Montana Demand Bond

Description

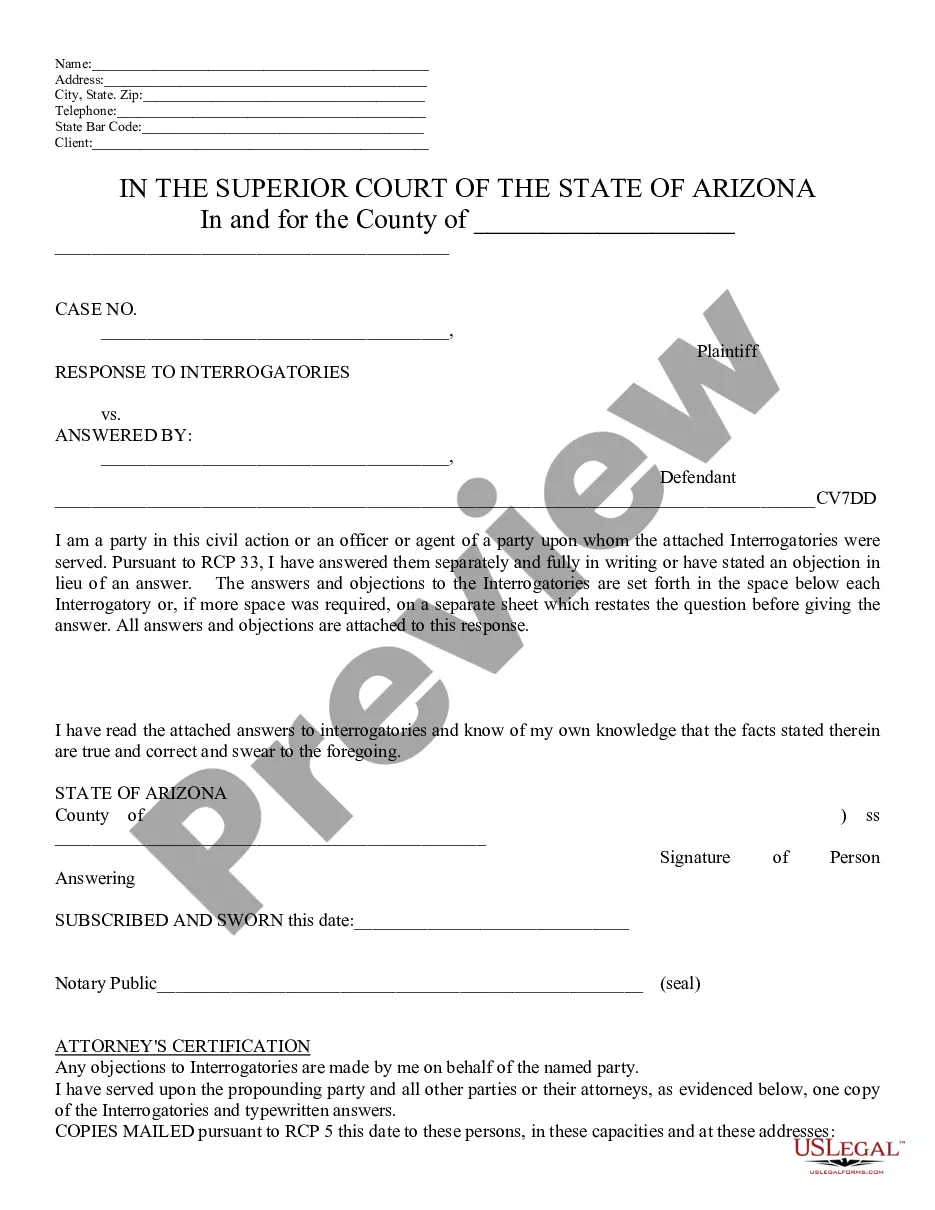

How to fill out Demand Bond?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a selection of legal document templates you can download or create.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Montana Demand Bond in moments.

If you already have a subscription, Log In and download the Montana Demand Bond from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Montana Demand Bond. Every template you save to your account has no expiration date and is yours indefinitely. Therefore, if you wish to obtain or print another copy, simply go to the My documents section and click on the form you desire. Access the Montana Demand Bond with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are straightforward instructions to get you started.

- Make sure you have selected the correct form for your city/state. Click on the Review button to examine the form's content.

- Read the form details to ensure you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you wish and provide your information to register for an account.

Form popularity

FAQ

Demand for bonds generally arises from the need for financial security and risk management in contractual agreements. Events such as delays, defaults, or project failures can trigger the use of a Montana Demand Bond, ensuring that the obligee has a safety net. As you navigate your contracts, consider how a Montana Demand Bond can mitigate risks and protect your interests.

An on demand bond allows the obligee to claim funds immediately upon default, while a performance bond guarantees that the contractor will fulfill their obligations. In the context of Montana, an on demand bond can provide quicker financial relief when issues arise, making it an appealing option for many. Understanding these differences can help you choose the right bond for your needs.

The key difference lies in the immediate access to funds. A demand bond allows the obligee to request payment instantly upon default, while a surety bond may require the obligee to prove a loss before receiving payment. For those involved in contracts in Montana, recognizing the benefits of a Montana Demand Bond can streamline financial processes and enhance security.

A demand bond is a financial guarantee that allows the obligee to call for payment whenever certain conditions are met. It serves as a protective measure for projects and contracts, particularly in Montana, where quick access to funds can be vital. Understanding the dynamics of a Montana Demand Bond can help you make informed decisions about your contracts.

'On demand' in a legal context means that a party can request payment or performance immediately, without any conditions. In the case of a Montana Demand Bond, the obligee can call upon the bond as soon as a specified event occurs, ensuring swift resolution. This immediacy provides a level of security that is crucial in many contractual agreements.

A surety bond involves three parties: the principal, the obligee, and the surety. In contrast, a Montana Demand Bond allows the obligee to demand payment from the surety immediately upon default without any need for further proof. This fundamental difference simplifies the process for the obligee, who can access funds quickly when needed.

Obtaining a bonded title in Montana can be straightforward if you follow the required steps. You'll need to provide necessary documentation and acquire a Montana Demand Bond. While the process may seem daunting initially, resources like USLegalForms can help guide you through each step efficiently.

The process for a bonded title to transition to a regular title can vary. Typically, you must maintain ownership of the vehicle for a designated period, often three years, without any claims against the bond. After this period and upon fulfilling all requirements, you can apply for a regular title, easing your ownership status.

To obtain a surety bond in Montana, you need to identify the type of bond required for your specific situation. You can then approach a surety bond provider who will evaluate your financial history and the bond amount. After this assessment, you will receive a Montana Demand Bond, which will secure your obligations.

In Montana, bail bonds allow individuals to secure their release from jail before a court appearance. A bail agent provides a bond, guaranteeing the court that the individual will appear for their scheduled hearing. If the person fails to appear, the court can claim the bond. Understanding the role of a Montana Demand Bond in this process can help clarify your options.