Montana Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Qualifying Subchapter-S Revocable Trust Agreement?

Have you been in a scenario where you require documentation for both professional or personal reasons nearly every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms provides a vast array of template documents, such as the Montana Qualifying Subchapter-S Revocable Trust Agreement, designed to meet both state and federal requirements.

Once you find the correct form, click on Get now.

Select the pricing plan you want, enter the required information to create your account, and pay for your order using your PayPal or credit card. Choose a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Montana Qualifying Subchapter-S Revocable Trust Agreement anytime. Click on the desired form to download or print it. Utilize US Legal Forms, the most extensive assortment of legal templates, to save time and prevent mistakes. The service provides professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Montana Qualifying Subchapter-S Revocable Trust Agreement template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and confirm it is for your correct area/state.

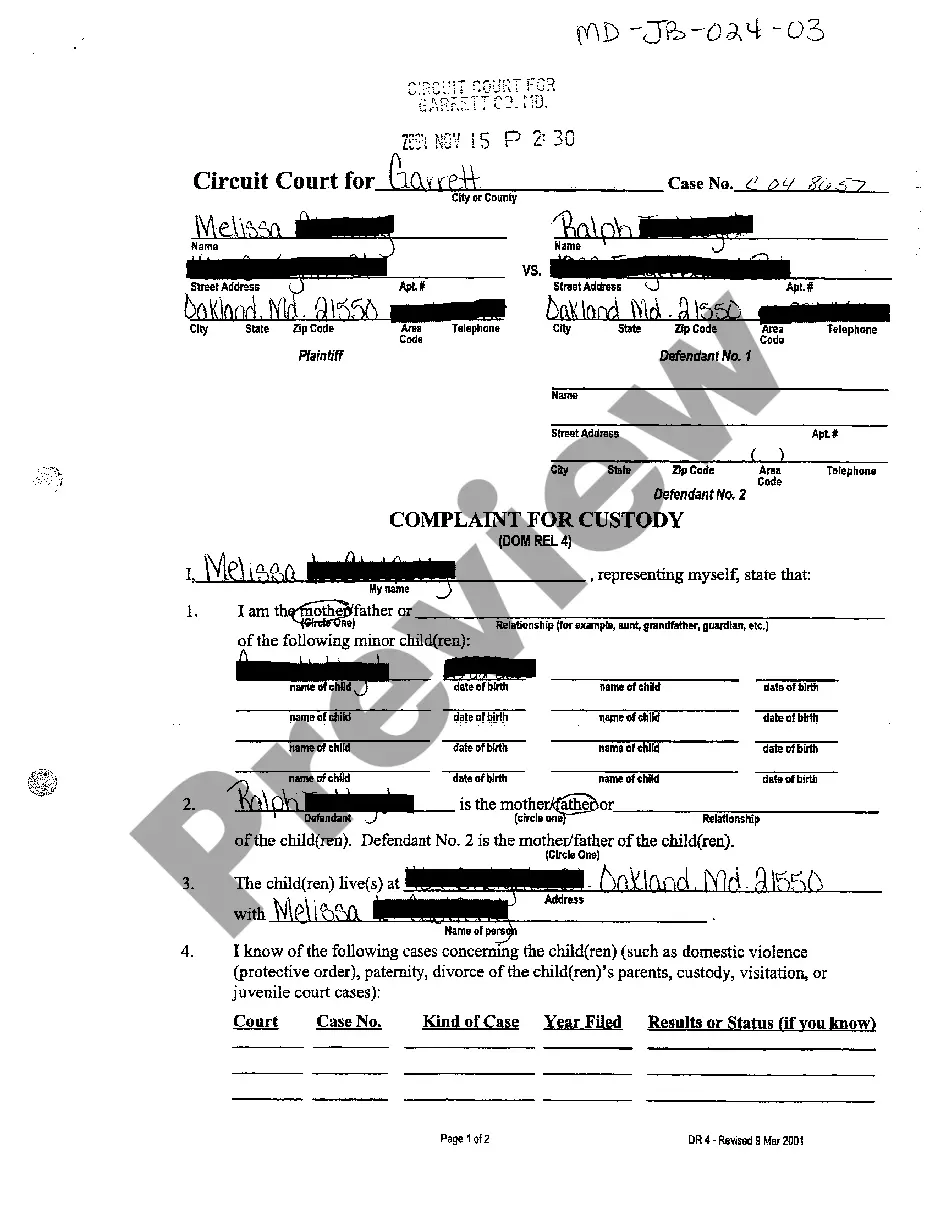

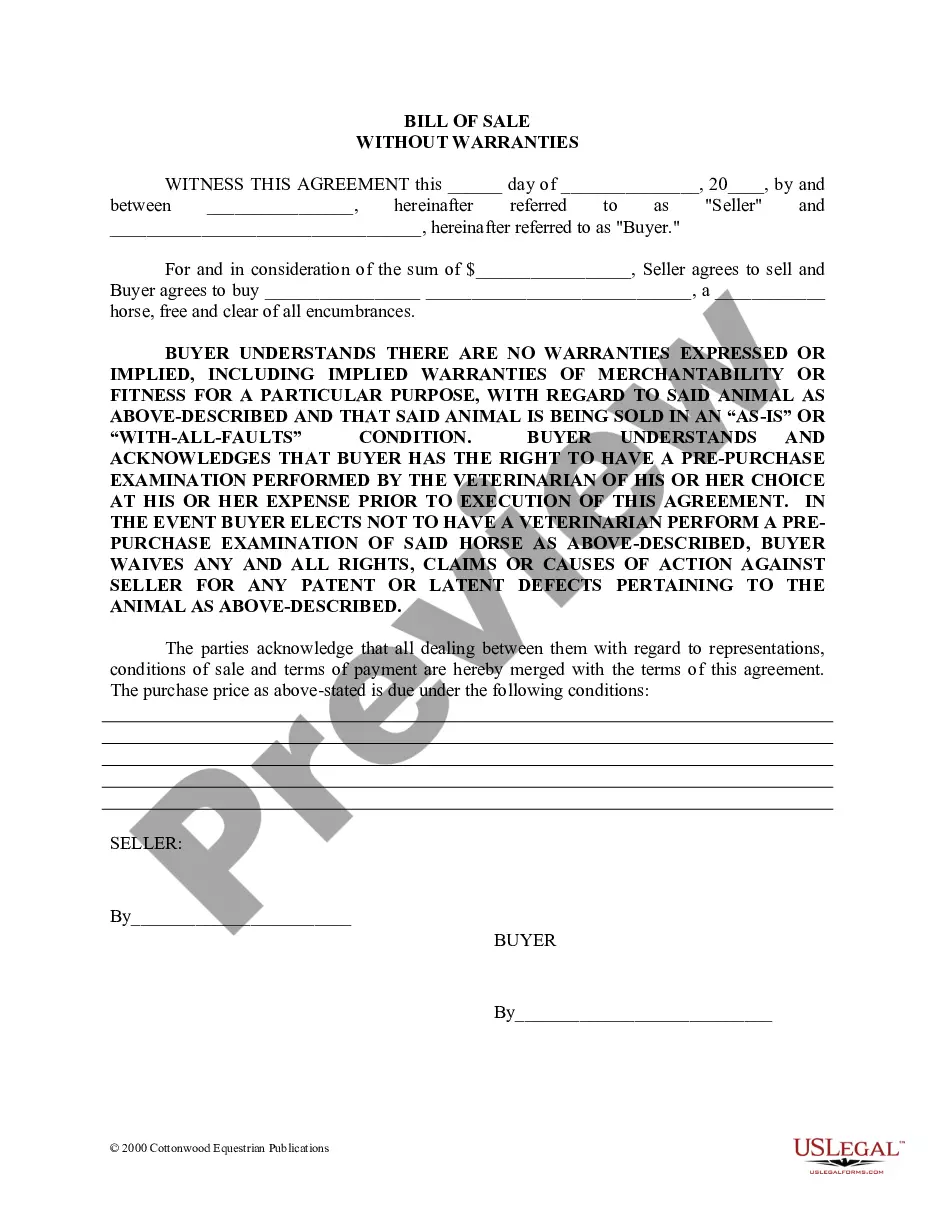

- Use the Review button to inspect the form.

- Read the description to ensure you have chosen the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Schedule K-1 for S corporationsThe S corporation provides Schedule K-1s that reports each shareholder's share of income, losses, deductions and credits. The shareholders use the information on the K-1 to report the same thing on their separate tax returns.

More In Forms and Instructions The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Yes, if the trust is a simple trust or complex trust, the trustee must file a tax return for the trust (IRS Form 1041) if the trust has any taxable income (gross income less deductions is greater than $0), or gross income of $600 or more. For grantor trusts, it depends.

A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.

The K-1 must be filed with your tax return. For limited partners and trust or estate beneficiaries, actually filling the K-1 along with Form 1040 is usually not necessary (though the data on it must be reported on the return and figured into the calculation of taxable income and income tax owed).

11189: 1041 - Simple Trust Requires a K-1 At least one K1 screen must be created when an estate or trust is distributing income. See Form 1041, line 18.

How do I file my own Schedule K-1 form? You can file your Schedule K-1 form when you submit your Form 1065 or 1120S to the IRS. The easiest thing to do is to submit the form electronically by using IRS Free File or tax prep software. You can also file the form by mail.

This form is required when an estate or trust is passing tax obligations on to one or more beneficiaries. For example, if a trust holds income-producing assets such as real estate, then it may be necessary for the trustee to file Schedule K-1 for each listed beneficiary.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Schedule K-1 (Form 1041) is a source document that is prepared by the fiduciary to an estate or trust as part of the filing of their tax return (Form 1041).