Montana Contract between General Agent of Insurance Company and Independent Agent

Description

In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

Have you ever found yourself in a situation where you require documents for both business or personal activities on a regular basis.

There are numerous legal document templates accessible online, but locating ones you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the Montana Contract between General Agent of Insurance Company and Independent Agent, which are crafted to comply with state and federal regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you will be able to download the Montana Contract between General Agent of Insurance Company and Independent Agent template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct state/region.

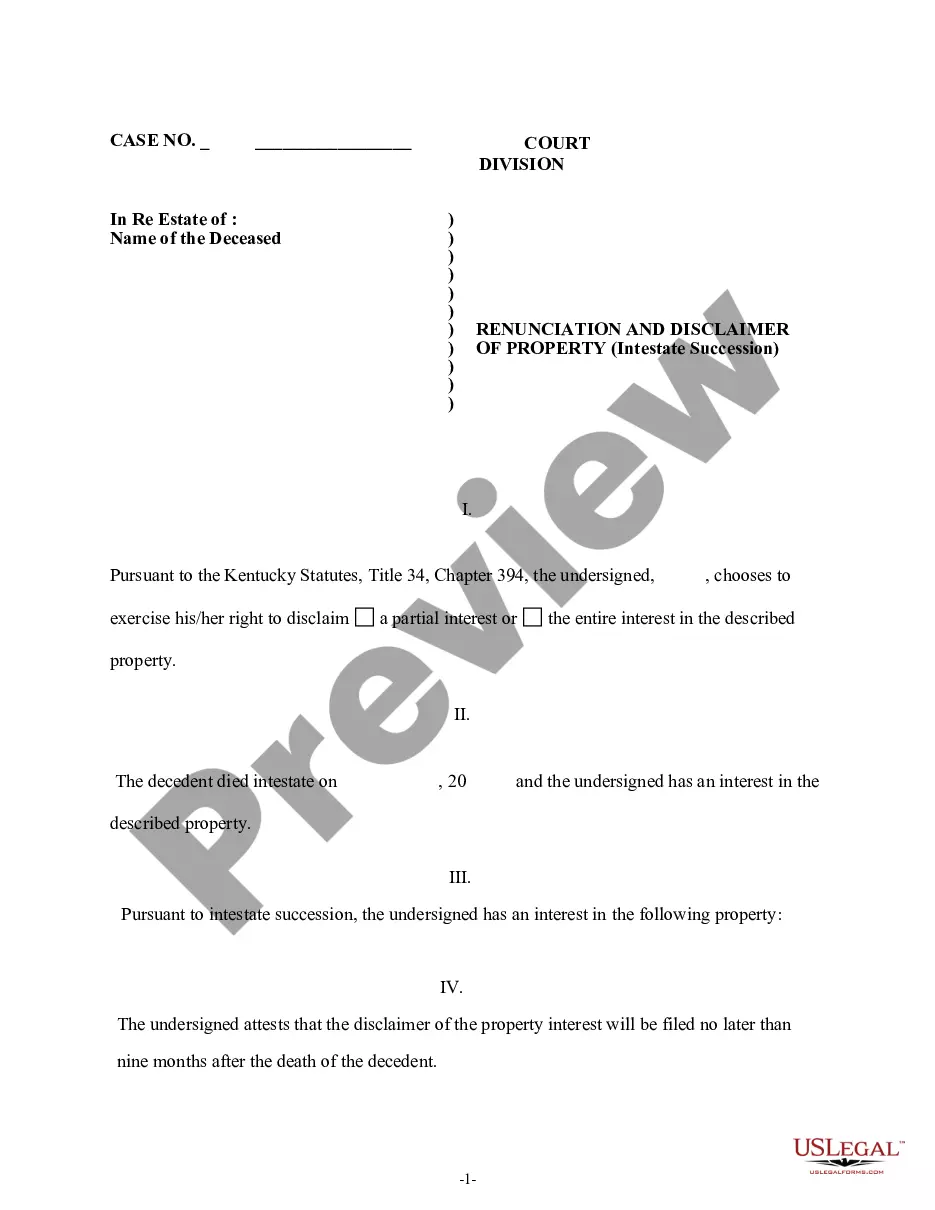

- Utilize the Preview feature to review the document.

- Check the summary to confirm you have selected the right form.

- If the form isn't what you're searching for, use the Search box to find the form that meets your needs and specifications.

Form popularity

FAQ

An independent agent is a professional who sells insurance policies from various providers, while an insurance company is an entity that underwrites and manages policies. Independent agents focus on serving the best interests of their clients, offering diverse options and expert guidance. This dynamic can significantly influence the Montana Contract between General Agent of Insurance Company and Independent Agent, ensuring smoother transactions.

No, Montana insurance licenses are not perpetual. Agents must renew their licenses periodically to maintain their ability to operate legally. Staying informed about renewal requirements is essential for compliance. Understanding the nuances of licensing can be fundamental when entering the Montana Contract between General Agent of Insurance Company and Independent Agent.

Independent agents work for themselves and have the ability to represent multiple insurance companies, while company agents are tied to one specific insurer. This distinction allows independent agents to offer a variety of options and find more suitable solutions for their clients. Their role can be pivotal in navigating the terms of the Montana Contract between General Agent of Insurance Company and Independent Agent.

Using an independent insurance agent often provides you with more choices for your coverage. They can shop around among various insurers, finding the best rate and policy for you. This approach can lead to better protection and potential savings. Ultimately, working with an independent agent can enhance the effectiveness of the Montana Contract between General Agent of Insurance Company and Independent Agent.

An independent agent represents multiple insurance companies rather than just one. This flexibility allows them to offer a broader range of policies to meet diverse client needs. Clients can benefit from customized coverage, tailored to their specific situations. Understanding the role of independent agents can clarify the Montana Contract between General Agent of Insurance Company and Independent Agent.

The relationship between the insurer and the broker is centered around collaboration and negotiation in the insurance market. Brokers work on behalf of the clients, connecting them with suitable insurance options from various insurers. Importantly, agreements like the Montana Contract between General Agent of Insurance Company and Independent Agent can help clarify the interactions between brokers and insurers, ensuring that clients receive optimal coverage tailored to their specific needs.

In the life insurance industry, an agent serves as the primary point of contact for clients seeking coverage options. They assess individual needs, provide advice on suitable policies, and guide clients through the application process. By utilizing frameworks such as the Montana Contract between General Agent of Insurance Company and Independent Agent, agents reinforce their role in ensuring clients make informed decisions regarding their insurance coverage.

The agreement between an agent and an insurer outlines the terms and conditions of how the agent can sell insurance products on behalf of the insurer. This often includes details about commissions, performance expectations, and legal obligations. The Montana Contract between General Agent of Insurance Company and Independent Agent serves as a quintessential example, establishing clear guidelines to ensure a productive partnership.

An insurance agent acts as a representative for an insurance company, helping clients select suitable policies that meet their needs. This relationship is typically formalized through a contract, such as the Montana Contract between General Agent of Insurance Company and Independent Agent, which defines the roles, responsibilities, and compensation of the agent. Consequently, the agent must maintain the best interests of both the insurer and the insured in their dealings.

The relationship between the insurance company and the insured is based on a contractual agreement where the insurer promises to provide financial protection against specific risks. In return, the insured pays premiums periodically. This contract, often defined through documents like the Montana Contract between General Agent of Insurance Company and Independent Agent, sets the terms of coverage available to the insured, ensuring clarity and mutual understanding.