Montana Direct Deposit Form for Employees

Description

How to fill out Direct Deposit Form For Employees?

If you need to finalize, obtain, or create valid document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Employ the site`s straightforward and convenient search to find the documents you require.

Various templates for business and personal uses are organized by categories and states, or keywords. Use US Legal Forms to locate the Montana Direct Deposit Form for Employees with just a few clicks.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, modify and print or sign the Montana Direct Deposit Form for Employees. Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Complete and obtain, and print the Montana Direct Deposit Form for Employees with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Montana Direct Deposit Form for Employees.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

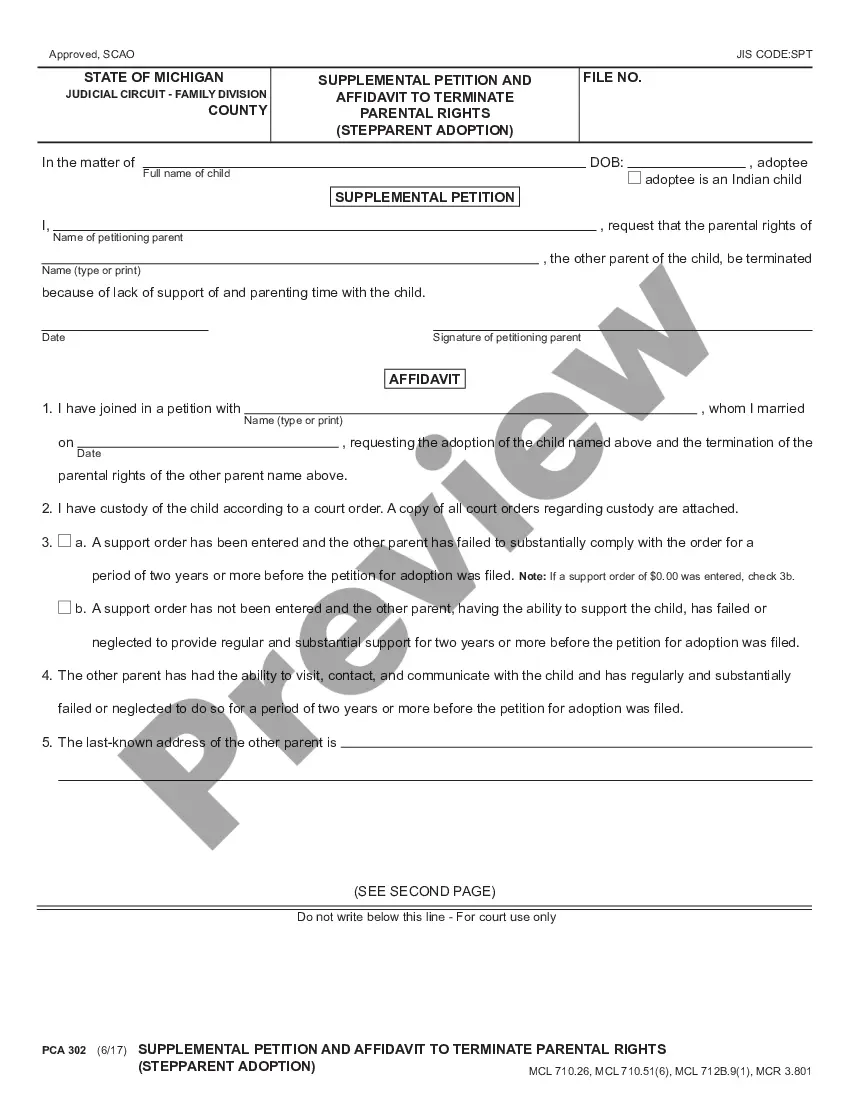

- Step 2. Use the Review option to examine the form`s content. Be sure to read the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the screen to find other versions of your legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Steps on How to Set Up Direct Deposit for Your Employees Decide on a payroll provider. If you don't have one set up already, you'll need a payroll provider that offers direct deposit services. ... Connect with your bank. ... Collect information from your employees. ... Create a payroll schedule. ... Run payroll.

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account. Direct deposit is the standard method most businesses use for paying employees.

Changing Banking Information After logging into Workday, click the Contact and Banking section. Click Change Settlement Bank Accounts: From here, you'll edit the current bank account with your banking information. Bank Name: The Name of Your Bank. Name on Account: This needs to be your name.

Steps on How to Set Up Direct Deposit for Your Employees Decide on a payroll provider. If you don't have one set up already, you'll need a payroll provider that offers direct deposit services. ... Connect with your bank. ... Collect information from your employees. ... Create a payroll schedule. ... Run payroll.

Here's everything you need to know about how to set up direct deposit at your financial institution. Get a direct deposit form from your employer. Ask for a written or online direct deposit form. ... Fill in account information. ... Confirm the deposit amount. ... Attach a voided check or deposit slip, if required. ... Submit the form.

The employer provides the form to the employee to fill out usually upon hire (since the option for direct deposit is an expectation of employees these days). The form is where the employee gives you permission for direct deposit and provides the bank information that you'll need to send them money.

In Workday, direct deposit is entered under Payment Elections. Here, you can add your direct deposit account(s) and set how your pay is distributed between those accounts. You must have your checking or savings account(s) number and the routing number available. You can have up to 10 accounts.

Navigate to Regular Payments. On the right-hand side of the Regular Payments section, click Edit. Under Payment Elections, set your Payment Type to Direct Deposit. Under Account, select the account you wish to use for your direct deposit.