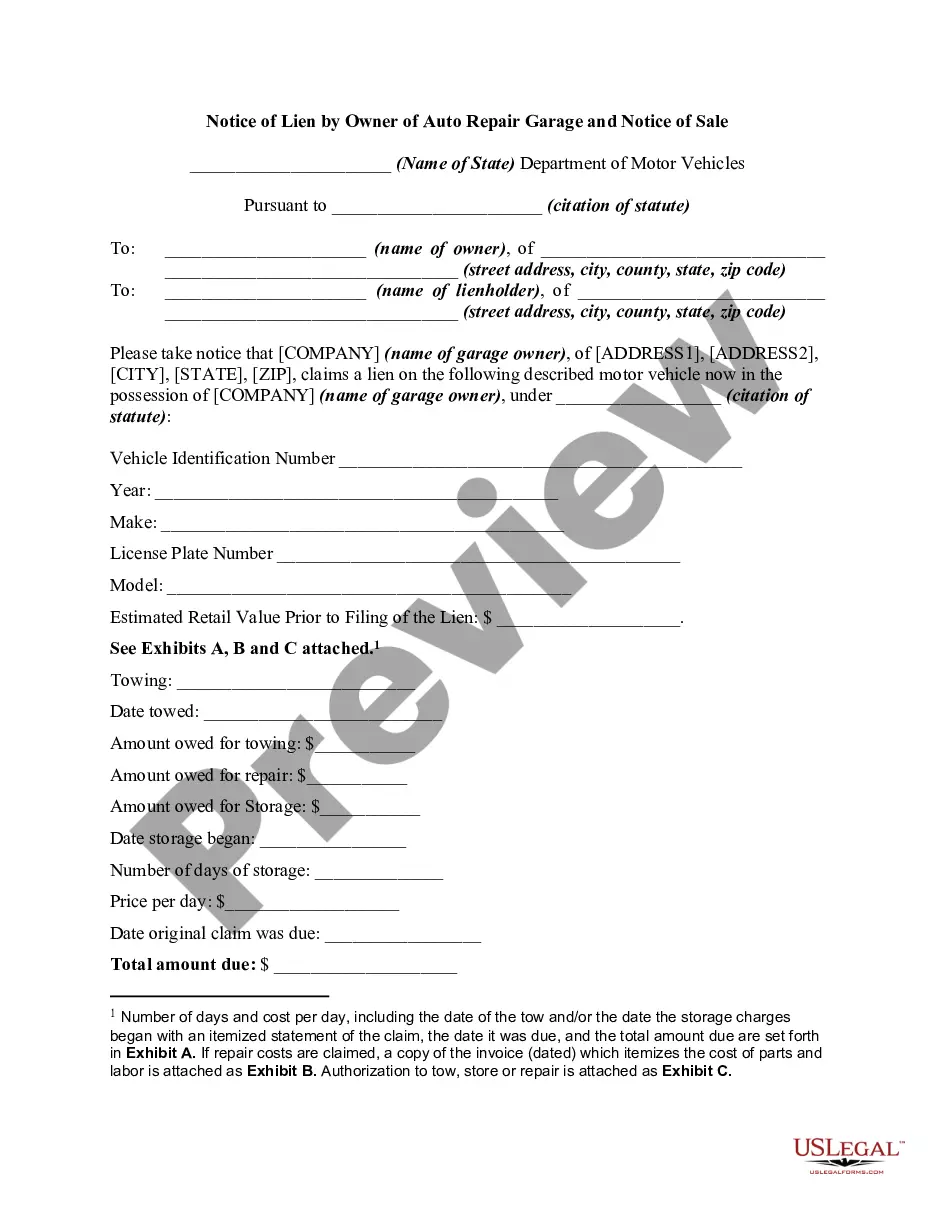

Montana Lien Notice

Description

How to fill out Lien Notice?

Finding the appropriate legal document format can be challenging.

Clearly, there are numerous templates accessible online, but how can you obtain the legal form you require.

Make use of the US Legal Forms website. The service offers a vast array of templates, such as the Montana Lien Notice, which you can utilize for both business and personal needs.

First, ensure that you have selected the correct form for your city/county. You can preview the form using the Preview button and review the form description to make sure it is the right one for you.

- All templates are verified by experts and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Acquire button to locate the Montana Lien Notice.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

A lien in Montana remains valid for 6 months from the date it is filed. After this period, if you do not take further legal action, the lien can expire. To maintain your rights, it's essential to follow up on a Montana Lien Notice if payment issues persist. U.S. Legal Forms supports you with documentation and guidance to help uphold your lien rights efficiently.

In Montana, a contractor has 180 days from the last day they provided labor or materials to file a lien notice. This timeframe is crucial for contractors to protect their rights to payment. Ensuring that you file the Montana Lien Notice within this period helps prevent potential financial loss. For those seeking assistance, U.S. Legal Forms offers resources to simplify the lien filing process.

A notice of intent to lien in Montana serves as a formal warning to a property owner before filing a lien. This document outlines your intention to pursue a lien due to unpaid obligations. Sending this notice allows the property owner a final opportunity to settle debts, potentially avoiding further legal actions. It's an essential step in the lien process, emphasizing clarity and communication.

In Montana, tax liens occur when property taxes remain unpaid. The government places a lien on the property, securing the amount owed until settled. This process signifies a warning for property owners to act, as tax liens can lead to property foreclosure. Understanding your rights regarding tax-related Montana lien notices is essential for protecting your property.

Filing a lien in Montana can be accomplished relatively quickly, often within a day or two if all information is prepared in advance. However, the official processing time may vary based on the county clerk's workload. Utilizing US Legal Forms can expedite the preparation of required documents. Being organized and proactive can further streamline the process.

A lien in Montana typically lasts for 3 years from the date of filing, unless it is extended through specific legal actions. This duration allows creditors sufficient time to pursue payment. Understanding the timeline associated with a Montana lien notice is crucial for planning subsequent actions. Failing to act within this timeframe may compromise your rights.

To file a lien in Montana, you must complete a lien statement, which includes essential details about the work done and the property involved. After preparing the lien statement, you must file it with the county clerk and recorder in the county where the property is located. Using a reliable platform like US Legal Forms simplifies this process by offering templates and guidance. Ensure you file promptly to protect your rights effectively.

Montana lien law provides specific protections for contractors, subcontractors, and suppliers seeking payment for their work. The law requires proper filing of a Montana lien notice to enforce payment rights. Familiarizing yourself with these laws can help you navigate the complexities of lien filing. Compliance with these regulations is paramount to secure your interests.

In Montana, the minimum amount for a mechanics lien is generally $50. This amount reflects the minimum value of labor or materials provided. Understanding this threshold is vital when considering filing a Montana lien notice. A mechanics lien can protect your right to payment for valuable services rendered.

Yes, Montana is a tax lien state, which means local government entities can file tax liens against properties for unpaid property taxes. If you ignore a Montana Lien Notice related to taxes, you risk losing your property through foreclosure. Understanding tax liens is vital for property owners, as they can impact your financial standing significantly. To navigate this issue, consider using legal resources to protect your rights and obligations regarding these liens.