This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Installment Promissory Note with Acceleration Clause and Collection Fees

Description

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can quickly obtain the latest editions of forms such as the Montana Installment Promissory Note with Acceleration Clause and Collection Fees.

Examine the form summary to verify you have picked the right form.

If the form does not suit your needs, utilize the Search bar at the top of the page to find the appropriate one.

- If you already have an account, Log In to download the Montana Installment Promissory Note with Acceleration Clause and Collection Fees from the US Legal Forms library.

- The Download option will be available on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, below are simple instructions to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to check the form's details.

Form popularity

FAQ

To accelerate a promissory note, you need to follow the terms outlined in the note itself. Generally, you must provide the borrower with notice of default and state your intention to accelerate payment. If your note is a Montana Installment Promissory Note with Acceleration Clause and Collection Fees, make sure to reference the specific clauses that apply. Using platforms like uslegalforms can simplify this process by providing clear templates and necessary documentation.

To legally enforce a promissory note, the lender must provide proof of the borrower's default on payment terms. This includes maintaining records of all agreed payments, dates, and communications. In circumstances involving a Montana Installment Promissory Note with Acceleration Clause and Collection Fees, you can utilize legal mechanisms to ensure compliance and collect due amounts. For additional support, consider services like uslegalforms to guide you through the enforcement process.

The acceleration of a promissory note allows the lender to demand full repayment of the outstanding amount if the borrower defaults on any term of the agreement. This means that in instances where payments are missed, the lender can accelerate the repayment schedule. In the context of a Montana Installment Promissory Note with Acceleration Clause and Collection Fees, this feature enhances the lender's security. By structuring your agreements thoughtfully, you can protect your financial interests.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

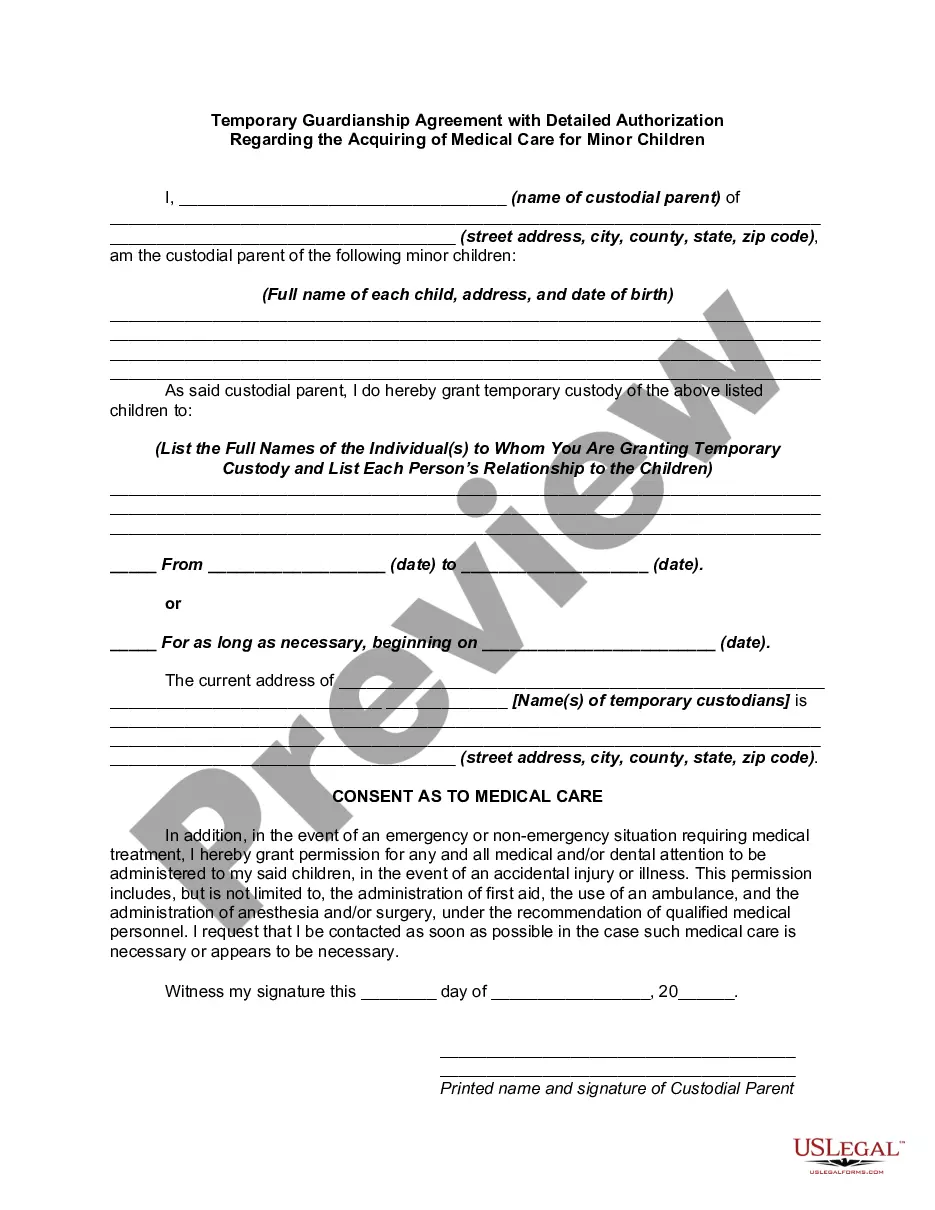

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

An acceleration clause (also called an acceleration covenant) is a provision, often written into loan agreements and promissory notes, that gives the lender, under certain circumstances, the right to require the borrower to pay off the entire loan amount immediately.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

An acceleration clause is a contract provision that allows a lender to require a borrower to repay all of an outstanding loan if certain requirements are not met. An acceleration clause outlines the reasons that the lender can demand loan repayment and the repayment required.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.