Montana Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children

Description

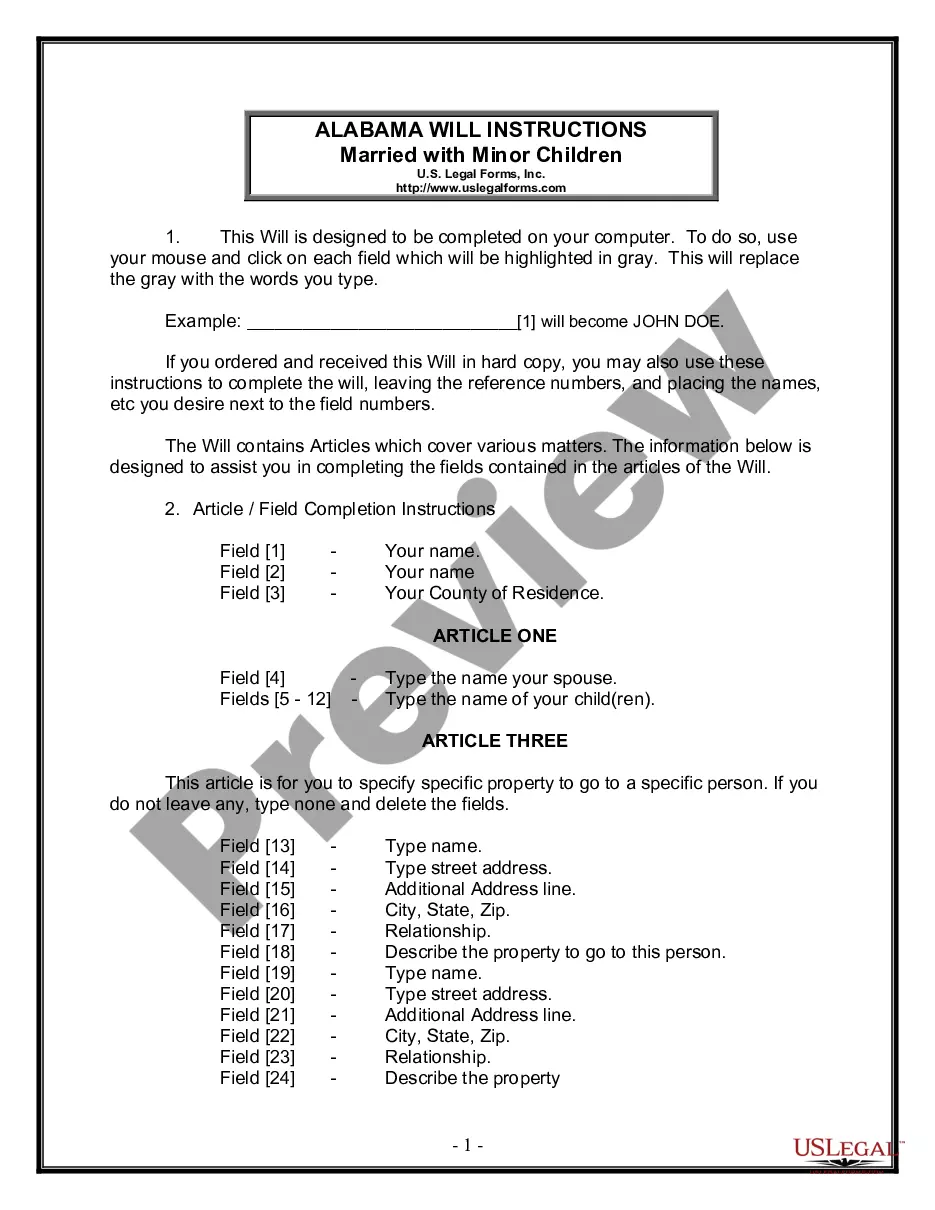

How to fill out Testamentary Trust Provision For The Establishment Of A Trust For A Charitable Institution For The Care And Treatment Of Disabled Children?

Are you presently in the circumstance where you require documents for potentially a business or particular functions almost consistently.

There are numerous legitimate document templates accessible online, but finding ones you can rely on isn’t easy.

US Legal Forms provides a vast array of form templates, including the Montana Testamentary Trust Provision for the Formation of a Trust for a Nonprofit Organization for the Care and Treatment of Disabled Children, designed to comply with federal and state regulations.

Choose a suitable document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Montana Testamentary Trust Provision for the Formation of a Trust for a Nonprofit Organization for the Care and Treatment of Disabled Children anytime you need. Just click the appropriate form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and possess your account, simply Log In.

- Following that, you will be able to download the Montana Testamentary Trust Provision for the Formation of a Trust for a Nonprofit Organization for the Care and Treatment of Disabled Children template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it's for the correct area/region.

- Utilize the Preview button to examine the form.

- Review the outline to make sure you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search area to locate the form that meets your needs and specifications.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you wish, provide the required information to create your account, and process the payment using your PayPal or credit card.

Form popularity

FAQ

In fact, a majority of Trusts have a Trustee who is also a Trust beneficiary. Nearly every revocable, living Trust created in California starts with the settlor naming themselves as Trustee and beneficiary. Many times a child of the Trust settlor will be named Trustee, and also as a Trust beneficiary.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

To create a testamentary trust, the settlor first must select the trustee and the beneficiary and specify the assets that are to be placed in trust. The settlor also has the ability to specify when and how to disburse the trust to the beneficiary. The last will and testament should detail all of this information.

Role and Appointment of Trustees Although it's generally accepted that there will be at least three trustees, two are perfectly sufficient. A trust company may well act as the only trustee.

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

Ten of the most effective ways to build trustValue long-term relationships. Trust requires long-term thinking.Be honest.Honor your commitments.Admit when you're wrong.Communicate effectively.Be vulnerable.Be helpful.Show people that you care.More items...?

For a valid trust to be created the founder must intend to create one, he must express his intention in a mode apt to create an obligation, the property subject to the trust must be defined with reasonable certainty, the trust object, which may either be personal or impersonal must be defined with reasonable certainty

You should have at least two trustees but can choose up to four.