Montana Sample Letter for Attempt to Collect Debt before Legal Action

Description

How to fill out Sample Letter For Attempt To Collect Debt Before Legal Action?

Choosing the right authorized document format can be quite a have a problem. Of course, there are plenty of themes available on the Internet, but how would you get the authorized form you require? Make use of the US Legal Forms site. The services provides thousands of themes, for example the Montana Sample Letter for Attempt to Collect Debt before Legal Action, which can be used for enterprise and private requirements. Each of the varieties are examined by professionals and satisfy state and federal needs.

When you are previously listed, log in to your bank account and then click the Obtain key to obtain the Montana Sample Letter for Attempt to Collect Debt before Legal Action. Make use of your bank account to appear through the authorized varieties you might have bought formerly. Proceed to the My Forms tab of your bank account and have another copy of the document you require.

When you are a whole new customer of US Legal Forms, allow me to share easy directions for you to stick to:

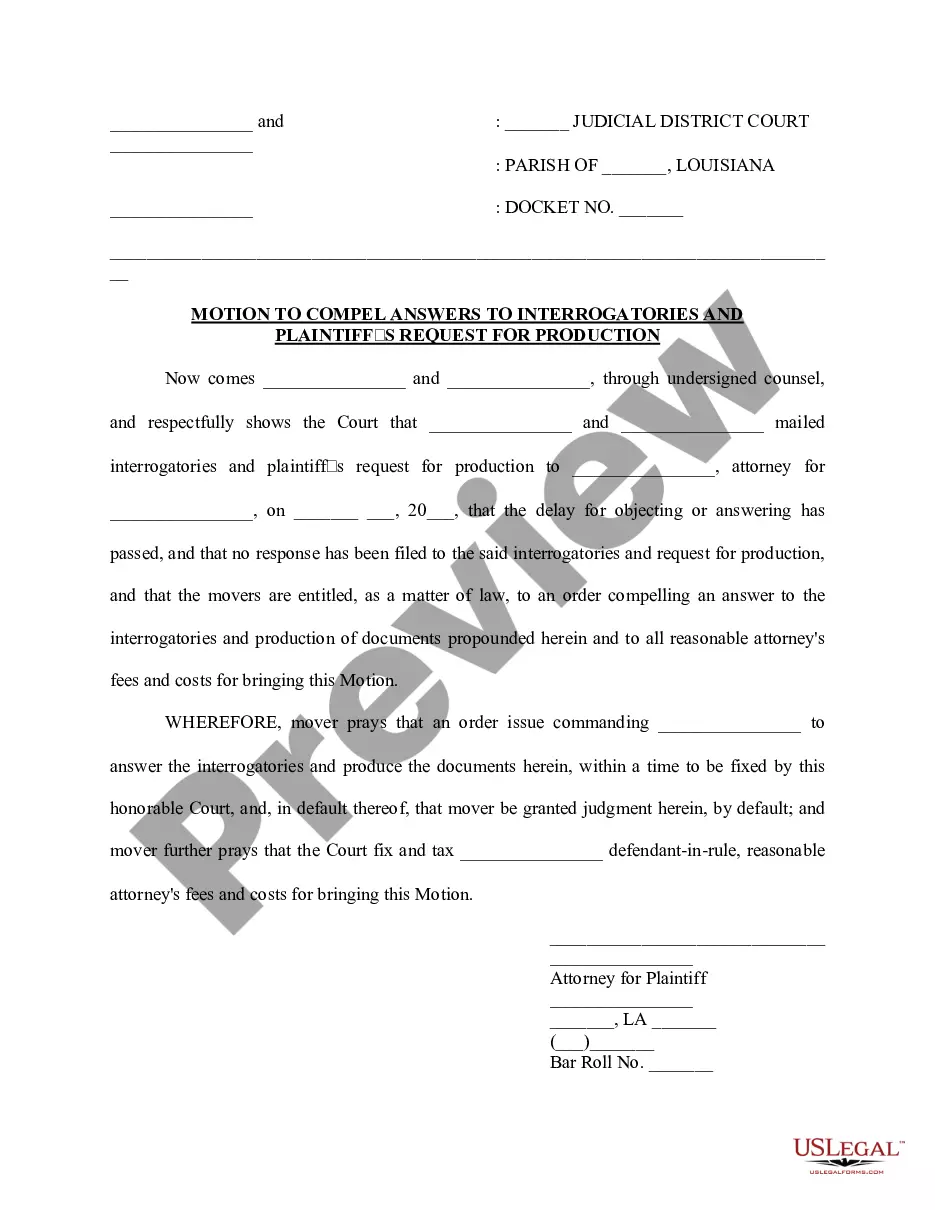

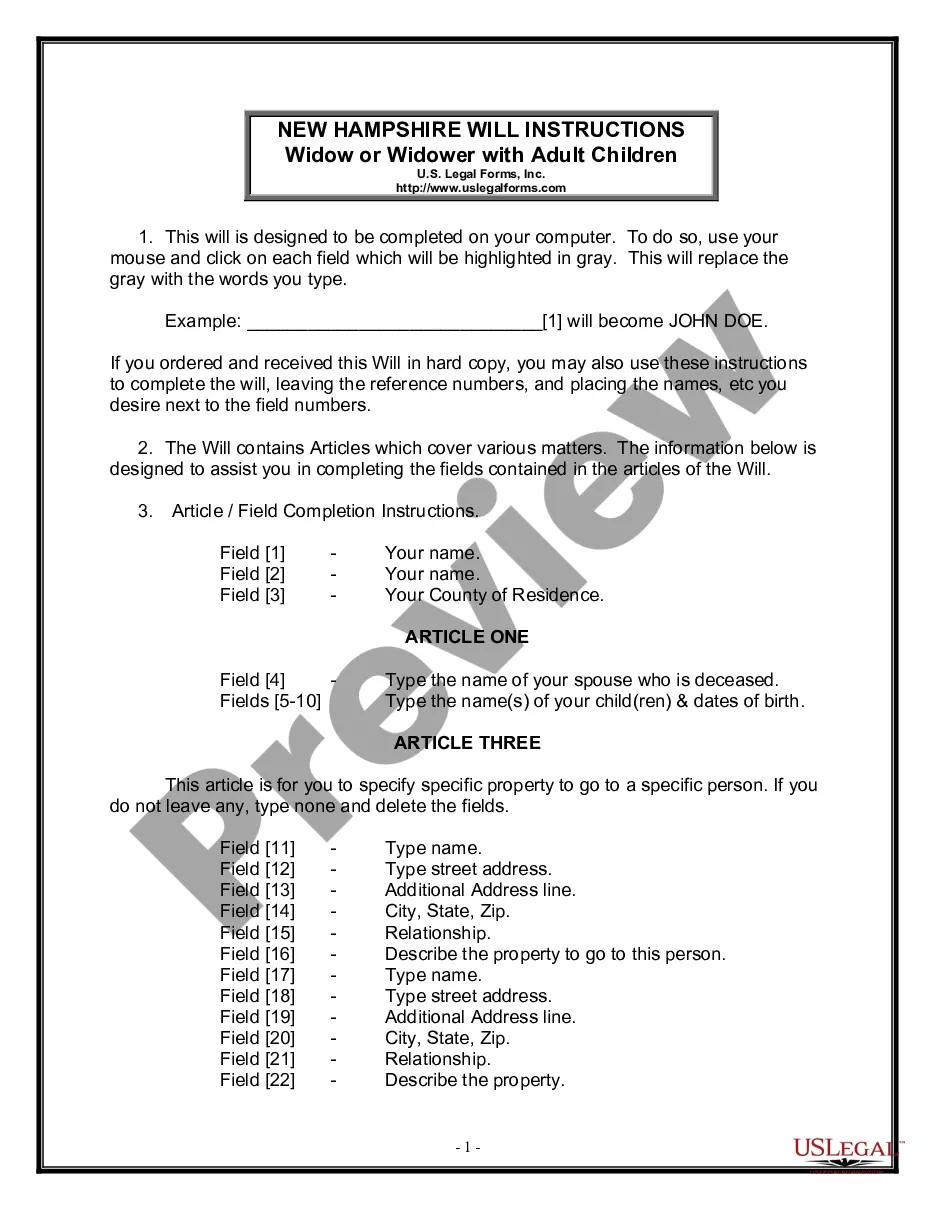

- Very first, ensure you have selected the proper form for your metropolis/county. It is possible to look through the form using the Preview key and study the form outline to make certain it is the right one for you.

- When the form will not satisfy your needs, utilize the Seach field to find the appropriate form.

- Once you are certain that the form is acceptable, click on the Buy now key to obtain the form.

- Opt for the rates plan you desire and enter in the needed info. Design your bank account and buy the order using your PayPal bank account or bank card.

- Opt for the submit structure and obtain the authorized document format to your device.

- Full, revise and print out and signal the attained Montana Sample Letter for Attempt to Collect Debt before Legal Action.

US Legal Forms will be the biggest library of authorized varieties that you can discover different document themes. Make use of the service to obtain professionally-manufactured papers that stick to express needs.

Form popularity

FAQ

A demand letter is written notice to the debtor that includes a formal demand for payment of the debt. A well-crafted demand letter will include the following basic information: A description of the amount owed. How the debt was incurred (e.g. unpaid fees for services rendered)

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

Hi [Contact Point's Name], We hope this email finds you well. This is a friendly reminder from [Name of Your Business] that your payment of [invoice amount] for Invoice [number] is due today. If you have any questions or concerns regarding your payment, do let us know.

A collection letter is a written notification to inform a consumer of his due payments. It is an official message to a borrower. A collection letter may include reminders, inquiries, warnings or notification of possible legal actions.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

Start with a polite reminder or enquiry about the bill, as overdue payment may not be any fault of the customer, and then follow up as necessary. Try one or more of the follow-up tactics below: Personal visit ? a face-to-face encounter can often solve the issue or ensure you get priority treatment.

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

Include your full name, company name, and mailing address. Address the letter to your client by their full name. State the problem: Specify and provide proof of the debt in question. Reference the original contract or agreement that states the services the client owes you for.