Corporations must be formed under the enabling legislation of a state or the federal government, since corporations may lawfully exist only by consent or grant of the sovereign. Therefore, in drafting pre-incorporation agreements and other instruments preliminary to incorporation, the drafter must become familiar with and follow the particular statutes under which the corporation is to be formed.

Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association

Description

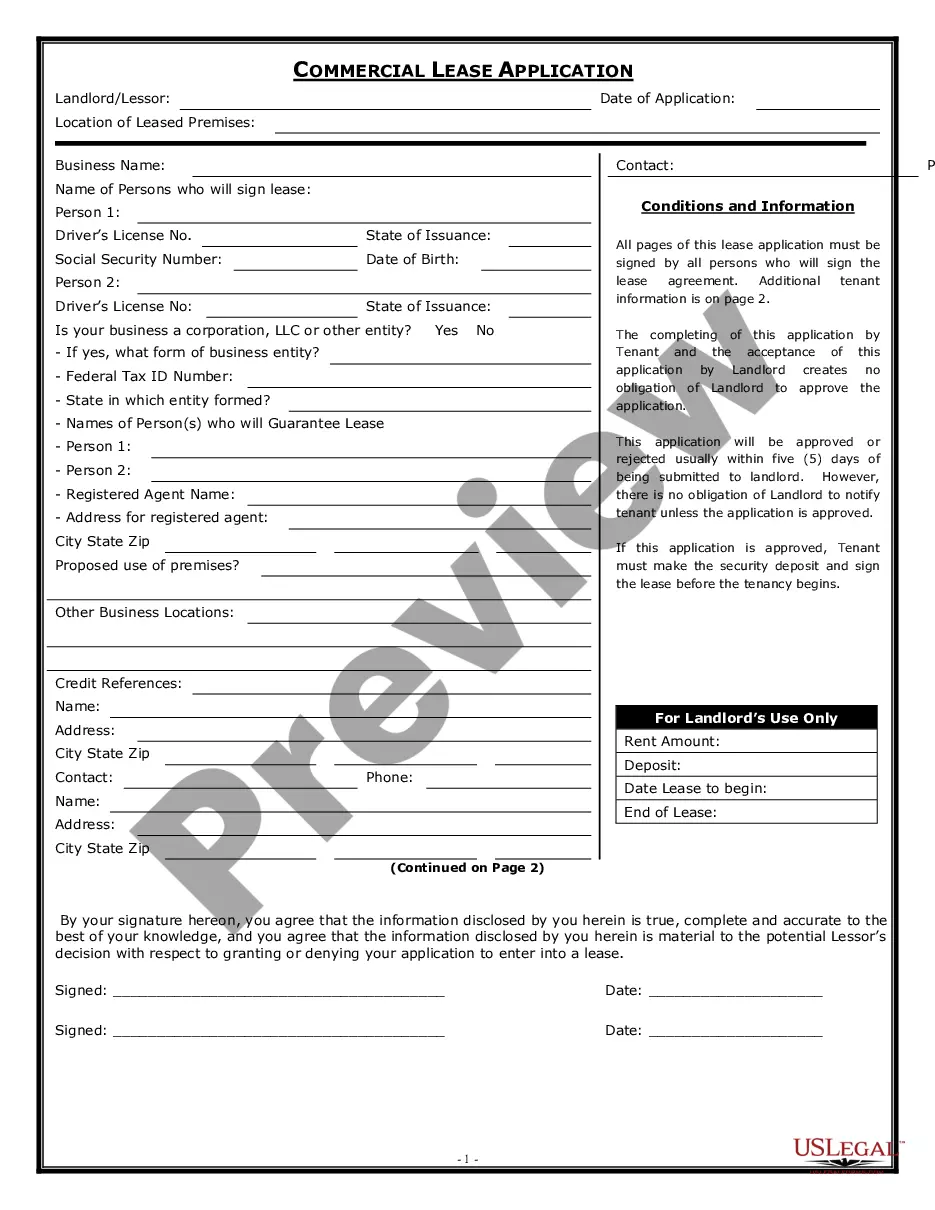

How to fill out Resolution To Incorporate As Nonprofit Corporation By Members Of A Church Operating As An Unincorporated Association?

You can spend countless hours online searching for the legal document template that meets the federal and state requirements you require.

US Legal Forms provides a vast array of legal forms that can be evaluated by experts.

You can download or print the Montana Resolution to Incorporate as a Nonprofit Corporation by Members of a Church functioning as an Unincorporated Association through this service.

Review the form description to ensure you have selected the appropriate form.

- If you possess a US Legal Forms account, you may Log In and press the Download button.

- After that, you can complete, modify, print, or sign the Montana Resolution to Incorporate as a Nonprofit Corporation by Members of a Church functioning as an Unincorporated Association.

- Every legal document template you receive is yours permanently.

- To obtain another copy of any downloaded form, visit the My documents section and click the respective button.

- If this is your first time using the US Legal Forms site, follow the straightforward instructions below.

- First, make sure you have selected the correct document template for the area/city you choose.

Form popularity

FAQ

The key difference lies in their legal status and structure. A nonprofit corporation is formally registered with the state and offers limited liability protection, while an unincorporated association is more informal and does not provide that same level of protection. Transitioning to a nonprofit through the Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association can offer significant benefits, especially for those looking to enhance their legal standing.

No, an organization does not have to be incorporated to apply for 501c3 status. However, most nonprofits find that incorporating helps to limit personal liability and boosts credibility. In cases involving members of a church operating as an unincorporated association, it’s wise to consider the Montana Resolution to Incorporate as Nonprofit Corporation for greater legal and tax advantages.

Yes, nonprofits typically adopt corporate resolutions to document important decisions and actions taken by their board. These resolutions help establish a clear record of governance, which beneficially aligns with the Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association. Formal resolutions help ensure compliance with state and federal laws while enhancing accountability.

Using an unincorporated association offers flexibility, ease of formation, and lower initial costs compared to a nonprofit corporation. It allows members to operate under a shared purpose without complex legal requirements at the outset. However, as the group grows, transitioning to a formal structure like the Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association can provide added legal protections and benefits.

Yes, an unincorporated association can qualify as a 501c3 organization if it meets certain criteria set by the IRS. To achieve this status, the association must pursue charitable, educational, or religious purposes. Additionally, members should consider the Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association to solidify their legal status.

Starting a non-profit in Montana involves several important steps. First, you need to gather a group of qualified individuals to serve as board members, then create your governing documents. After that, it's essential to file the necessary paperwork with the state and consider using services like uslegalforms for streamlined guidance on the Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association.

To become a non-profit organization in Montana, you must first draft and adopt your organizational documents, such as bylaws and a resolution. Next, file your Articles of Incorporation with the Secretary of State. Once approved, you should apply for federal and state tax exemptions to solidify your status as a Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association.

To qualify as a non-profit organization in Montana, you must operate for a charitable, educational, religious, or similar purpose. Additionally, your organization should not distribute profits to members but rather reinvest earnings back into the organization. This aligns with the Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, ensuring compliance with state laws.

To write a resolution for a non-profit like a Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, you should start with a clear title. Include the date and a statement of purpose, then outline the specific actions your organization intends to take. Make sure to include a paragraph that describes the mission and goals of the organization, and end with a sign-off that includes the names and titles of the members approving the resolution.

Writing a nonprofit board resolution involves drafting a document that outlines the specific decision to be made by the board. Start with a clear title, followed by a detailed description of the resolution, including the rationale and any voting outcomes. Utilizing tools offered by platforms like US Legal Forms can be beneficial when creating a resolution that adheres to the standards set in the Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association.