to secure the Montana Partnership Agreement for Business with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Montana Partnership Agreement for Business.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

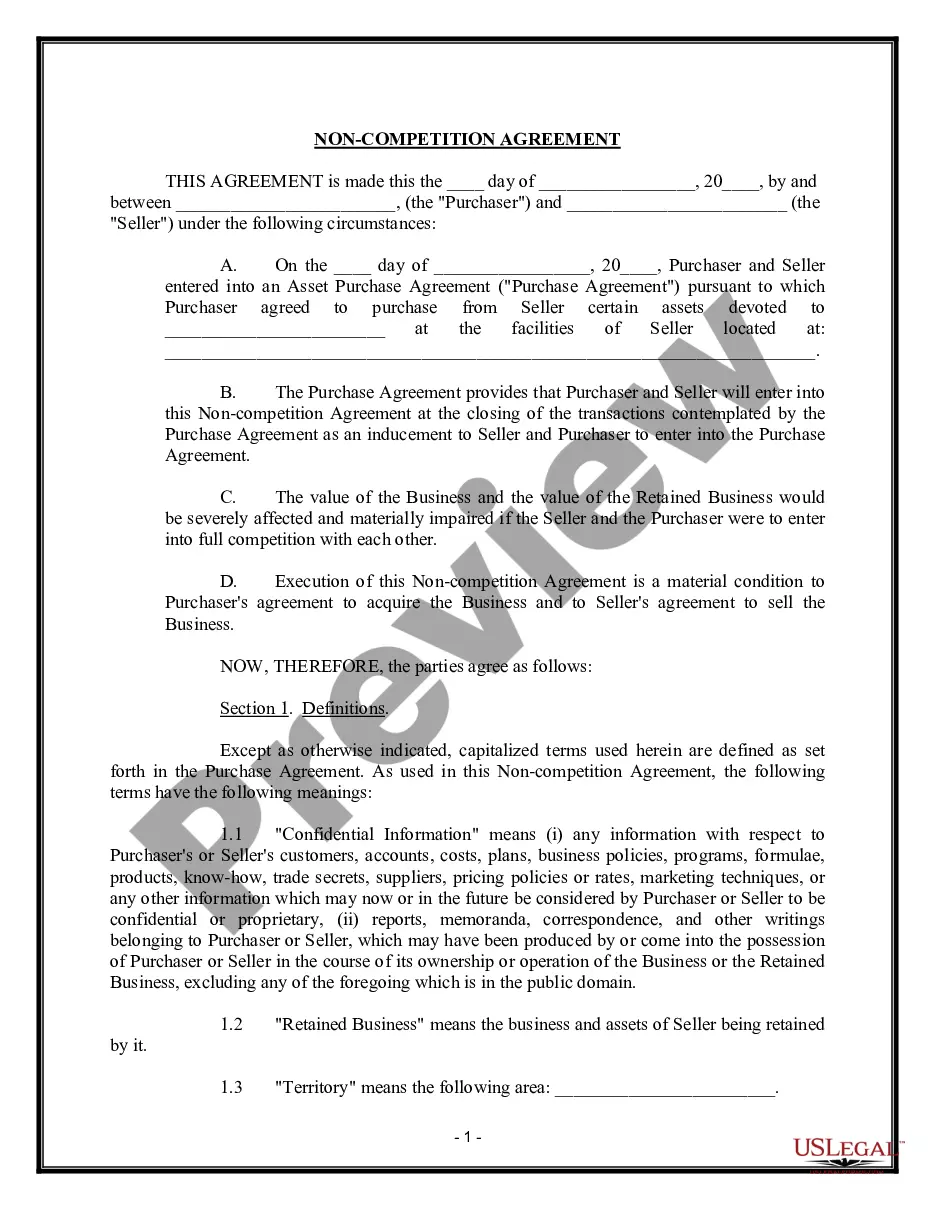

- Step 2. Use the Preview feature to examine the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you desire, click the Acquire now button. Choose the pricing plan you prefer and submit your credentials to register for an account.

Form popularity

FAQ

Although each partnership agreement differs based on business objectives, certain terms should be detailed in the document, including percentage of ownership, division of profit and loss, length of the partnership, decision making and resolving disputes, partner authority, and withdrawal or death of a partner.

Some elements to consider in your limited partnership agreement include but aren't limited to:Business name and purpose.Reason for establishing the limited partnership.Voting rights and decision-making processes.Ownership shares.Partners' capital contributions.Dissolution guidelines.

5 Steps to Filing Partnership TaxesPrepare Form 1065, U.S. Return of Partnership Income. Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065.Prepare Schedule K-1.File Form 1065 and Copies of the K-1 Forms.File State Tax Returns.File Personal Tax Returns.

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

Take the partnership agreement and the partnership form to your secretary of state's office. You can usually submit the form in person or via mail or fax, but be sure to confirm delivery.

Partnership - Montana allows an automatic five-month extension without written request.

Forming a PartnershipChoose a business name for the partnership and check for availability.Register the business name with local, state, and/or federal authorities.Negotiate and execute a partnership agreement.Obtain any required local licenses.More items...

How to form a partnership: 10 steps to successChoose your partners.Determine your type of partnership.Come up with a name for your partnership.Register the partnership.Determine tax obligations.Apply for an EIN and tax ID numbers.Establish a partnership agreement.Obtain licenses and permits, if applicable.More items...?

A partnership (also known as a general partnership) is an informal business structure consisting of two or more people. You don't have to file paperwork to establish a partnership -- you create a partnership simply by agreeing to go into business with another person.