The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

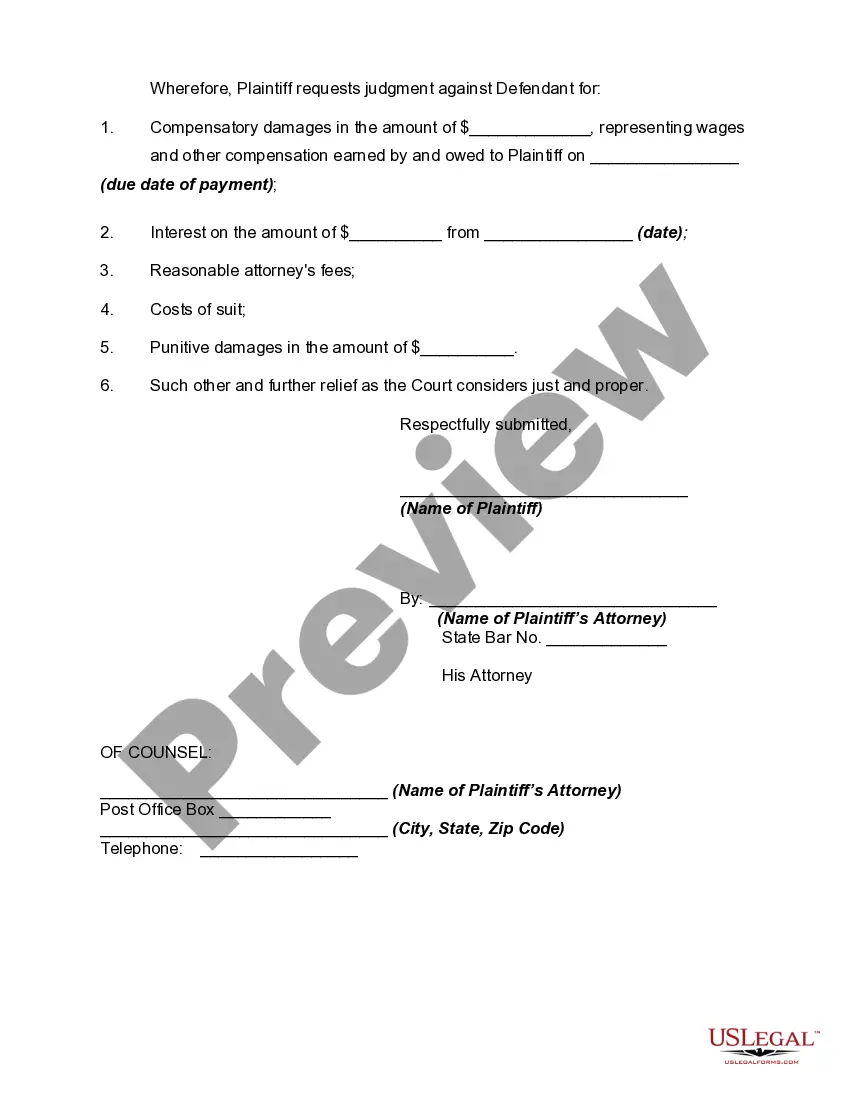

Montana Complaint for Recovery of Unpaid Wages

Description

How to fill out Complaint For Recovery Of Unpaid Wages?

If you want to comprehensive, obtain, or print out lawful file layouts, use US Legal Forms, the most important selection of lawful varieties, which can be found on the Internet. Use the site`s basic and handy search to discover the files you will need. Numerous layouts for organization and specific functions are categorized by types and states, or keywords. Use US Legal Forms to discover the Montana Complaint for Recovery of Unpaid Wages in just a handful of mouse clicks.

Should you be previously a US Legal Forms buyer, log in in your bank account and then click the Download option to have the Montana Complaint for Recovery of Unpaid Wages. Also you can entry varieties you in the past saved from the My Forms tab of your respective bank account.

If you are using US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for your right metropolis/region.

- Step 2. Take advantage of the Review choice to look over the form`s information. Don`t forget to read through the information.

- Step 3. Should you be not happy with the type, utilize the Lookup industry at the top of the screen to discover other variations from the lawful type format.

- Step 4. Upon having located the shape you will need, click on the Purchase now option. Opt for the costs program you choose and put your accreditations to register on an bank account.

- Step 5. Procedure the deal. You may use your Мisa or Ьastercard or PayPal bank account to perform the deal.

- Step 6. Select the structure from the lawful type and obtain it on your gadget.

- Step 7. Total, change and print out or sign the Montana Complaint for Recovery of Unpaid Wages.

Every single lawful file format you purchase is your own permanently. You possess acces to each and every type you saved within your acccount. Click on the My Forms portion and choose a type to print out or obtain yet again.

Compete and obtain, and print out the Montana Complaint for Recovery of Unpaid Wages with US Legal Forms. There are millions of specialist and status-certain varieties you can utilize for the organization or specific requires.

Form popularity

FAQ

(1) Except as provided in subsections (2) and (3), every employer of labor in the state of Montana shall pay to each employee the wages earned by the employee in lawful money of the United States or checks on banks convertible into cash on demand at the full face value of the checks, and a person for whom labor has ...

Wrongful termination from employment in Montana can arise under several circumstances. First, an employee terminated from his employment because of being a part of a protected class, or reporting discriminatory conduct, is entitled to recovery under both state and federal law.

(1) An employer who fails to pay an employee as provided in this part or who violates any other provision of this part is guilty of a misdemeanor. A penalty must also be assessed against and paid by the employer to the employee in an amount not to exceed 110% of the wages due and unpaid.

Statute of Limitations -- (§ 39-3-207, MCA) ? An employee has 180 days from the default of the payment to file a wage claim. ? An employee may recover wages and penalties for a period of 2 years, 3 years if willful violation.

(1) Except as provided in subsections (2) and (3), when an employee is separated from the employ of any employer, all the unpaid wages of the employee are due and payable within 3 days, except for employees of the state of Montana and its political subdivisions who would be paid on the next regular payday for the pay ...

If an employee is laid off, or discharged, all wages are due immediately unless the employer has a pre-existing, written personnel policy that extends the time for payment. The wages cannot be delayed beyond the next pay day for the period in which the separation occurred, or 15 days, whichever occurs first.

If an employee is laid off, or discharged, all wages are due immediately unless the employer has a pre-existing, written personnel policy that extends the time for payment. The wages cannot be delayed beyond the next pay day for the period in which the separation occurred, or 15 days, whichever occurs first.