Montana Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card?

Choosing the right lawful document web template can be quite a struggle. Of course, there are a lot of web templates available on the Internet, but how would you find the lawful form you need? Use the US Legal Forms web site. The assistance provides a large number of web templates, such as the Montana Credit Cardholder's Report of Lost or Stolen Credit Card, that can be used for business and private needs. Every one of the forms are checked by experts and meet up with federal and state specifications.

If you are currently signed up, log in to your account and then click the Download button to get the Montana Credit Cardholder's Report of Lost or Stolen Credit Card. Utilize your account to look throughout the lawful forms you have acquired earlier. Proceed to the My Forms tab of your own account and obtain another backup in the document you need.

If you are a whole new consumer of US Legal Forms, allow me to share simple instructions that you should adhere to:

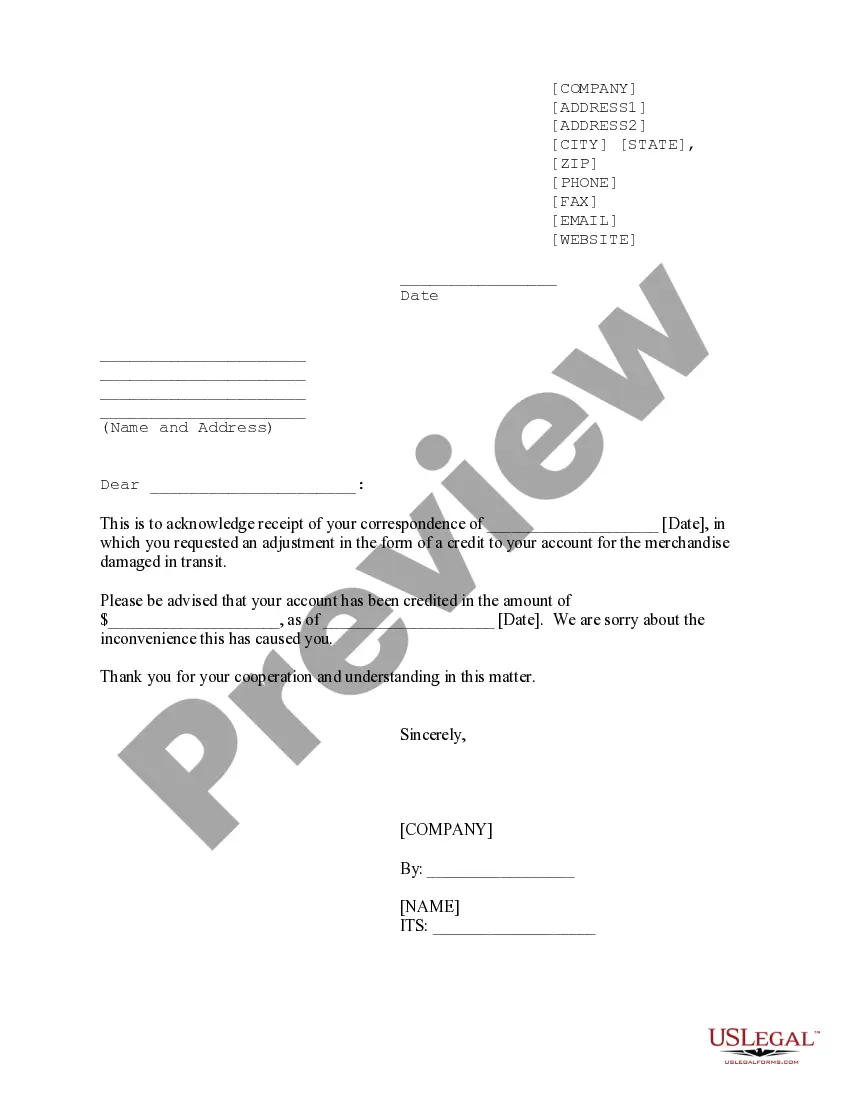

- Very first, make certain you have chosen the correct form to your metropolis/region. You are able to examine the shape making use of the Preview button and browse the shape outline to make sure this is the best for you.

- When the form does not meet up with your needs, take advantage of the Seach area to get the proper form.

- Once you are sure that the shape is suitable, click on the Buy now button to get the form.

- Pick the costs plan you would like and enter in the required information and facts. Build your account and buy the order using your PayPal account or bank card.

- Opt for the data file file format and download the lawful document web template to your device.

- Complete, modify and printing and signal the acquired Montana Credit Cardholder's Report of Lost or Stolen Credit Card.

US Legal Forms will be the most significant library of lawful forms that you can discover different document web templates. Use the service to download skillfully-made files that adhere to express specifications.

Form popularity

FAQ

What to Do If Credit Card Theft Happens to You. In the event that your credit card is stolen in the United States, federal law limits the liability of cardholders to $50, regardless of the amount charged on the card by the unauthorized user.

Also, if an unauthorized charge to your ATM is reported to your bank statement, you are liable for the full amount unless you report the charge within 60 days of the date the statement is sent to you. In other words, report the loss/theft of your ATM card immediately.

The good news is, credit card companies are usually quick to reimburse you for fraudulent charges, and Rathner reassures you should get the money credited back to your account within days of reporting it. And if you've sent away for a new card, you can expect to get it in the mail within a few days.

If a thief takes your customer's credit card and charges $10,000 over a three-month period, your customer is responsible for $50, and you must pick up the rest of the tab. However, if the customer reports the credit card as lost or stolen before charges occur, you (the card issuer) are responsible for all the losses.

Contact your credit card issuer When you speak to a representative, tell them that your account was compromised and list the fraudulent transactions. The bank will cancel the card (this doesn't mean your account is closed) and mail you a new card with a new account number, expiration date and security code.

If you suspect credit card fraud, you should contact your credit card issuer immediately to report it. The issuer will then begin a fraud investigation where they will collect any necessary information to make their assessment. If fraud is suspected, the card will be locked so that no one else can use it.

If you report the loss of a debit card within two business days after you realize it's missing, you won't be responsible for more than $50 for unauthorized use. If you wait more than two business days, you could lose up to $500.

The FCBA limits the liability to $50, regardless of the total amount charged by an unauthorized user. Disputed charges must be reported within 60 days of the statement date, and the credit card company has 90 days from the day they receive the notice to act.