Montana Wire Transfer Instruction to Receiving Bank

Description

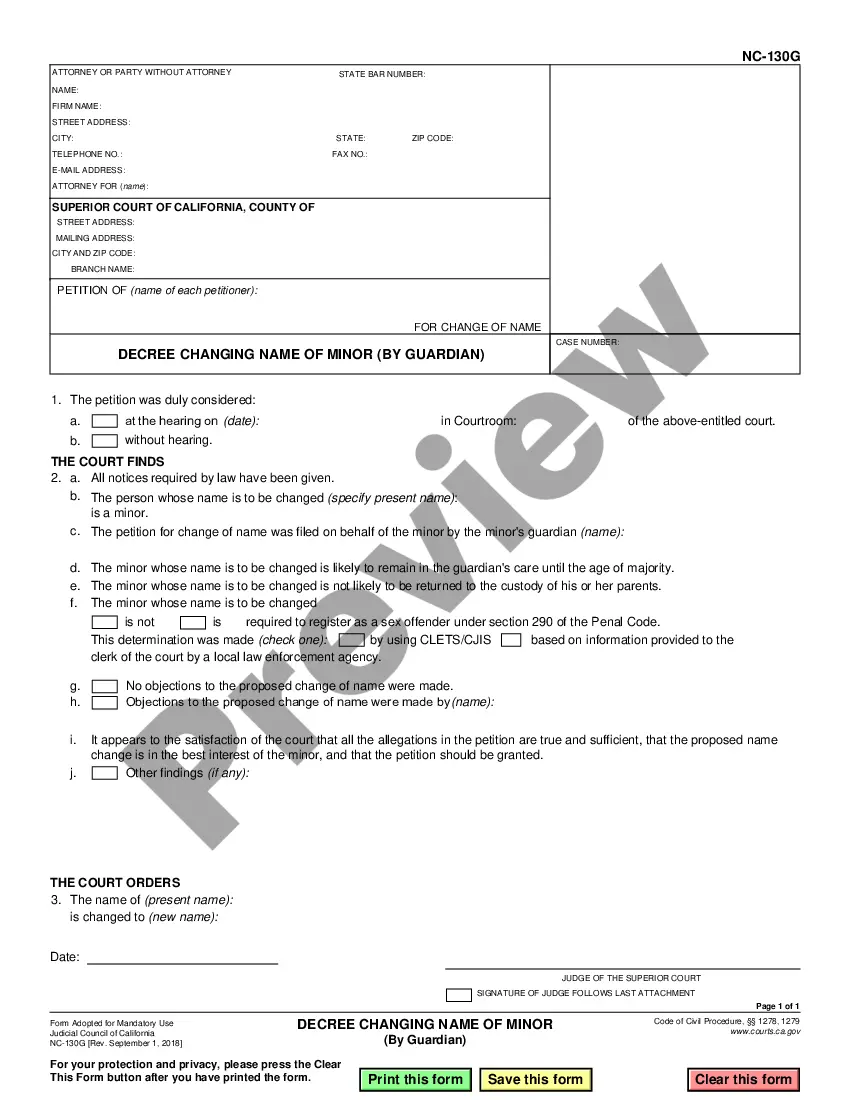

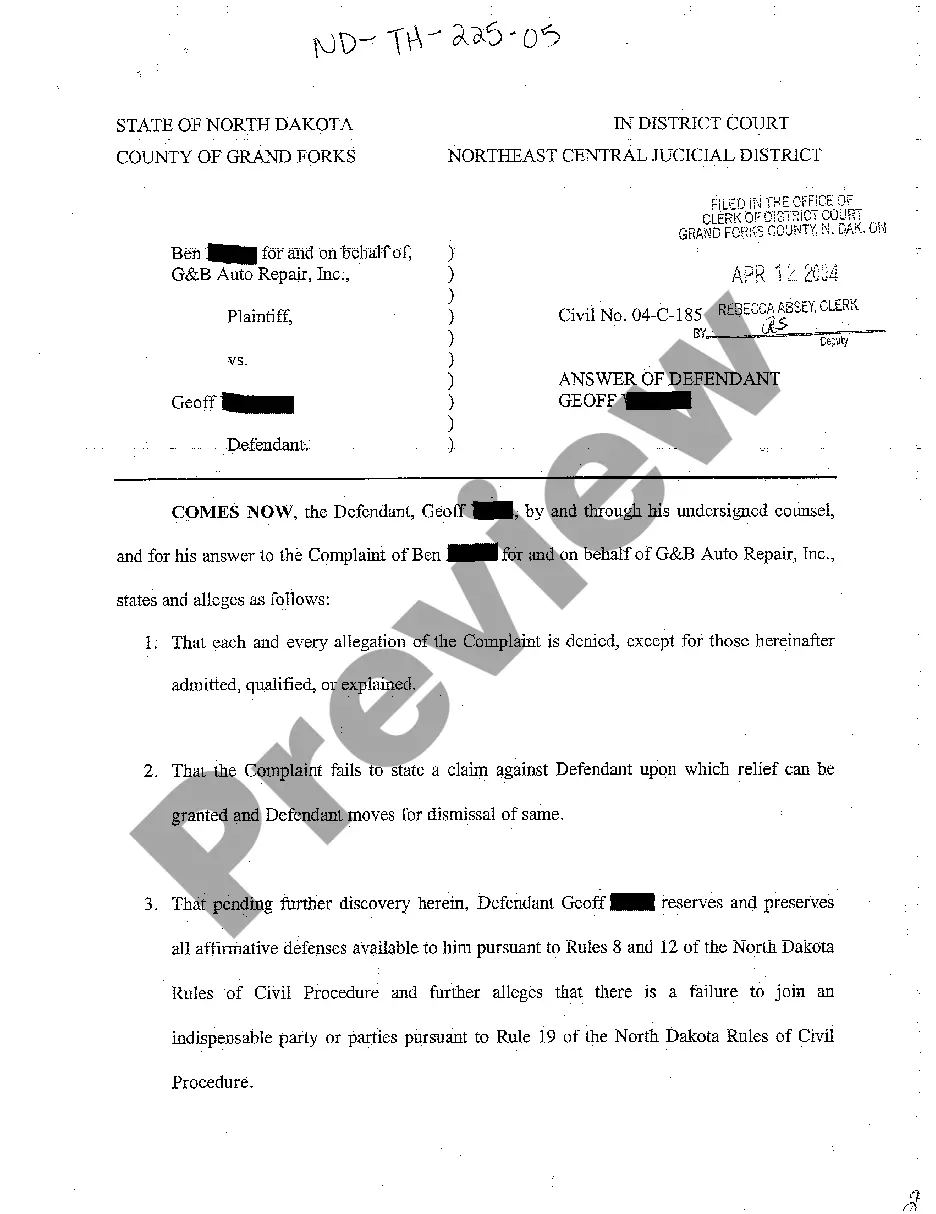

How to fill out Wire Transfer Instruction To Receiving Bank?

Are you presently in a placement in which you need documents for both company or specific uses virtually every day time? There are tons of lawful papers layouts available online, but finding types you can depend on is not easy. US Legal Forms gives 1000s of kind layouts, just like the Montana Wire Transfer Instruction to Receiving Bank, that happen to be written to satisfy state and federal requirements.

If you are previously knowledgeable about US Legal Forms internet site and possess your account, basically log in. Afterward, you can obtain the Montana Wire Transfer Instruction to Receiving Bank web template.

Unless you provide an bank account and want to start using US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is for your proper area/region.

- Utilize the Preview button to review the shape.

- Look at the outline to actually have selected the right kind.

- In the event the kind is not what you are trying to find, utilize the Research area to discover the kind that meets your requirements and requirements.

- When you get the proper kind, simply click Acquire now.

- Pick the pricing prepare you would like, fill in the desired info to produce your account, and pay money for the order with your PayPal or credit card.

- Choose a convenient document structure and obtain your duplicate.

Find all of the papers layouts you may have bought in the My Forms food list. You can aquire a additional duplicate of Montana Wire Transfer Instruction to Receiving Bank at any time, if required. Just go through the required kind to obtain or produce the papers web template.

Use US Legal Forms, probably the most extensive selection of lawful varieties, to conserve time and steer clear of blunders. The assistance gives expertly created lawful papers layouts that can be used for a range of uses. Generate your account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

In 1856, it stood for Manufacturers & Traders. Founded more than 160 years ago, M&T has built a reputation for providing outstanding customer service.

The routing number for M&T Bank for domestic wire transfer is 22000046. The routing number for M&T Bank for international wire transfer is 31302955.

Your full name, as it appears on the account. Your full account number. For domestic wires, your routing number. For international wires, they need to use a Swift Code instead of the routing number.

Your routing number is a 9-digit code that will be used to identify where your bank account was opened. It may also be known as an RTN, an ABA routing number, or a routing transit number. As you prepare to send money internationally, one of the numbers that you'll want to have on hand is your routing number.

When you order new checks, they will have M&T Bank's routing number. For any new payments that you setup, we recommend that you use the M&T Bank routing number, 022000046.

From experience, as long as the bank's routing number / sort code and recipient's account number are correct, the wire should go through. If by "address" you mean the bank's street address, that shouldn't be an issue. If you mean recipient's address, that also should be no problem.

To send a wire transfer by bank, you will typically be asked to provide the following information: Recipient full name. Sender full name. Recipient phone number. Sender phone number. Recipient address. Recipient bank name and information. Recipient checking account information.