Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

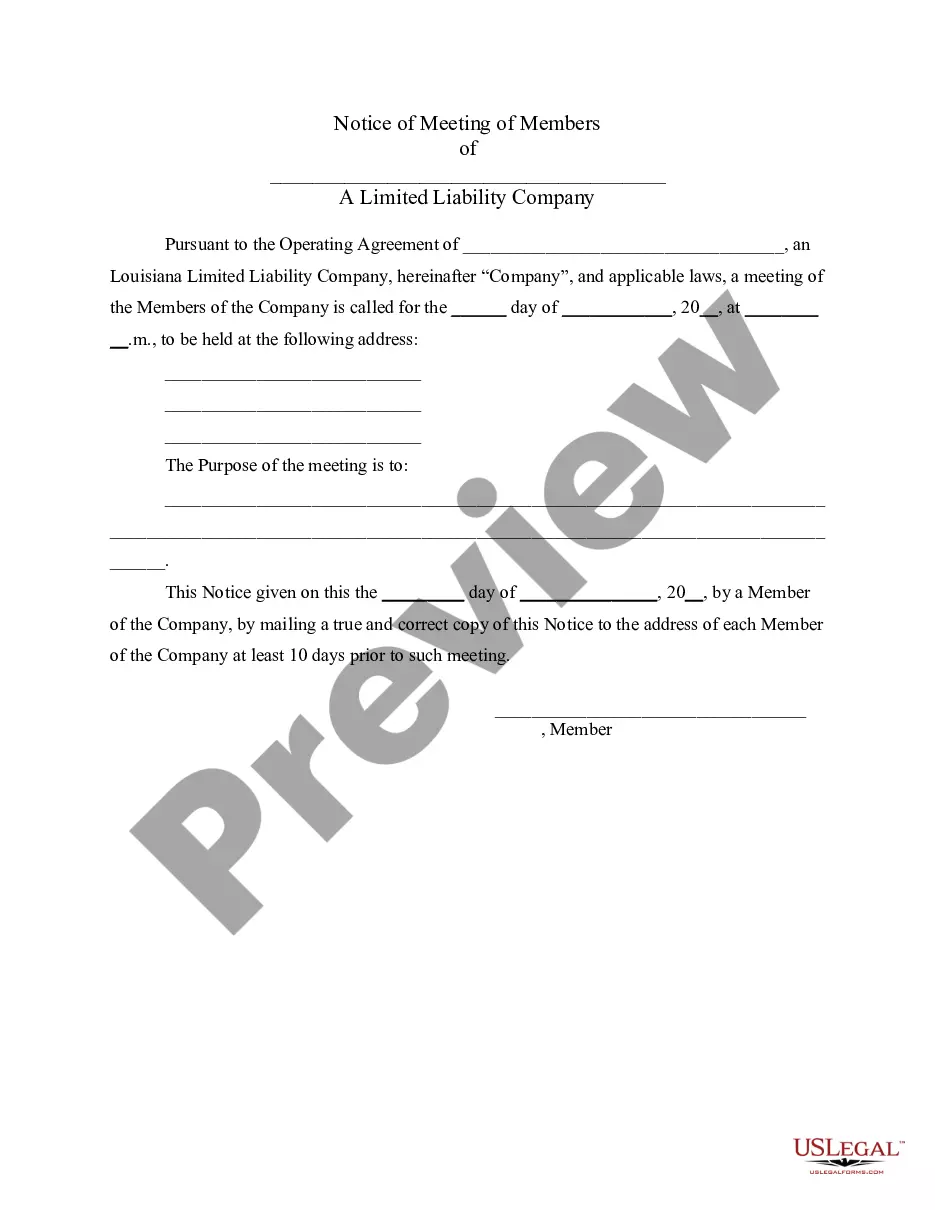

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

If you wish to be thorough, download, or print out legitimate document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the website's simple and functional search tool to locate the documents you need.

Various templates for business and personal purposes are classified by categories and states, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

- Utilize US Legal Forms to locate the Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

- You can also access forms you have previously acquired via the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Yes, a contractor license is often required in Montana for specific trades, such as plumbing, electrical, and general contracting. This requirement is aimed at protecting the public by ensuring that contractors meet necessary standards. When entering into a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, confirming license compliance can safeguard your project against potential issues.

An independent contractor license in Montana is required for certain professions, particularly those involved in construction and skilled trades. This helps regulate the industry and protect consumers. When creating a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, ensure that all licensing requirements are addressed to avoid legal complications.

Yes, independent contractors in Montana may need to obtain a business license, depending on the nature of their services and where they operate. It's important to check local regulations as varying jurisdictions may have different requirements. Crafting a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause should be accompanied by compliance with any licensing needed to ensure a smooth operation.

In Montana, an Independent Contractor Exemption Certificate (ICEC) is necessary for those who wish to work as independent contractors without needing workers' compensation insurance. This certificate helps to simplify the contracting process; however, it does not remove other legal obligations. When formulating a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, consider including ICEC requirements for clarity.

The most significant factor in distinguishing an employee from an independent contractor is the degree of control exercised over the work performed. Employers typically dictate how and when employees complete their tasks, while independent contractors have more freedom in how to meet project goals. This factor is crucial when drafting a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, as it determines the relationships and liabilities of each party.

To verify a contractor in Montana, you can check their license status through the Montana Department of Labor and Industry. Additionally, it's beneficial to review reviews and references from previous clients to gauge the contractor's reliability and quality of work. Before entering into a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, these steps can ensure you select a qualified professional.

In Montana, distinguishing between an independent contractor and an employee hinges on various factors, including the level of supervision and control. Independent contractors maintain greater autonomy in how they complete their work, while employees are typically subject to more oversight from their employer. Recognizing these differences can aid in creating a more informed Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

Yes, in Montana, sole proprietors are generally required to have workers' compensation insurance if they have employees. However, if they do not have employees, they can opt out of this requirement. It's crucial to consider this insurance carefully when setting up a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to protect all parties involved.

In Montana, the main difference between an employee and an independent contractor lies in the level of control and independence in the work arrangement. Employees usually work under the direction of their employer, who controls the means and methods of work. Conversely, an independent contractor operates independently, managing their tasks and schedules. Understanding these distinctions is vital when drafting a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

Yes, non-US citizens can work as independent contractors in the U.S., including Montana. They must secure the proper visa allowing them to work legally. When entering into a Montana Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it's crucial to specify the terms that comply with immigration laws. Platforms like uslegalforms provide resources to help streamline this process.