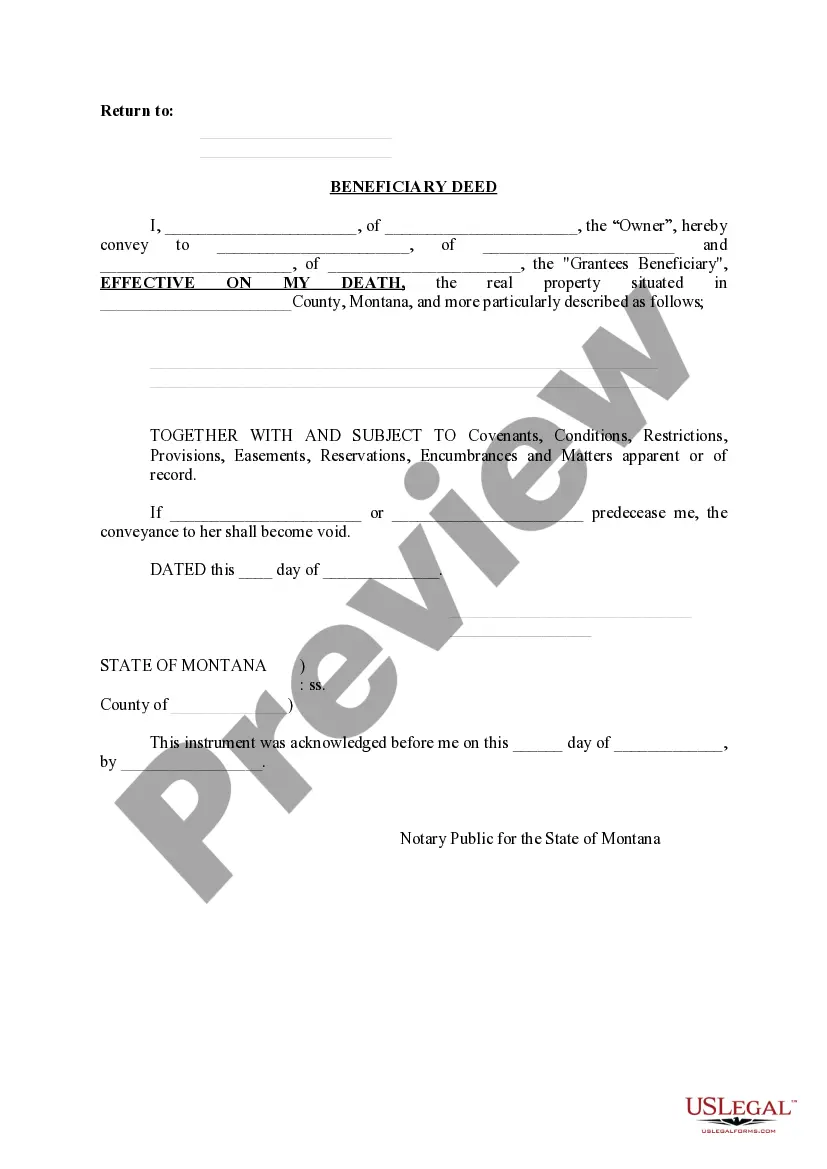

Montana Beneficiary Deed

Description

How to fill out Montana Beneficiary Deed?

Steer clear of costly lawyers and discover the Montana Beneficiary Deed you seek at an affordable rate on the US Legal Forms website.

Utilize our straightforward categories feature to locate and acquire legal and tax paperwork. Examine their details and preview them thoroughly prior to downloading.

Select to receive the document in PDF or DOCX format. Simply click Download and locate your template in the My documents section. You can save the form to your device or print it out. After downloading, you can complete the Montana Beneficiary Deed by hand or with editing software. Print it out and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms offers clients step-by-step guidance on how to download and complete each template.

- US Legal Forms users essentially need to Log In and retrieve the exact form they require from their My documents section.

- Those who haven’t subscribed yet should adhere to the following instructions.

- Ensure the Montana Beneficiary Deed is valid for use in your jurisdiction.

- If applicable, review the details and utilize the Preview function prior to downloading the templates.

- If you believe the document is suitable for your needs, click on Buy Now.

- If the form is incorrect, utilize the search tool to find the appropriate one.

- Next, establish your account and select a subscription option.

- Make payment via credit card or PayPal.

Form popularity

FAQ

As of September 2019, the District of Columbia and the following states allow some form of TOD deed: Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia,

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

A beneficiary deed is one in which an owner conveys an interest in Montana real property to a grantee beneficiary effective upon the owner's death. In other words, real property is transferred from the deceased person to the person(s) listed on the deed.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A beneficiary deed is generally used for avoidance of probate, although it may be used to remove a particular property from a probate estate.

The beneficiary deed does for real estate what the payable on death or POD designation does for a bank account. It allows the owner to designate a beneficiary for that asset and creates a method by which ownership of the asset will transfer directly to the beneficiary upon the owner's death.

Using a beneficiary deed may reduce or eliminate fees for probating the estate or managing a trust. Liens and loans. After a beneficiary deed is signed, grantors may still do what they want with the property, including selling it or mortgaging it.