A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

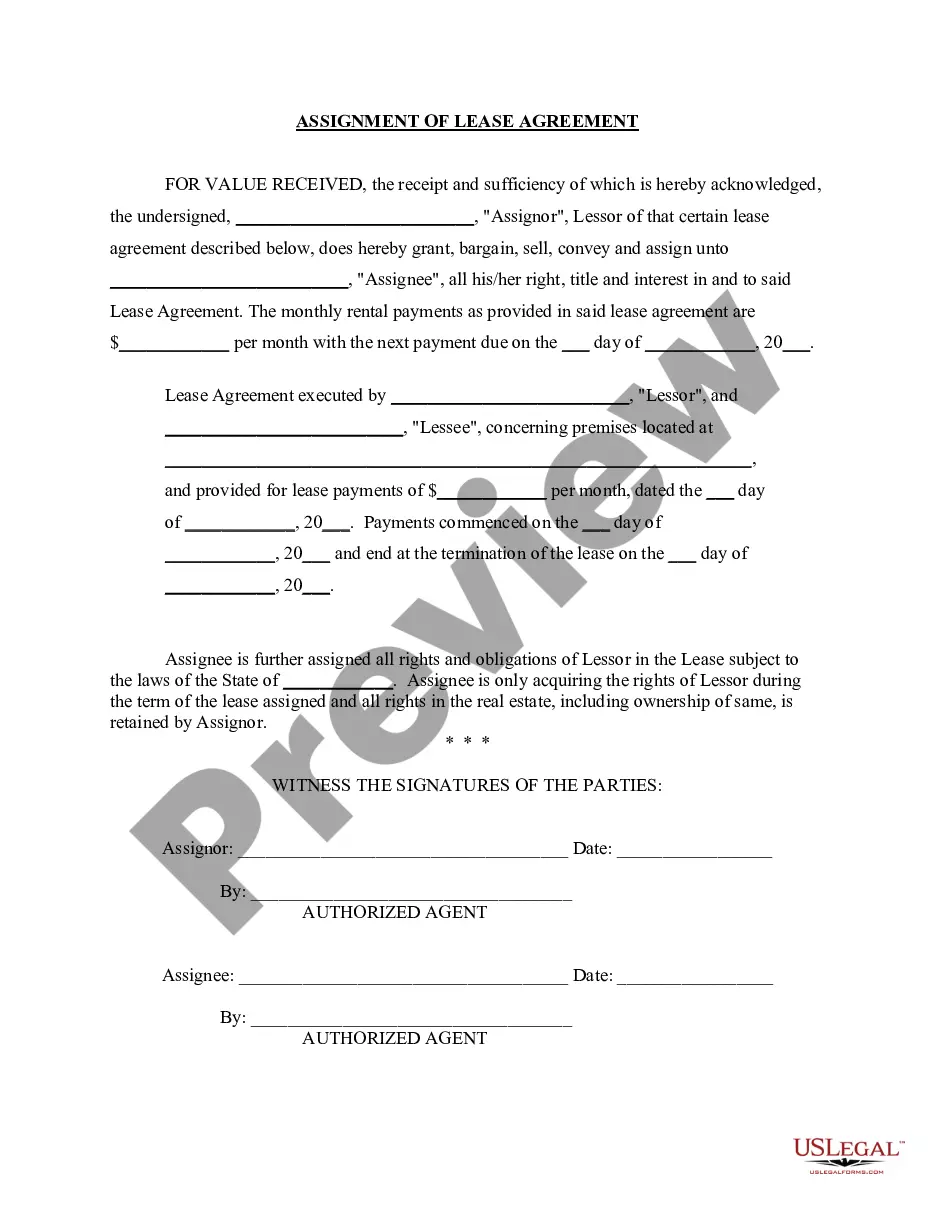

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

It is feasible to spend hours online looking for the appropriate legal document template that meets the federal and state requirements you will require.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

You can download or print the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability from the service.

Review the form outline to confirm that you have selected the correct template. If available, utilize the Review option to preview the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

- Each legal document template you buy is yours indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city you choose.

Form popularity

FAQ

Loopholes in a personal guarantee may exist, particularly concerning the clarity and enforceability of terms. The Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability embraces legal nuances that can sometimes be exploited. Consulting with a professional can help you identify these loopholes and protect your interests.

The liabilities of a guarantor can include being responsible for the debt if the primary borrower defaults. Under the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, these obligations may be limited based on specific terms. It's essential to clearly understand the extent of your liabilities before providing a guarantee.

A guarantor provides a full guarantee for a debt, whereas a limited guarantor is liable only up to a specified amount or under certain conditions. Understanding this distinction is vital within the framework of the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Knowing your role helps you gauge your financial exposure and obligations effectively.

Filling out a personal guarantee requires precise attention to detail. When working with the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, ensure you provide accurate information about your identity and the nature of the liability. It is also wise to review the document carefully before signing, as errors can have significant consequences.

A personal guarantee typically has several limitations, particularly under the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. For example, such guarantees may not cover debts incurred after a specific date or those exceeding certain amounts. It's essential to review the terms and consult a legal expert to fully understand your exposures.

Defending against a personal guarantee involves understanding the terms and conditions outlined in the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. You can argue issues such as the creditor's failure to disclose vital information or present evidence of undue influence. Seeking professional legal guidance will improve your chances of successfully defending yourself.

To invalidate a personal guarantee, you can focus on factors like lack of consideration or improper execution. Utilizing the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can support your case by providing specific legal frameworks. Consulting with a legal expert may reveal additional grounds for invalidation based on your unique situation.

Yes, there are ways to exit a personal guarantee, especially when considering the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. You can negotiate with creditors to release you from the guarantee or demonstrate a change in your financial situation. Working with an attorney can also help you explore options such as proving duress or misrepresentation at signing.

Many people mistakenly believe that a guarantor's liability under the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is unlimited. In reality, a guarantor's liability is often limited to a specific amount or the conditions outlined in the agreement. Furthermore, the guarantor is typically not liable for actions taken by the borrower that fall outside the scope of the guarantee. It is crucial to understand these limitations to avoid unexpected financial responsibilities.

Different types of guarantors include personal guarantors, corporate guarantors, and limited guarantors. Each type assumes varying degrees of risk and liability for debts. By recognizing these distinctions, individuals and businesses can better navigate the complexities of the Montana Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, ensuring that they choose the right guarantor for their needs.