Montana Sample Letter for Claim Probated

Description

How to fill out Sample Letter For Claim Probated?

Have you been within a place in which you require paperwork for sometimes enterprise or person uses almost every working day? There are plenty of authorized record templates available on the net, but finding versions you can rely on is not effortless. US Legal Forms offers a large number of kind templates, like the Montana Sample Letter for Claim Probated, which are composed to satisfy state and federal specifications.

If you are presently informed about US Legal Forms website and possess an account, basically log in. Next, it is possible to obtain the Montana Sample Letter for Claim Probated design.

Should you not come with an profile and would like to begin using US Legal Forms, adopt these measures:

- Find the kind you will need and ensure it is to the appropriate area/state.

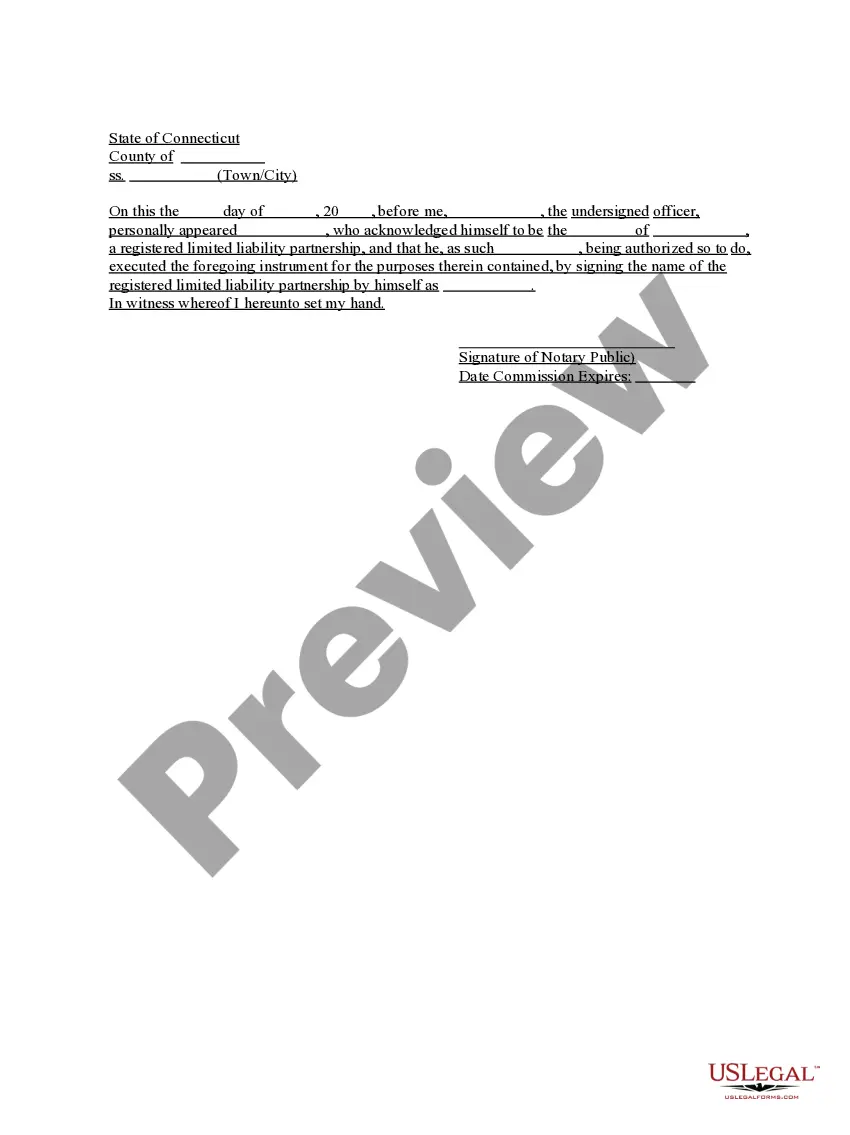

- Utilize the Review switch to examine the form.

- Browse the information to ensure that you have chosen the correct kind.

- If the kind is not what you are searching for, use the Research field to obtain the kind that meets your requirements and specifications.

- Once you get the appropriate kind, simply click Acquire now.

- Select the pricing program you would like, submit the required info to generate your money, and pay for the order with your PayPal or charge card.

- Choose a hassle-free file format and obtain your copy.

Discover each of the record templates you have purchased in the My Forms food selection. You can aquire a further copy of Montana Sample Letter for Claim Probated at any time, if required. Just go through the required kind to obtain or printing the record design.

Use US Legal Forms, probably the most comprehensive selection of authorized varieties, in order to save efforts and prevent faults. The service offers professionally made authorized record templates which you can use for a range of uses. Make an account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

When a loved one dies, you have up to two years to file probate with the local courts. Montana probate law also requires heirs to wait at least five days to begin proceedings. Once you file probate, the process usually takes six months to a year, though it can be longer.

If someone dies without a will in Montana, the estate is under court jurisdiction. The court will elect a personal representative to assist with the proceedings. Often, this person is a spouse or adult child of the deceased. In this case, the court requires a formal probate procedure, which could take a year or longer.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

Under Montana's probate laws, you can distribute certain types of property and assets without a probate court's approval. They include: Accounts with a named beneficiary, such as life insurance policies and retirement funds. Assets and property that is held in a living trust.

Montana recognizes holographic (handwritten) wills so long as the signature and material portions of the document are in the testator's handwriting. In Montana, holographic wills do not have be witnessed in order to be valid.

Collection of Personal Property by Affidavit ? This procedure may be initiated 30 days after a person dies, if the value of the entire estate (less liens and encumbrances) does not exceed $50,000.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.